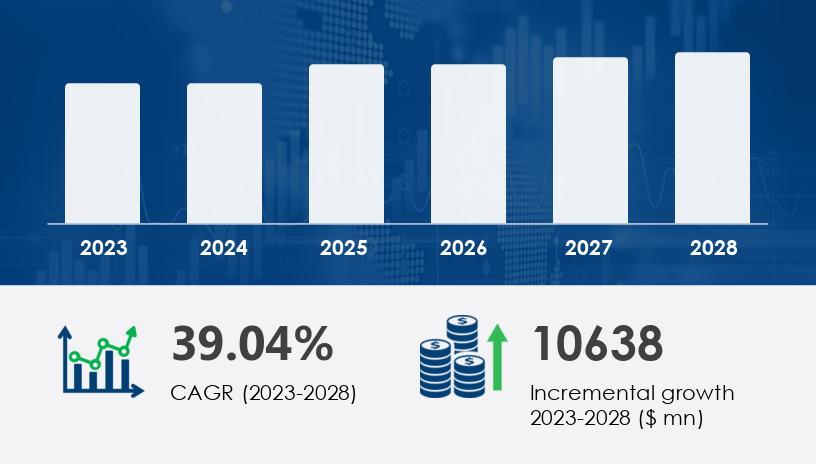

In an era where consumers increasingly prioritize wellness, sustainability, and transparency, CBD-infused cosmetics are fast becoming a defining trend in the global beauty industry. With a projected market expansion of USD 10.64 billion between 2024 and 2028, and a staggering CAGR of 39.04%, this sector stands as one of the most dynamic in the personal care landscape.

For more details about the industry, get the PDF sample report for free

The CBD-Infused Cosmetics Market is witnessing strong growth, driven by rising consumer interest in holistic wellness, clean beauty, and natural ingredients. Products such as CBD skincare, moisturizing creams, facial cleansers, and lip balms are increasingly favored for their anti-inflammatory properties, antioxidant benefits, and skin hydration capabilities. The use of hemp extract, cannabidiol oil, and hemp-derived CBD is prominent in delivering therapeutic effects without the psychoactive impact, thanks to the non-psychoactive nature of CBD. As consumers demand more from their skincare routines, vegan formulas, organic cosmetics, and botanical extracts have become essential attributes. Product categories now extend beyond skincare into haircare solutions, makeup enhancers, and fragrance blends, with an emphasis on daily skincare for sensitive skin and skin soothing applications.

The beauty and personal care industry is experiencing a generational shift — away from synthetic ingredients and toward natural, therapeutic solutions. CBD (Cannabidiol), a non-psychoactive compound from hemp and marijuana plants, fits squarely into this ethos. Its anti-inflammatory, antioxidant, and skin-calming properties offer genuine performance in soothing irritation, reducing acne, and combatting premature aging.

CBD's rise is no longer just trend-driven — it's science-backed and efficacy-focused.

CBD-infused cosmetics are personal care products containing cannabidiol (CBD) extracted from cannabis plants. These may include creams, balms, oils, serums, face masks, and more. Unlike THC, CBD does not induce psychoactive effects, making it widely accepted in beauty formulations.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Cosmetic brands are expanding their CBD product portfolios — launching premium lines that combine CBD with botanicals like aloe vera, shea butter, and essential oils. Packaging innovations such as airless pumps and sustainable containers enhance user experience and appeal to eco-conscious consumers.

The hemp segment, valued at over USD 389.3 billion in 2018, continues to dominate, thanks to its accessibility, favorable regulations, and skin-friendly properties. Hemp-derived CBD is now mainstream in department stores, retail pharmacies, and e-commerce platforms.

Online beauty platforms and influencer-driven marketing have helped CBD-infused cosmetics penetrate mainstream consumer markets. Beauty bloggers and dermatologists now openly advocate for CBD-based products as part of holistic skincare routines.

With robust R&D, liberal regulations, and digitally native CBD brands like CBD For Life and Joy Organics, North America is the market's powerhouse. U.S. consumers show strong preference for multi-functional skincare, and department stores increasingly feature dedicated “clean beauty” aisles with CBD options.

Markets like the UK and Germany are embracing organic CBD-infused skincare, often linked to green beauty movements. European giants like L’Oréal and Unilever are integrating CBD into heritage lines while collaborating with biotech startups.

Despite cultural preferences for traditional remedies and price sensitivity, the APAC region, particularly China, is ripe for disruption, especially in the luxury beauty segment. Brands that educate and localize their offerings are poised for first-mover advantage.

Hemp (Leading) – Eco-friendly, high in skin-soothing terpenes.

Marijuana – Limited use due to THC regulations; niche, high-end products.

Skincare (Dominant) – Oils, serums, masks, moisturizers.

Makeup & Haircare – Emerging sub-category.

Fragrances & Aromatherapy – Gaining traction with wellness integration.

Others

Research in the CBD-infused cosmetics market is centered on cosmetic innovation and the integration of functional compounds like pure CBD, CBD isolates, and full-spectrum CBD to deliver enhanced skincare outcomes. Products such as premium serums, body lotions, face masks, and hydrating lotions are gaining traction due to their promising roles in skin repair, acne treatment, and providing anti-aging benefits. With an increasing shift toward luxury cosmetics, manufacturers are focusing on skin nourishment, calming effects, and solutions designed for inflammation relief. The inclusion of beauty oils and targeted wellness applications under the broader category of wellness products shows how CBD cosmetics are becoming a staple in advanced skincare routines. As consumers seek more personalized, safe, and efficacious beauty solutions, research continues to support the efficacy and market potential of cannabidiol-based formulations across the cosmetic landscape.

| Pros | Cons |

|---|---|

| Anti-inflammatory and calming | Regulatory complexity by region |

| Antioxidant properties for anti-aging | Misconceptions around THC content |

| Appeals to clean beauty enthusiasts | Shelf-life and preservative issues |

| Versatile usage (oils, creams, balms) | Market penetration low in developing countries |

Invest in Consumer Education – Clarify the difference between hemp-derived and marijuana-based CBD; stress non-psychoactive nature.

Prioritize Transparency – Third-party testing, ingredient clarity, and traceability are key to consumer trust.

Leverage E-Commerce & Influencers – Meet consumers where they shop and seek advice.

Diversify Across Skin Types & Conditions – Target acne, eczema, sensitive skin — high-need, high-conversion areas.

Prepare for Regulation – Comply with FDA, EMA, and national cosmetic regulations proactively.

The 2025 outlook indicates sustained momentum, particularly in CBD oils and serums, which offer fast absorption and visible results. Expect increased cross-industry collaborations — think pharmaceutical-grade skincare with wellness benefits — and the rise of CBD in luxury spa and aromatherapy treatments.

As research validates CBD's dermatological benefits, its reputation will evolve from a fringe trend to a standard skincare staple.

Lack of awareness in emerging markets – Brands must localize messaging and simplify benefits.

Bacterial contamination & preservatives – Requires innovation in natural preservation systems.

THC confusion – Ongoing consumer education needed to separate CBD’s benefits from marijuana’s reputation.

Safe and Secure SSL Encrypted