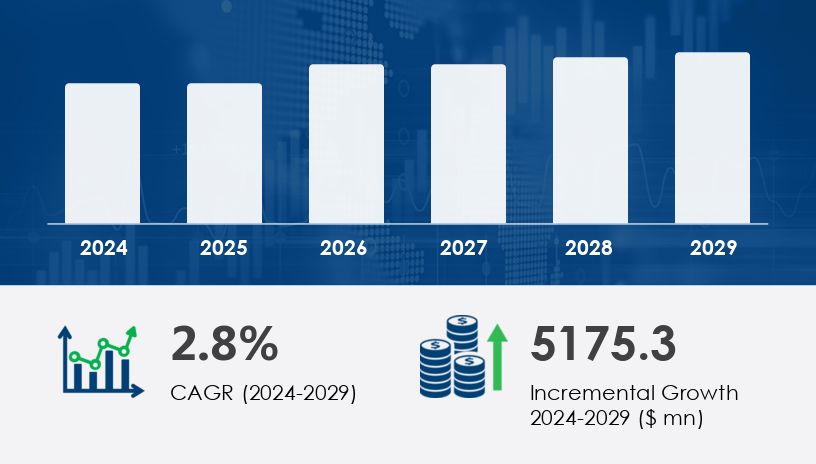

The enterprise external OEM storage systems market is poised for a remarkable shift, projected to grow by USD 5.18 billion from 2024 to 2029, at a CAGR of 2.8%. This surge is powered by a convergence of technological advancements and the ever-expanding data footprint of enterprises worldwide. As organizations grapple with digital transformation and rising demands for high-speed data access, scalable, and secure storage infrastructures, OEM storage systems are stepping into the spotlight. This report explores how businesses are evolving their storage strategies, what innovations are shaping the market, and which players are leading the charge.

What You’ll Learn from This Report

The technologies driving demand for enterprise OEM storage solutions

Growth opportunities by region and industry segment

Key players and their strategies

Trends in hybrid, flash, and NVMe-based storage systems

Challenges and how enterprises are mitigating them

Strategic insights into customer adoption and behavior

For more details about the industry, get the PDF sample report for free

In today’s digital-first economy, enterprise external OEM storage systems have become indispensable for data-intensive operations across industries. These systems, built by original equipment manufacturers (OEMs), are designed for robust external storage capabilities including all-flash arrays, hybrid storage, SAN, NAS, and DAS configurations. Their popularity stems from their ability to deliver high-availability, fast throughput, and secure data management across various enterprise environments.

The push towards NVMe-enabled systems, offering ultra-low latency and lightning-fast data transfers, is redefining expectations. Additionally, businesses are gravitating toward software-defined storage (SDS) and storage orchestration technologies to build flexible, future-proof infrastructure.

Several tech giants dominate the landscape, each innovating to meet unique customer demands in storage management, security, and scalability.

Leading Companies in the Market:

Dell Technologies Inc.

Hewlett Packard Enterprise Co.

IBM Corporation

NetApp Inc.

Huawei Technologies Co. Ltd.

Western Digital Corp.

Seagate Technology Holdings Plc

Fujitsu Ltd.

Oracle Corp.

Pure Storage Inc.

These firms are focusing on strategic alliances, product enhancements, and region-specific expansions to maintain competitive advantage. A notable trend is the shift toward cloud-integrated OEM storage, enabling enterprises to manage hybrid and multi-cloud environments seamlessly.

Get more details by ordering the complete report

The market segmentation by end-user, type, and geography reveals critical adoption patterns:

SMEs (Small and Medium Enterprises):

Witnessing accelerated growth as these businesses adopt external OEM systems to enhance data protection, performance, and scalability—without building complex in-house IT ecosystems.

Large Enterprises:

Continue to dominate revenue share due to the sheer volume of data generated and processed.

SAN (Storage Area Network)

NAS (Network Attached Storage)

DAS (Direct Attached Storage)

SAN remains the preferred choice for high-performance enterprise storage, while NAS and DAS are gaining traction in more cost-sensitive environments.

The adoption of Non-Volatile Memory Express (NVMe) has transformed the landscape. With reduced latency and superior IOPS, NVMe makes external OEM systems ideal for real-time analytics, big data, and high-performance computing.

Organizations are blending on-premises and cloud storage to achieve a balance of control, speed, and scalability. Hybrid systems allow for data tiering, ensuring mission-critical data remains on fast local storage while archival content is offloaded to the cloud.

With data volumes exploding, enterprises are prioritizing data lifecycle strategies, from deduplication and archiving to replication and DRaaS (Disaster Recovery as a Service). Cold storage and immutable storage are becoming staples for compliance and long-term retention.

A growing need to manage both structured and unstructured data is fueling demand for unified storage systems that support object, file, and block formats, as well as scalable file systems capable of accommodating growth without performance bottlenecks.

For more details about the industry, get the PDF sample report for free

APAC is projected to contribute significantly to total market growth between 2025 and 2029. This momentum is driven by:

Rapid digitalization in China, Japan, and India

Expansion of data centers and cloud infrastructure

Government support for Industry 4.0 and smart city initiatives

North America remains a stronghold due to:

High penetration of advanced technologies like AI, IoT, and 5G

Mature IT and telecom infrastructure

Industry adoption across BFSI, healthcare, retail, and IT sectors

European companies are investing heavily in multi-cloud strategies, placing greater emphasis on storage compliance, encryption, and DRaaS as they transition from legacy systems.

South America

Middle East and Africa

The Enterprise External OEM Storage Systems Market is undergoing significant transformation due to advancements in technologies such as Storage Area Networks (SAN Systems), Fibre Channel, and SCSI Protocol, which provide robust support for high-performance data transfer. Ethernet Protocol and Block Data handling are also critical in driving performance across RAID Systems and Backup Devices. These systems often rely on Interface Cards to enhance connectivity and performance in enterprise environments. Additionally, Scalable File architecture and effective Data Lifecycle management have become key differentiators, enabling features like Automated Tiering and Data Archiving in modern Data Centers. Technologies like Elastic Block storage and Immutable Storage contribute to high-integrity solutions, while Storage Containers and Disaster Recovery mechanisms ensure business continuity. Distributed Storage and Cold Storage configurations are increasingly favored for specific workloads, especially with the rise of Software-Defined environments and demand for High Availability setups.

Get more details by ordering the complete report

Here’s a quick overview of what’s shaping the market:

Rising demand for NVMe-enabled solutions

Adoption of hybrid and software-defined storage

Increased data center investments

Shift toward storage-as-a-service (STaaS) models

Need for disaster recovery and immutable backups

Storage tiering for cost optimization

Despite the numerous advantages, one persistent challenge is the high upfront cost associated with enterprise-grade OEM storage systems. SMEs, in particular, struggle with the capex model, though cloud integration and subscription-based services are beginning to offer relief.

Additionally, data center construction delays, driven by regulatory hurdles and funding issues, continue to slow down deployment for large enterprises in certain regions.

For more details about the industry, get the PDF sample report for free

On the analytical front, trends show a sharp incline in adoption of Flash Storage and Persistent Storage due to their ability to support Multi-Cloud environments with enhanced Storage Compliance and Storage Encryption standards. Protocols like NVMe, FCoE, and iSCSI are gaining momentum for delivering fast and reliable Data Transfer with Low Latency and High Throughput performance. These advancements support growing requirements for Storage Scalability and Data Preservation across complex infrastructures. Additionally, Storage Optimization strategies are focusing on enabling Concurrent Access and fortifying Storage Security. Enterprise organizations are heavily investing in Data Management and External Storage platforms powered by OEM Solutions, which offer flexibility and integration with various Storage Protocols. The continued push for Data Efficiency is shaping next-generation systems that align with both regulatory requirements and operational performance goals.

The enterprise external OEM storage systems market is undergoing a transformation fueled by innovation, necessity, and the exponential growth of data. From high-speed NVMe storage to multi-cloud ecosystems and AI-powered data orchestration, this market is dynamic and full of opportunity. Businesses that invest now in scalable, secure, and efficient storage infrastructures will be well-positioned to lead in a data-driven world.

Safe and Secure SSL Encrypted