Coal To Liquid (CTL) Market: Growth, Trends, and Key Players (2024-2028)

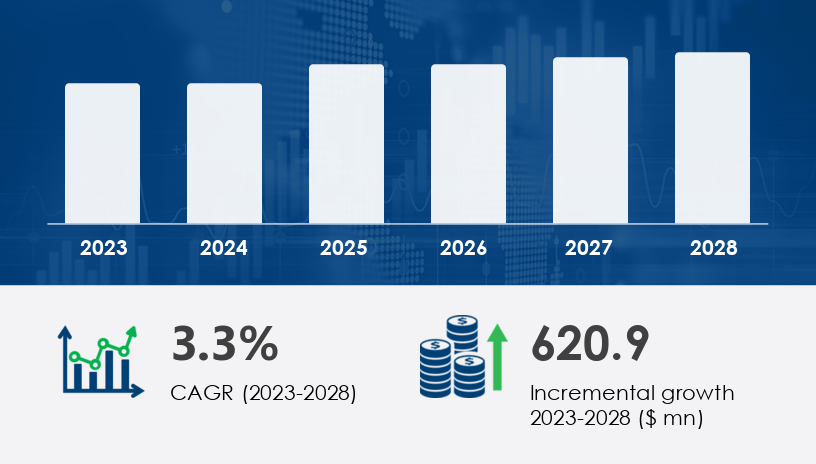

The global Coal To Liquid (CTL) Market is projected to grow significantly, with a forecasted increase of USD 620.9 billion at a CAGR of 3.3% between 2023 and 2028. This expansion is driven by the abundant availability of coal, growing demand for petrochemical feedstocks, and CTL’s potential to offer an alternative to volatile crude oil prices. CTL technology converts coal into liquid fuels and chemicals, with two primary methods: Direct Coal Liquefaction (DCL) and Indirect Coal Liquefaction (ICL). Hydrogen plays a crucial role in these processes, serving as a reducing agent in DCL and a feedstock in ICL.

For more details about the industry, get the PDF sample report for free

Product Segmentation

The CTL market is primarily segmented by product type:

- Liquid Fuels: Expected to witness significant growth, with synthetic fuels like diesel, kerosene, gasoline, and LPG being produced. The liquid fuels segment generated USD 2.70 billion in 2018 and is forecasted to continue its gradual increase.

- Chemicals: The use of CTL-derived synthetic fuels extends to various chemical products, including those used in petrochemical industries.

Regional Market Insights

- APAC: Dominating the market with an estimated 67% contribution to the global market growth, APAC is home to key players such as China Shenhua Energy Co. Ltd. and Yitai Investment Co. Ltd. The demand for synthetic fuels in APAC is driven by expanding industrial applications and energy needs.

- Key Countries: China, India, Indonesia, Australia

- North America: The U.S. remains a significant player in the CTL market due to its substantial coal reserves and the development of advanced CTL technologies.

- Key Countries: United States

- Europe: Europe’s market is influenced by stringent environmental regulations aimed at reducing emissions and enhancing the carbon efficiency of fuel production.

- Key Countries: Germany, United Kingdom

- Middle East and Africa: The Middle East and South Africa are important markets for CTL due to their growing energy demand.

- Key Countries: South Africa

- South America: Coal reserves and growing demand for synthetic fuels from countries like Brazil and Argentina contribute to the market's growth in this region.

- Key Countries: Brazil, Argentina

Key Market Drivers, Trends, and Challenges

-

Market Drivers:

- Abundant Coal Reserves: The discovery and exploration of coal reserves across major producing nations, including China, India, the U.S., Indonesia, and Australia, provide a substantial foundation for the market's growth. These countries possess significant coal reserves, which support the widespread use of CTL technology.

- Hydrogen Utilization: Hydrogen is integral to the CTL process and has growing applications in fuel cells, carbon fiber production, and supercapacitors. Its role in improving carbon efficiency in CTL processes is crucial.

-

Market Trends:

- Growing Demand for Petrochemical Feedstocks: As petrochemical applications increase in sectors such as fertilizers, electronics, and renewable energy components, CTL technology offers a promising alternative to oil-derived feedstocks. Through DCL and ICL processes, coal is converted into liquid hydrocarbons, which are then refined into valuable petrochemicals.

- Environmental Concerns and Technological Developments: Despite the rise of renewable energy, CTL remains an essential part of the global energy mix. The development of carbon capture, utilization, and storage (CCUS) technologies aims to reduce the environmental impact of CTL production.

-

Challenges:

- Volatile Crude Oil Prices: Fluctuations in oil prices significantly impact the cost competitiveness of CTL processes. When oil prices are low, conventional refining becomes more economical. However, when oil prices rise, CTL becomes more attractive due to its potential cost advantages.

Get more details by ordering the complete report

Key Companies in the Coal To Liquid (CTL) Market

Some of the key companies of the Coal To Liquid (CTL) Market are as follows:

- Air Products and Chemicals Inc.

- Altona Rare Earths Plc

- Celanese Corp.

- Chevron Corp.

- China Shenhua Energy Co. Ltd.

- DKRW Energy Partners LLC

- Envidity Energy Inc.

- Inner Mongolia Yitai Investment Co. Ltd.

- Linc Energy Systems

- Pall Corp.

- PT. Bakrie Global Ventura

- Qatargas Operating Co. Ltd.

- Regius Synfuels Ltd.

- Sasol Ltd.

- Shell plc

- TransGas Development Systems

- Yankuang Group

Recent Developments

- January 2024: China Shenhua Energy Co. Ltd. announced advancements in its ICL technology, improving efficiency and reducing emissions.

- December 2023: Chevron Corp. launched a new CCUS project aimed at mitigating CO2 emissions from its CTL operations.

- November 2023: Sasol Ltd. expanded its CTL operations in South Africa, enhancing fuel production capacity