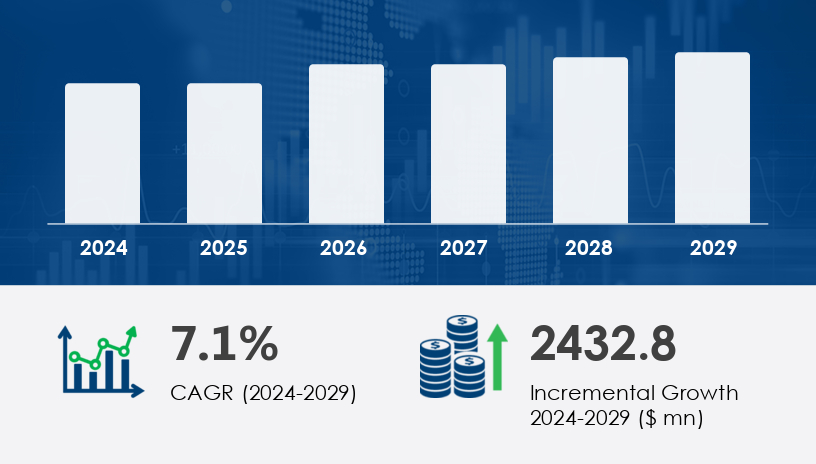

The Cardiopulmonary Stress Testing Systems Market is poised for strong expansion between 2025 and 2029, fueled by rising global health concerns and increased adoption of diagnostic tools. In 2024, the market is valued at a substantial baseline and is projected to increase by USD 2.18 billion by 2029, growing at a CAGR of 6.78%. Cardiopulmonary stress testing systems are critical for diagnosing heart and lung conditions, particularly in elderly populations, athletes, and individuals at risk for cardiovascular disease. With the rising prevalence of cardiovascular diseases (CVDs) and respiratory disorders, this market is becoming essential for effective diagnosis and management of heart and lung health.

For more details about the industry, get the PDF sample report for free

One of the primary drivers for the growth of the cardiopulmonary stress testing systems market is the proliferation of heart specialty centers, particularly in developed nations. The global surge in cardiovascular diseases (CVDs) such as heart failure, atrial fibrillation, and hypertension has led to an increased need for specialized outpatient cardiovascular clinics. These centers are equipped with advanced diagnostic technologies and skilled personnel, leading to more efficient workflows and improved patient outcomes. The availability of licensed cardiac specialists and tailored treatment approaches ensures more accurate diagnoses, which in turn, boosts the demand for high-end cardiopulmonary stress testing systems. This infrastructure shift is enabling early detection and better disease management, directly fueling market growth.

A significant trend shaping the market is the integration of digital and remote technologies into stress testing systems. Healthcare providers are increasingly adopting mobile health applications, wearable technologies, and connected devices that facilitate real-time patient monitoring. The CASE system by GE HealthCare exemplifies this trend, offering a digital platform for accessing cardiac data during exercise testing. This shift toward portable and remote diagnostics is improving access, flexibility, and data continuity, especially in outpatient and telehealth settings. Digitized workflows and integrated data systems are streamlining diagnostics, which enhances treatment planning and fosters broader adoption across both urban and rural healthcare infrastructures.

The Cardiopulmonary Stress Testing Systems Market is gaining momentum due to the rising prevalence of cardiovascular diseases and respiratory disorders, driving demand for advanced diagnostic technologies. Core systems like CPET systems, stress ECG, and SPECT systems are widely utilized in cardiology clinics, diagnostic centers, and ambulatory centers for exercise testing and stress testing. These tools enable monitoring of key physiological parameters such as heart rate, blood pressure, oxygen uptake, and cardiac output during controlled physical exertion. The integration of pulse oximeters, stress monitors, and wearable devices enhances real-time monitoring and data precision, contributing to more accurate cardiac diagnostics. Innovations in ventilation analysis, oxygen pulse, and functional capacity assessment support clinicians in evaluating exercise intolerance, heart failure, and myocardial ischemia. Additional tests like hypertension testing, arrhythmia detection, and angina symptoms analysis are essential for comprehensive patient evaluations.

Product Outlook:

CPET systems

Stress ECG

SPECT systems

Stress blood pressure monitors

Pulse oximeters

End-user Outlook:

Hospitals

Ambulatory surgical centers

Diagnostic centers

Among the various product categories, CPET systems (Cardiopulmonary Exercise Testing) dominate the cardiopulmonary stress testing systems market and are expected to maintain their lead through 2029. These systems, which were valued at USD 1.92 billion in 2018, are considered the gold standard for evaluating patients with chronic heart failure. CPET systems offer a noninvasive means of assessing the functionality of cardiovascular, pulmonary, and muscular systems during exercise. Their lightweight and portable design has made them a preferred choice in hospitals and clinics. Analysts note that the precision and reliability of CPET in measuring a patient’s exercise tolerance and functional capacity are key reasons for its widespread adoption and continued market leadership.

Covered Regions:

North America (US, Canada)

Europe (UK, Germany, France, Rest of Europe)

Asia (China, India, Argentina, Others)

Rest of World (Saudi Arabia, South Africa, Brazil, Others)

North America leads the cardiopulmonary stress testing systems market, driven by a combination of high CVD prevalence, advanced healthcare infrastructure, and favorable reimbursement scenarios. In 2022, North America accounted for the largest market share, a trend expected to continue through the forecast period. Initiatives like the American Heart Association’s Heart Month and the National Institutes of Health’s The Heart Truth program have significantly boosted awareness and early diagnosis of heart diseases in the US. These government and community efforts not only increase public awareness but also stimulate funding and adoption of diagnostic systems. The availability of skilled physicians and widespread deployment of high-tech diagnostic centers further accelerate market growth in the region.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Despite the market’s robust growth, a major impediment is the high cost of cardiopulmonary stress testing devices. Advanced systems used in diagnostic labs and hospitals are expensive, making them inaccessible for smaller clinics and outpatient centers. This limits adoption, especially in cost-sensitive markets. For example, stress testing combined with echocardiography or nuclear imaging is notably more costly and can increase patients' out-of-pocket expenses. Radiation exposure from nuclear imaging, such as myocardial perfusion scans, also raises safety concerns, impacting patient willingness and limiting test utilization. These financial and safety barriers pose significant challenges to widespread market penetration.

Research indicates significant adoption of non-invasive diagnostics and portable devices, particularly in cardiac centers seeking scalable, patient-friendly solutions. Advances in wireless acquisition, ECG interpretation, and AI analytics are improving diagnostic speed and accuracy across multiple applications. The use of smart technologies enables enhanced remote monitoring, offering benefits in post-hospital care and chronic disease management. Complementary diagnostic modalities such as nuclear stress, echocardiography, and biomarker monitoring are also gaining relevance for their detailed insights into heart rhythm and structural heart health. Additionally, tools for fitness assessment are increasingly deployed not only for clinical use but also in preventive settings. Testing protocols now frequently include ECG readings, exercise intolerance tracking, and functional data for oxygen uptake and stress response, enabling deeper analysis of cardiac diagnostics in both symptomatic and asymptomatic patients.

Analytical trends highlight the market's evolution toward data-driven diagnostics, with AI-powered platforms and portable stress testing systems driving broader adoption across both clinical and outpatient settings. The combination of clinical-grade accuracy, patient convenience, and smart integration is expected to fuel future growth, especially as global demand for early cardiovascular and pulmonary disease detection increases.

Leading companies in the cardiopulmonary stress testing systems market are actively pursuing strategic alliances, product innovation, and geographic expansion to enhance their market presence. Key players such as Becton Dickinson and Co., COSMED Srl, General Electric Co., Hill-Rom Holdings Inc., Siemens Healthineers AG, and Koninklijke Philips NV are investing heavily in R&D, AI integration, and mobile health platforms to align with the shift toward portable and home-based diagnostic solutions.

Analysts also note that the emergence of lightweight and portable CPET systems and digitally integrated ECG and pulse oximeter devices is expected to accelerate adoption across outpatient and diagnostic center settings. As innovation continues, manufacturers are focusing on affordability, user-friendly interfaces, and remote connectivity to meet growing demand in both mature and emerging markets.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Product

6.1.1 CPET systems

6.1.2 Stress ECG

6.1.3 SPECT systems

6.1.4 Stress blood pressure monitors

6.1.5 Pulse oximeters

6.2 End-User

6.2.1 Hospitals

6.2.2 Ambulatory surgical centers

6.2.3 Diagnostic centers

6.3 Geography

6.3.1 North America

6.3.2 Asia

6.3.3 Europe

6.3.4 ROW

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted