“Myocardial infarctions are no longer just a mortality statistic—they’re a call to innovation,” said a leading cardiac surgeon at a 2024 global health conference. That call is now being answered by an accelerating market reshaped by next-gen diagnostics, robotic-assisted surgeries, and biomaterial breakthroughs. As we enter 2025, the cardiovascular and soft tissue repair patches market is no longer a peripheral segment—it’s a $2 billion inflection point, poised to redefine surgical recovery from the inside out.

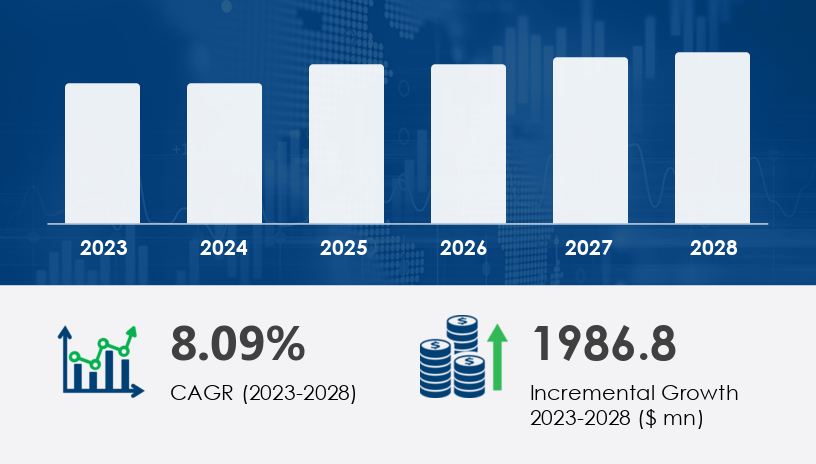

Next-Gen Outlook: With a projected CAGR of 8.09% from 2023 to 2028 and an expected addition of USD 1.99 billion in market value, the years 2024–2028 will be a defining period where technological precision meets systemic health demands.

For more details about the industry, get the PDF sample report for free

From underused surgical tools to indispensable components of modern procedures, cardiovascular and soft tissue repair patches have evolved rapidly. This transformation has been propelled by the surge in myocardial infarctions (MI), rising minimally invasive surgeries, and diagnostic advancements. What was once an auxiliary product line is now central to clinical strategies worldwide.

| Metric | 2020 | 2024 (Now) | 2028 (Projected) |

|---|---|---|---|

| Market Size (USD) | $1.45 Billion | $1.99 Billion | ~$3.5 Billion |

| Leading Region | Europe | North America (37%) | North America |

| Disruptive Trend | Bovine Pericardium Use | Minimally Invasive MI Surgeries | Tissue-Engineered Smart Patches |

Legacy Disruption: Historically associated with hernia repairs and post-trauma interventions, soft tissue patches were slow to integrate into broader cardiovascular treatment pathways.

New Strategy Emerging: Integration into congenital defect correction and procedures for congenital diaphragmatic hernias is now driving cross-specialty adoption.

Analyst Insight: “Soft tissue repair is now as much about cardiac recovery as it is about orthopedic reinforcement,” notes a Technavio research analyst.

Business Case: A Midwest medical center replaced traditional sutures with next-gen patches in over 60% of hernia and vascular cases, reducing post-op infection rates by 20%.

Market Data:

Atherosclerotic-related procedures continue to drive demand due to hypercholesterolemia prevalence.

Legacy Disruption: Treated as high-risk and dependent on highly specialized cardiac surgeons, cardiac repairs faced procedural delays.

New Strategy Emerging: Use of tissue-engineered patches and robotic implants is mitigating the dependence on highly skilled labor.

Analyst Insight: “The patch has moved from passive material to an active component in regenerative cardiac care.”

Business Case: A cardiovascular startup in Texas deployed a bionic heart patch in a clinical pilot, cutting patient recovery time from 14 days to 7.

Market Data:

Rise in congenital defect repairs (atrial and ventricular septal defects) driving increased application.

MI affects ~790,000 Americans annually, fueling urgent demand.

Get your free PDF sample report now for key industry insights and forecasts.

Legacy Disruption: Early reliance on basic synthetic materials limited integration with host tissues.

New Strategy Emerging: Use of ePTFE and bovine pericardium provides enhanced biocompatibility and long-term durability.

Analyst Insight: “The raw materials now inform the regenerative potential, not just structural support.”

Business Case: A Japanese supplier shifted entirely to bioengineered tissue for patches, enabling 30% higher integration in vascular grafts.

Market Data:

Raw material innovation addressing cost-related hesitancies and complication risks like infections or rejection.

With diagnostic modalities like cardiac MRI and CT angiography refining disease mapping, companies are developing patches tailored for specific anatomical precision.

“Precision in diagnosis now demands precision in repair,” said a panelist at the 2024 MedTech Future Conference.

North America’s rise to 37% market share is partially attributed to reimbursement frameworks, which de-risk adoption for hospitals and clinics. Suppliers with FDA-approved materials gain faster traction.

The lack of skilled cardiac surgeons globally is reshaping design priorities, favoring minimally invasive-ready and preformed patch kits. Companies like CorMatrix Inc. are leading this transformation.

The Cardiovascular and Soft Tissue Repair Patches Market is experiencing significant growth driven by rising incidences of heart conditions, congenital defects, and increasing demand for minimally invasive surgical procedures. Advanced patch technology is revolutionizing heart repair by addressing critical conditions such as myocardial infarction, heart attack, and atrial septal or ventricular septal abnormalities. The integration of biocompatible materials like bovine pericardium and EPTFE material ensures improved patch durability and better patient outcomes. Applications in vascular repair and diaphragmatic hernia management are enhancing cardiovascular health and promoting the use of vascular patches in heart surgery. Additionally, the use of synthetic patches and biological patches in hernia treatment, especially for inguinal hernia and abdominal wall reinforcement, supports the overall expansion of the soft tissue repair segment.

Unlock detailed market trends—download the complimentary PDF sample report

By 2028, expect patches designed using AI-driven modeling for personalized tissue repair, optimizing flow dynamics and cellular integration.

Robotic surgery platforms combined with real-time consultation from cardiac experts in global centers will minimize geographic surgical disparities.

With companies like Tisgenx Inc. exploring time-sensitive biodegradability, future patches will not just repair, but stimulate regeneration and dissolve post-function.

Prioritize biomaterial innovation: Invest in biomaterial and tissue engineered material for next-gen patch design.

Address skilled labor shortages: Develop minimally invasive-compatible solutions that reduce procedural complexity.

Accelerate AI integration: Apply AI-driven inventory optimization for regional demand forecasts and surgical readiness.

Expand diagnostics partnership: Align with providers of advanced diagnostic modalities to offer bundled surgical solutions.

Prepare for value-based care models: Build economic arguments around reduced recovery times and fewer complications.

Research trends in the Cardiovascular and Soft Tissue Repair Patches Market emphasize advancements in tissue engineering, tissue regeneration, and cardiac regeneration, particularly for heart defects and tissue damage repair. Innovations in medical biotechnology are fostering the development of next-generation cardiac patches, which function as tissue scaffolds to facilitate tissue healing and long-term tissue reinforcement. The focus on surgical innovation has enabled precise patch application techniques, especially in procedures addressing hernia repair and cardiovascular surgery. Additionally, the development of surgical patches tailored for tissue scaffolds and regenerative applications underscores the growing intersection of patch durability and functionality. Research continues to highlight the benefits of cutting-edge materials and design in elevating the performance and therapeutic impact of cardiovascular and soft tissue patches.

The cardiovascular and soft tissue repair patches market is evolving from structural support to intelligent, regenerative solutions that redefine patient recovery. As technological, demographic, and systemic forces converge, the coming years will favor companies that view patches not just as products—but as platforms for transformation.

Access our Full 2024–2028 Playbook to lead your market transformation.

Safe and Secure SSL Encrypted