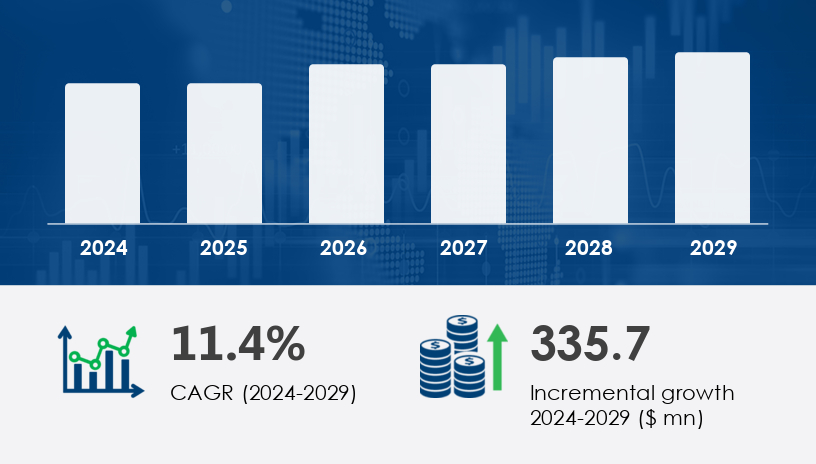

The budget apps market is poised for significant growth, with a projected CAGR of 11.4% from 2025 to 2029, translating to an incremental increase of USD 335.7 million. This surge is driven by the rising demand for financial literacy tools, particularly among younger demographics, and the increasing adoption of digital financial solutions. This comprehensive guide delves into the market's segmentation by deployment, type, and geography, offering strategic insights for stakeholders aiming to capitalize on emerging opportunities.For more details about the industry, get the PDF sample report for free

The global budget apps market is experiencing robust growth, fueled by technological advancements and a heightened focus on personal financial management. The market's expansion is further supported by the proliferation of smartphones and increased internet accessibility, enabling users to manage finances conveniently.

Growth Drivers & Challenges

The cloud-based deployment segment is leading the market, driven by its scalability, cost-effectiveness, and ease of access. Organizations are increasingly adopting cloud solutions to enhance user experience and streamline operations. However, concerns regarding data security and privacy remain challenges for widespread adoption.

Expert Insight

"The shift towards cloud-based budget apps is a testament to the industry's commitment to providing flexible and user-friendly financial solutions," notes a research expert at Technavio

Case Study: Brightfin's Cloud Transition

In July 2024, Brightfin launched a cloud-based financial wellness app targeting younger users. The app's success underscores the growing preference for cloud solutions that offer real-time financial tracking and personalized insights.

Key Stats

Cloud-based deployment is expected to dominate the market during the forecast period.

The overall market is projected to grow by USD 335.7 million from 2025 to 2029.

Growth Drivers & Challenges

Personal budgeting apps are witnessing significant adoption, especially among millennials and Gen Z, due to their intuitive interfaces and personalized features. Family budgeting apps cater to households aiming for collective financial planning, while business budgeting apps assist small enterprises in managing expenses. Challenges include differentiating features in a saturated market and ensuring user engagement.

Expert Insight

"Customization and user-centric design are pivotal in driving the adoption of budgeting apps across different user segments," emphasizes Technavio Expert

Case Study: FamilyBudget Pro

FamilyBudget Pro, launched in early 2025, offers shared expense tracking and goal setting for families. Its user-friendly design and collaborative features have led to a 25% increase in user engagement within six months.

Key Stats

Personal budgeting apps hold the largest market share among the type segments.

The market's growth is significantly influenced by the rising demand for personalized financial management tools.

Growth Drivers & Challenges

The Asia-Pacific (APAC) region is leading the market growth, attributed to increasing smartphone penetration and a growing middle-class population seeking financial management tools. North America and Europe continue to be significant markets due to high digital literacy and established financial infrastructures. Challenges include varying regulatory environments and cultural differences affecting app adoption.

Case Study: BudgetMaster in India

BudgetMaster tailored its app features to cater to Indian users, incorporating local languages and regional financial practices. This localization strategy resulted in a 40% increase in user base within a year.

Key Stats

APAC is expected to contribute significantly to market growth during the forecast period.

Countries like India and China are emerging as key markets due to their large, tech-savvy populations.

Get more details by ordering the complete report

The budget app market is rapidly evolving as consumers increasingly seek efficient personal finance solutions to enhance their money management and achieve their financial goals. These apps typically feature an array of tools such as expense trackers, spending trackers, and income tracking modules that help users monitor their cash flow effectively. The integration of budget planners and financial apps has simplified financial planning, allowing users to set savings goals, track their debt payoff progress, and manage bill reminders to avoid missed payments. Popular functionalities include expense management, budget calculators, and budget trackers which assist in maintaining a spending limit and preparing detailed expense reports. This growing demand for comprehensive budget tools and finance trackers has also fueled the rise of savings apps and debt management features, creating a more holistic approach to budget management and financial budgeting for everyday users.

Opportunities

Expansion into emerging markets with increasing smartphone adoption.

Integration of AI and machine learning for personalized financial insights.

Partnerships with financial institutions to offer comprehensive services.

Risks

Data security and privacy concerns may hinder user trust.

Intense competition leading to market saturation.

Regulatory challenges across different regions.

The budget apps market is projected to grow by USD 335.7 million from 2025 to 2029, at a CAGR of 11.4%. The market will continue to evolve with technological advancements and changing consumer behaviors.

Expert Prediction

"The integration of advanced analytics and user-centric features will define the next phase of growth in the budget apps market," predicts Technavio Expert

Are companies ready to pivot and embrace these emerging trends to stay competitive?

For more details about the industry, get the PDF sample report for free

For Cloud-based Deployment Providers

Enhance data security measures to build user trust.

Offer scalable solutions to cater to varying user needs.

Invest in user-friendly interfaces for better engagement.

For Personal Budgeting App Developers

Incorporate AI-driven insights for personalized financial advice.

Focus on gamification to increase user retention.

Collaborate with influencers to reach younger demographics.

For Regional Market Expansion

Conduct thorough market research to understand local financial behaviors.

Adapt app features to align with regional preferences and regulations.

Establish partnerships with local financial institutions for credibility.

In analyzing the budget apps market, it is evident that the combination of money apps with specialized features like bill organizers, budget software, and money planners enhances user engagement and improves overall financial health. Advanced tools such as expense budgets, debt trackers, and bill trackers empower consumers with greater control over their bill payments and income planning. Many apps now incorporate savings calculators and debt calculators to provide precise projections that support tailored savings plans and debt management strategies. The integration of finance planners and budget management systems delivers a seamless experience, enabling users to monitor their expense monitors and optimize their money budgets. These financial tools and finance apps are increasingly popular for their ability to deliver personalized expense planners and budget calculators that simplify expense monitoring and promote consistent money saving, thus driving growth in the finance tracker segment.

Get more details by ordering the complete report

The budget apps market is on an upward trajectory, driven by technological innovations and a growing emphasis on personal financial management. Stakeholders must stay abreast of emerging trends and tailor their strategies to meet evolving consumer needs.

Safe and Secure SSL Encrypted