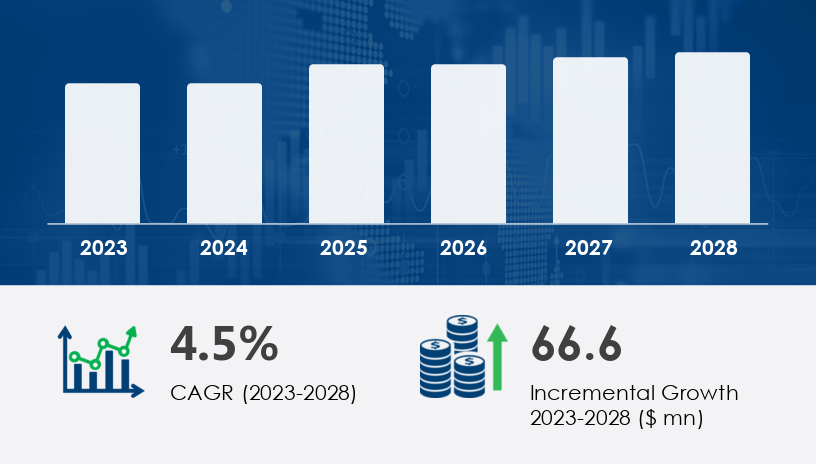

The global dioctyl maleate (DOM) market is projected to grow by USD 66.6 million between 2024 and 2028, expanding at a steady CAGR of 4.5%, fueled by surging demand from the cosmetics, personal care, and construction sectors. In this 2025 Outlook and Comprehensive Guide, we explore the major growth drivers, segment trends, regulatory dynamics, and key takeaways for stakeholders aiming to capitalize on this expanding market.From being a niche plasticizer to a vital component in eco-conscious formulations, dioctyl maleate is rapidly gaining prominence across diverse industries. Its dual role as a non-phthalate plasticizer and a chemical intermediate positions it as a sustainable alternative to traditional phthalates, increasingly scrutinized by global regulatory bodies.For more details about the industry, get the PDF sample report for free

Dioctyl Maleate (DOM) is an ester derived from 2-ethylhexanol and maleic anhydride, commonly used as a chemical intermediate, plasticizer, and surfactant. With applications spanning from cosmetics and personal care to construction adhesives and textile coatings, its versatility is unmatched. It also serves as a critical non-phthalate alternative, aligning with shifting global regulatory frameworks.

“In today’s regulatory climate, brands are actively replacing phthalate-based ingredients. DOM offers a viable alternative with performance and environmental compliance,” remarks Dr. Elena Marquez, Senior Chemical Industry Analyst.

Why the cosmetics sector matters: DOM functions as an emollient, surfactant, solvent, and skin conditioning agent in formulations for moisturizers, skin creams, makeup, and lotions. It forms a protective barrier that hydrates and softens skin — essential for premium cosmetic products.

Furthermore, stringent ingredient disclosure regulations in regions like the U.S. and Canada make DOM a preferable choice for brands targeting “clean beauty” credentials.

For more details about the industry, get the PDF sample report for free

Surfactants remain the largest application segment, projected to retain dominance through 2028. With usage across detergents, wetting agents, agrochemical formulations, and personal care, the cumulative demand remains stable and robust.

Data Callout: The surfactant segment was valued at USD 98.80 million in 2018 and has shown consistent year-over-year growth.

Adhesives: DOM acts as a plasticizer and wetting agent, particularly in construction adhesives.

Coatings & Inks: DOM enhances flexibility and performance in industrial paints and inks.

Textiles: Used in manufacturing waterproof and heat-resistant fabrics.

Asia-Pacific is the epicenter of global DOM demand, led by China, India, Japan, South Korea, and Indonesia. Rapid urbanization and construction booms across these countries fuel the need for adhesives, coatings, and paints — all core applications for DOM.

Case Study: India’s “Housing for All” Initiative

As part of its national development agenda, India’s infrastructure sector is increasingly using DOM-enhanced adhesives and coatings. This presents a lucrative market for suppliers able to meet bulk volume needs with sustainable credentials.

Get more details by ordering the complete report

The global shift toward green chemistry and non-toxic ingredients is amplifying DOM’s relevance. Traditional phthalate plasticizers like Dioctyl Phthalate (DOP) are being phased out due to health concerns, especially in products with human contact like medical devices and cosmetics.

DOM, as a non-phthalate alternative, finds growing use in:

Food packaging films

Plastic medical devices

Toys and childcare products

Despite growing demand, the DOM industry faces regulatory headwinds. Countries like Canada and the EU are tightening controls on chemical ingredients in personal care products. DOM, though generally safer, must still be carefully evaluated and disclosed.

Implication: Manufacturers must stay abreast of changing ingredient laws and invest in regulatory affairs teams to navigate compliance

Top players are implementing strategic alliances, product innovations, and regional expansions to bolster their market share. Notable companies include:

Avantor Inc.

Biesterfeld AG

ChemCeed

ESIM Chemicals GmbH

Polynt SpA

Tokyo Chemical Industry Co., Ltd.

These firms are categorized based on market penetration and specialization, ranging from pure-play suppliers to diversified chemical giants.

For more details about the industry, get the PDF sample report for free

The Dioctyl Maleate (DOM) Market is experiencing steady growth, driven by its increasing usage in producing flexible PVC and as a key ingredient in vinyl acetate and acrylic emulsion systems. Its role in copolymer films is vital, especially as a phthalate alternative, offering improved polymer flexibility and compatibility with PVC additives used in soft plastics. DOM is favored for its plasticizer compatibility and classification among low-toxicity plasticizers, making it a safer choice in formulations. It also finds widespread application in sodium sulfosuccinate derivatives, acting as wetting agents, detergent additives, emulsion stabilizers, and components in sulfosuccinate surfactants. In the personal care and cosmetic emulsifiers segment, DOM helps in regulating surface tension and enhances the efficacy of anionic detergents. Furthermore, DOM is gaining popularity in construction adhesives, automotive adhesives, and flexible adhesives, thanks to its ability to improve adhesive durability, sealant flexibility, and performance as a bonding agent.

High Growth Potential: A 4.5% CAGR with a value increase of USD 66.6 million suggests steady market acceleration.

Cosmetics Are Key: Eco-friendly, regulatory-compliant formulations are driving DOM demand in personal care.

Asia-Pacific Dominance: 55% contribution from APAC underscores the importance of regional expansion.

Surfactants Segment Strength: End-use applications in cleaning, personal care, and agrochemicals ensure baseline demand.

Green Chemistry Edge: Replacing phthalates with DOM offers both compliance and marketability benefits.

Get more details by ordering the complete report

Invest in Green Certification: Secure eco-labels and compliance certifications to enhance product appeal.

Expand in APAC Markets: Tap into India and China’s infrastructure boom with region-specific strategies.

Strengthen R&D in Cosmetics Applications: Develop DOM-based emollients and surfactants tailored to "clean beauty" standards.

Monitor Regulatory Shifts: Proactively align with evolving ingredient disclosure and safety regulations.

Leverage Digital Marketing for B2B Outreach: Educate manufacturers on the advantages of DOM over traditional plasticizers.

On the analytical front, DOM serves as a critical raw material in creating adhesive copolymers, industrial sealants, and packaging adhesives, with significant use in adhesive formulations for emulsion paints and water-based coatings. These products benefit from DOM's contribution to low-VOC coatings, coating flexibility, and paint adhesion, all while enhancing weather resistance in industrial coatings, architectural paints, and coating additives. In specialized applications, DOM improves vinyl coatings, textile coatings, and waterproof fabrics, especially those requiring heat-resistant textiles. The compound plays a functional role in dye surfactants, enhancing fabric durability in textile dyes, leather coatings, and sports apparel through effective textile additives and fabric flexibility. From a chemical synthesis standpoint, DOM is produced via maleic anhydride and 2-ethylhexanol, linking it to broader markets for succinic acid, chemical intermediates, and pharmaceutical intermediates including tablet formulations. It is also utilized in food packaging, cling films, and materials requiring heat resistance and eco-friendly additives.

For more details about the industry, get the PDF sample report for free

As consumer expectations shift toward transparency, sustainability, and safety, dioctyl maleate is poised to benefit from these evolving standards. Regulatory momentum, coupled with DOM’s functional versatility, could lead to new formulations in bioplastics, biodegradable adhesives, and pharma-grade surfactants.

Safe and Secure SSL Encrypted