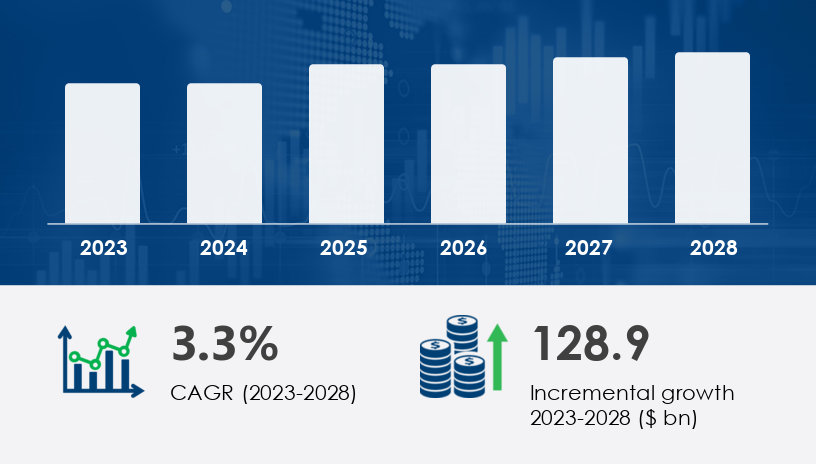

The global cigarettes market is forecast to grow by USD 128.9 billion between 2023 and 2028, expanding at a compound annual growth rate (CAGR) of 3.3%. This growth is being fueled by the rising adoption of alternative smoking products such as e-cigarettes and heat-not-burn tobacco devices, as well as the increasing accessibility and convenience of online retail platforms. While regulatory and health concerns continue to challenge traditional cigarette consumption, market players are leveraging innovation and expanding their product portfolios to meet evolving consumer preferences.For more details about the industry, get the PDF sample report for free

The cigarettes market is undergoing a significant transformation with the increasing popularity of smokeless tobacco products. E-cigarettes, vaping devices, and heat-not-burn technologies are gaining traction as consumers perceive them to be less harmful alternatives to traditional cigarettes. This trend is particularly strong among younger demographics in developed markets, where awareness of health issues associated with smoking is high.

Market players such as Philip Morris International Inc., Japan Tobacco Inc., and British American Tobacco Plc are heavily investing in research and development to introduce smoke-free and reduced-risk products. The rapid uptake of these alternatives is reshaping the competitive landscape of the tobacco industry and driving demand across various regions.

The proliferation of e-commerce platforms has revolutionized the retailing of cigarettes and tobacco products. Online platforms provide consumers with greater access to a wide range of products, including international brands and emerging alternatives such as e-cigarettes. This channel is especially favored by tech-savvy consumers in urban areas, and it provides convenience, price transparency, and discreet purchasing options.

Companies like Altria Group Inc. and Imperial Brands Plc are optimizing their online distribution channels to strengthen their market presence and tap into new customer segments. Moreover, the COVID-19 pandemic accelerated digital adoption, leading to a permanent shift toward online shopping behaviors across the global consumer base.

The global cigarettes market is highly consolidated, with a few dominant players accounting for a substantial share of global revenue. These companies continue to invest in strategic partnerships, new product launches, and regional expansion to maintain their market positions.

Altria Group Inc. – Known for the Marlboro brand in the U.S. and expanding its presence in the vaping category.

British American Tobacco Plc – Offers a diverse portfolio of combustible and non-combustible tobacco products across global markets.

China Tobacco International HK Co. Ltd. – Dominates the Chinese tobacco market and is a critical player in the global supply chain.

Imperial Brands Plc – Focuses on next-generation products and international market penetration.

Japan Tobacco Inc. – Maintains a strong global footprint, especially in Asia-Pacific and Eastern Europe.

Philip Morris International Inc. – Pioneering the shift to smoke-free alternatives with its IQOS platform.

KT and G Corp. – A key player in South Korea and expanding into the Middle East and Central Asia.

ITC Ltd. – A dominant domestic player in India with a diverse product line.

RAI Services Co. – A subsidiary of Reynolds American, active in the U.S. tobacco market.

Turk Tabacco A.S. – A significant regional player in Eastern Europe and the Middle East.

These companies are adopting aggressive marketing, expanding product ranges, and leveraging technology to appeal to modern consumers, particularly in markets with loosening regulatory environments for alternatives like e-cigarettes.

Get more details by ordering the complete report

Flavored Cigarettes: Flavored cigarettes, including menthol and fruit-flavored variants, continue to grow in popularity, especially in Asia-Pacific and Latin America. These products appeal to new and younger smokers and are often seen as less harsh.

Non-Flavored Cigarettes: Despite regulatory restrictions, non-flavored or traditional cigarettes maintain a strong foothold in markets such as China, India, and Eastern Europe, where consumption remains culturally entrenched.

Offline: This segment includes convenience stores, supermarkets, tobacco kiosks, and duty-free shops. It remains the dominant distribution channel globally, particularly in rural and developing regions.

Online: Rapid digitalization and increased comfort with e-commerce are boosting the online sales of cigarettes and related products. In Western Europe, North America, and parts of Asia-Pacific, online channels are quickly catching up in volume and revenue share.

Asia-Pacific is expected to account for 60% of the global market’s growth during the forecast period. Countries such as Indonesia, Vietnam, Malaysia, Singapore, and India contribute significantly to this growth due to their large populations of habitual smokers and cultural acceptance of tobacco usage. China remains the largest cigarette market globally, both in terms of volume and revenue, dominated by state-owned China Tobacco.

Companies are increasingly targeting Asia-Pacific markets by launching flavored and heat-not-burn products, as well as expanding retail networks. For instance, Japan Tobacco Inc. and KT and G Corp. are scaling their operations in Southeast Asia through joint ventures and local manufacturing partnerships.

European markets, particularly Western Europe, are experiencing a transition driven by regulatory restrictions on traditional tobacco and growing acceptance of e-cigarettes and heated tobacco. Governments are imposing stricter advertising bans, plain packaging requirements, and smoking cessation campaigns. These challenges are driving innovation in nicotine replacement therapies and reduced-risk products.

Countries like the UK, Germany, and Italy are witnessing a shift toward vaping, especially among younger consumers. British American Tobacco and Philip Morris International are leveraging this shift to grow their market share in the region through their respective platforms—Vuse and IQOS.

The North American market, led by the U.S. and Canada, is seeing a gradual decline in traditional cigarette volumes due to rising health awareness and regulatory pressures. However, premium brands and smoke-free alternatives are providing new revenue streams. Altria Group Inc. and RAI Services Co. are focusing on premiumization strategies and expanding their e-cigarette portfolios to counter declining traditional sales.

Canada’s strict tobacco control policies are fostering innovation in reduced-risk nicotine delivery systems. Meanwhile, the U.S. Food and Drug Administration (FDA) continues to evaluate the impact of e-cigarette use on public health, shaping the regulatory landscape.

The Middle East and Africa (MEA) region offers a relatively untapped opportunity for market players, with consistent demand for traditional tobacco products and a growing appetite for flavored and alternative products. Countries like Turkey, Egypt, South Africa, and Saudi Arabia are key growth drivers in this region.

Limited regulation compared to Western nations allows companies more freedom to market and distribute their products. Players like Turk Tabacco A.S. and KT and G Corp. are expanding operations in the region through licensing agreements and local collaborations.

South America

Get your free PDF sample report now for key industry insights and forecasts.

The global Cigarettes Market showcases a dynamic landscape shaped by evolving consumer preferences and regulatory interventions. Key product elements such as cigarette filters, nicotine content, and diverse tobacco blends continue to drive market segmentation. Product types including menthol cigarettes, clove cigarettes, light cigarettes, ultra-light cigarettes, and flavored tobacco cater to different user tastes. Innovations in rolling papers, filter tips, and cigarette sizes—including king-size cigarettes and slim cigarettes—further influence purchasing decisions. Additionally, cigarette packaging with mandated health warnings plays a vital role in consumer perception. Leaf tobacco quality, cigarette additives, and cigarette brands remain central to product differentiation, while organic tobacco is gaining traction. Market trends also reflect growing awareness around nicotine addiction and public health, with tobacco regulations and anti-smoking campaigns contributing to reduced smoking prevalence in several region

Consumers are increasingly seeking personalized smoking experiences, leading to a rise in customizable products such as flavored filter tips and adjustable nicotine strengths. Premium brands are also gaining traction, particularly in developed markets where consumers are willing to pay more for perceived quality and innovation.

Tobacco companies are entering into cross-sector partnerships to diversify their portfolios. For instance, collaborations with pharmaceutical firms are helping develop nicotine replacement therapies, while tech partnerships are aiding the development of smart smoking devices with usage tracking features.

Heated tobacco products are witnessing growing popularity in Japan, South Korea, and parts of Europe. These products are marketed as reduced-risk alternatives and are attracting smokers looking to switch from traditional cigarettes. Major brands like IQOS (Philip Morris) and Ploom (Japan Tobacco) are aggressively expanding their reach in both developed and emerging markets.

Stringent government regulations and anti-smoking campaigns in key regions such as North America and Europe have significantly limited advertising, packaging, and public smoking. Growing public awareness of the health risks associated with tobacco use is prompting consumers to quit smoking or switch to less harmful alternatives, impacting traditional cigarette sales. - Taxation policies and pricing pressure in countries like India, the UK, and Australia are reducing margins and discouraging volume purchases. - Illicit trade and counterfeit cigarette production, especially in regions with weak regulatory enforcement, continue to undercut legitimate market players and reduce tax revenues for governments. - Litigation risks remain a major concern, particularly in the United States, where class-action lawsuits and regulatory scrutiny can lead to substantial financial liabilities and brand damage. - Supply chain disruptions caused by geopolitical tensions, trade restrictions, and raw material shortages are affecting production timelines and logistics for manufacturers.

Access in-depth industry analysis—grab your free sample report today

From a regulatory and behavioral perspective, the market is shaped by factors such as tobacco taxes, plain packaging laws, and smoking cessation efforts. Illicit trade, cigarette smuggling, and unregulated hand-rolled cigarettes pose challenges for policymakers and legitimate stakeholders. Tobacco farming practices and cigarette consumption patterns vary globally, while smoking bans in public spaces have become more prevalent. Public smoking restrictions and tobacco control measures are backed by deeper scrutiny into cigarette ingredients and their impact on health, including secondhand smoke concerns. Issues such as cigarette butts contributing to environmental waste and the processes of tobacco curing are gaining importance. Analysis of smoking habits highlights demographic shifts, particularly in youth behaviors influenced by cigarette vending access, tobacco advertising restrictions, and the legal smoking age. Additionally, factors like cigarette excise duties and evolving consumer sentiment continue to shape the competitive and regulatory framework of the industry

Safe and Secure SSL Encrypted