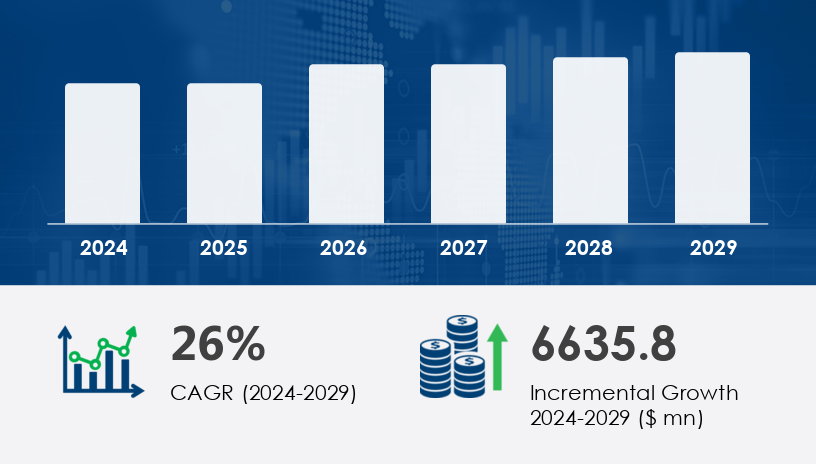

The Contract Life-Cycle Management (CLM) Software Market is poised for significant growth, driven by increased digitalization and the growing need for streamlined contract processes across industries. The market size is expected to increase by USD 6.64 billion from 2024 to 2029, expanding at a robust CAGR of 26%. As businesses of all sizes seek improved governance, risk management, and operational efficiency, the demand for advanced CLM solutions continues to rise.

For more details about the industry, get the PDF sample report for free

A primary driver fueling the growth of the CLM software market is the adoption of value-based pricing models and flexible deployment strategies that cater to organizations of varying sizes. Enterprises—particularly in the IT, healthcare, and life sciences sectors—are increasingly turning to CLM software to enhance contract visibility, reduce legal expenses, and accelerate contract cycles. According to the report, these tools automate contract workflows and centralize data, improving decision-making and reducing risks. Aided by real-time reporting and approval processes, organizations can now manage contract complexities more efficiently. The shift toward digital transformation and remote work arrangements further strengthens the demand for scalable, cloud-based CLM systems.

One of the most significant emerging trends is the integration of advanced analytics into CLM platforms. These analytics tools enable companies to extract insights from contract data, identifying trends, compliance issues, and potential risks early in the contract lifecycle. This capability is especially beneficial in highly regulated sectors like healthcare, where proactive contract governance is critical. Analysts from Technavio note that this trend is enhancing automation and intelligence within contract management systems, allowing organizations to optimize decision-making processes while reducing human error and operational delays. The analytics trend underscores the broader movement toward intelligent contract lifecycle automation, transforming CLM software into a strategic asset for businesses.

The Contract Life-Cycle Management (CLM) Software Market is undergoing rapid transformation, driven by the increasing demand for digital transformation and compliance in legal and procurement operations. Key features like contract analytics, compliance tracking, and cloud CLM are becoming industry standards, enabling organizations to manage contracts more efficiently and securely. Solutions offer enhanced contract automation capabilities and support for digital signatures, crucial for streamlining approval processes and ensuring risk mitigation. Companies are now relying on a centralized contract repository, supported by workflow automation and a comprehensive clause library, to manage large volumes of contracts. In addition, the inclusion of audit trails, robust contract drafting tools, and seamless approval workflows ensures greater control and traceability across the contract lifecycle.

Segmentation Categories:

By Component: Software, Services

By Deployment: On-premises, Cloud-based

The software segment is expected to lead the market in terms of share and growth during the forecast period. Valued at USD 802.70 million in 2019, this segment continues to grow steadily, driven by rising adoption in the IT, healthcare, and life sciences industries. CLM software provides a centralized platform for contract creation, execution, and renewal, reducing cycle times and disputes. Advanced features such as self-service contract drafting, real-time performance tracking, and automated workflows offer substantial efficiency gains. Analysts highlight that organizations benefit from these tools through quicker revenue cycles, reduced legal overhead, and improved compliance. This positions the software segment as a foundational element in enterprise digital transformation strategies.

Covered Regions:

North America (US, Canada)

Europe (Germany, UK, France, Italy)

APAC (China, India, Japan)

Middle East and Africa

South America

North America is projected to contribute approximately 44% of the global market growth between 2024 and 2029, making it the leading regional market. The United States and Canada are at the forefront, driven by heightened regulatory compliance requirements and the widespread digitization of business operations. The region's strong technology infrastructure and early adoption of enterprise software make it a fertile ground for CLM deployment. CLM software in North America is valued for its ability to automate workflows, enforce contract governance, and increase operational efficiency, particularly amid remote work trends. Technavio analysts emphasize that digital tools supporting regulatory compliance and contract risk mitigation are key differentiators fueling regional market dominance.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Despite the strong growth outlook, the high implementation and maintenance costs of CLM software remain a significant challenge, particularly for Small and Medium Enterprises (SMEs). The total cost of ownership—including software licensing, customization, training, and ongoing upgrades—can be prohibitively expensive for smaller organizations. Additionally, effective deployment requires cross-functional collaboration, long-term planning, and continuous support, which can strain internal resources. While large enterprises often benefit from economies of scale, SMEs may struggle with the resource-intensive nature of adoption. This financial barrier may slow broader market penetration unless vendors adapt pricing models to be more inclusive and scalable.

Current market research indicates growing adoption of AI CLM solutions, which provide actionable contract insights and enable proactive obligation tracking, especially in complex vendor management and SLA monitoring environments. The availability of standardized contract templates and enhanced data encryption mechanisms ensures security and consistency across organizations. Advanced integration APIs are enabling better contract negotiation workflows and real-time collaboration, improving both speed and accuracy. Focus on policy compliance and cost optimization continues to grow, with tools designed to offer real-time contract visibility and intuitive reporting dashboards. Furthermore, the rise of mobile CLM platforms is allowing legal and procurement teams to manage agreements remotely, improving agility and responsiveness in global contract operations.

Detailed research analysis of the CLM software market highlights the increasing sophistication of tools managing contract metadata, risk alerts, and multi-party contracts. The incorporation of e-signature integration and intelligent contract versioning capabilities is proving crucial in fast-paced business environments. Tools offering analytics dashboards and real-time obligation alerts are helping organizations maintain transparency and accountability. Emphasis on contract standardization is particularly strong in managing supplier contracts, with growing interest in industry-specific solutions like procurement CLM. The ability to perform lifecycle analytics provides deep insight into contract performance, renewal risks, and compliance gaps—empowering companies to optimize strategies and minimize legal exposure across all stages of the contract journey.

The Contract Life-Cycle Management (CLM) Software Market is witnessing a surge in innovation and strategic activity among key players to expand their market presence. Companies such as Contract Logix LLC, DocuSign Inc., SAP SE, Oracle Corp., and Icertis Inc. are leveraging AI and machine learning technologies to enhance contract analysis, risk detection, and automation. For instance, Contract Logix enables users to access and manage contracts securely from any device, reflecting the shift toward mobile-enabled CLM solutions. These developments aim to increase accessibility, reduce error rates, and shorten contract cycles.

Mergers and acquisitions, such as those initiated by enterprise tech giants, are further consolidating market offerings, allowing vendors to provide more comprehensive and integrated solutions. Moreover, CLM providers are increasingly offering cloud-based deployment options that support remote work scenarios and allow for seamless integration with ERP and other business systems. These strategies reflect a broader move to ensure that CLM software becomes a critical operational backbone for compliance, risk management, and productivity.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Component

6.1.1 Software

6.1.2 Services

6.2 Deployment

6.2.1 On-premises

6.2.2 Cloud-based

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted