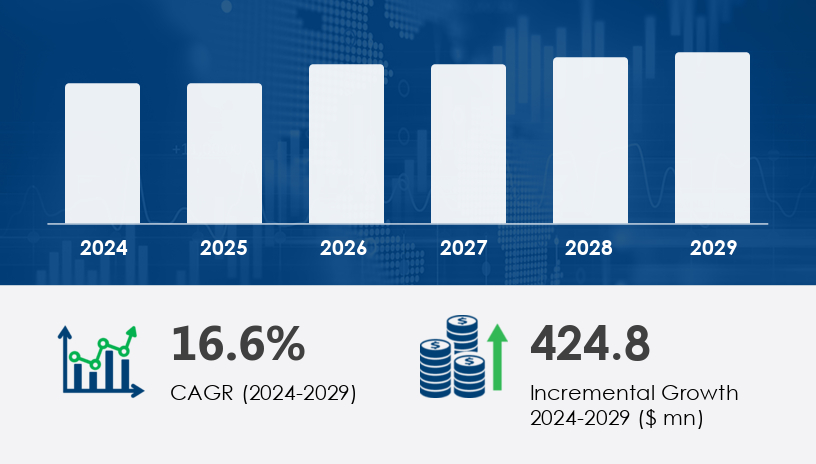

The Blue Laser Diode Market is poised for strong expansion as advancements in laser technology continue to reshape industries such as healthcare, manufacturing, and telecommunications. Valued at a promising baseline in 2024, the market is projected to grow by USD 424.8 million, registering a compound annual growth rate (CAGR) of 16.6% between 2024 and 2029. This rapid growth reflects increasing demand for high-power laser solutions across both consumer and industrial applications.

Request Your Free Report now to stay ahead with exclusive market intelligence.

A primary driver propelling the Blue Laser Diode Market forward is the widespread adoption of laser projectors, particularly in home entertainment and professional display systems. As leading companies transition from conventional lamp-based projectors to laser phosphor technology, blue laser diodes have become essential components. These diodes generate blue light that is projected onto a phosphor wheel to produce red, green, and blue light, enabling superior image quality and 4K resolution. The advantages of this technology—enhanced brightness, longer lifespan, and energy efficiency—are fueling increased investment and demand, especially from firms aiming to innovate in projector design and manufacturing.

An emerging trend influencing the Blue Laser Diode Market is the rising popularity of high-power blue laser diodes, particularly for industrial and scientific applications. Industry leaders like USHIO and OSRAM have released advanced models delivering up to 250W at a 450 nm wavelength, which offer higher efficiency and lower heat generation. These diodes are increasingly adopted in fields such as metal cutting, semiconductor processing, and medical diagnostics, where traditional red or green lasers fall short. Their ability to cut reflective materials like copper and gold—unachievable with other diode types—positions high-power blue lasers as indispensable tools for next-gen industrial workflows.

The Blue Laser Diode Market is witnessing significant growth driven by innovations in gallium nitride-based semiconductor laser technologies, which are central to producing compact and efficient blue light sources. Key applications span across laser projectors, Blu-ray discs, and optical storage systems, where precise and high-intensity beams are essential. The adoption of high-power diodes is particularly notable in sectors such as laser headlights, medical lasers, and display technology, where performance and reliability are critical. As industries explore next-generation solutions, technologies like quantum dots, holographic displays, and microdisplay panels are increasingly incorporating blue laser components for enhanced resolution and color depth. The integration of fiber optic systems and laser scanning applications further solidifies the role of blue laser diodes in advanced optical setups.

Type: Single-mode, Multi-mode

Application: Bio/medical, Laser projectors and scanners, Blu-ray devices, Others

Material: Gallium nitride (GaN), Indium gallium nitride (InGaN)

Product Type: Continuous wave (CW), Pulsed

The Single-mode blue laser diode segment is leading the market in both growth and market share. Valued at USD 169.10 million in 2019, it has experienced steady growth due to its high beam quality, narrow linewidth, and excellent coherence, making it ideal for medical diagnostics, laser printing, and automotive displays. These diodes are increasingly used in cutting-edge applications such as quantum computing, optical coherence tomography, and laser spectroscopy. Analysts note that the surge in demand is also driven by the semiconductor and scientific research sectors, where efficient and compact laser sources are essential for innovations in laser cooling, fluorescence microscopy, and data storage.

North America

Europe

APAC

South America

Middle East and Africa

Asia Pacific (APAC) is forecast to contribute 44% of the global market growth between 2025 and 2029, making it the dominant regional force. China, in particular, leads this expansion due to its high demand for home theater and cinema systems powered by laser projection. Companies like Xiaomi are leveraging ALPD 3.0 and similar innovations to produce affordable, high-performance laser projectors. APAC is also a major hub for semiconductor manufacturing, where blue laser diodes are vital for laser manipulation, flow cytometry, and quantum well applications. According to analysts, the combination of consumer electronics demand and industrial automation is expected to sustain the region’s dominance through the forecast period.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite its strong growth trajectory, the Blue Laser Diode Market faces a notable challenge: the decline in demand for Blu-Ray and DVD players. These optical storage devices once represented a major application for blue laser diodes. However, with the rise of streaming platforms like Netflix and Amazon Prime, and the increasing use of USB drives and cloud storage, physical media consumption has sharply declined. This trend has significantly reduced one of the market’s traditional revenue streams, pushing manufacturers to diversify into medical, industrial, and telecom sectors to maintain growth momentum.

Extensive market research indicates a rising demand for applications involving laser engraving, laser welding, laser cutting, and laser marking, fueled by the precision and efficiency of modern laser modules. The market also sees increasing deployment of diode arrays, laser optics, and laser pointers in both consumer and industrial segments. To improve beam quality, innovations in beam shaping, optical lens technologies, and optical cavity design are playing pivotal roles. Additionally, laser illumination is gaining traction in automotive and architectural sectors, enabled by advancements in diode chip performance and photonics devices. Emerging uses in laser sensors and optical communication demonstrate the growing scope of these diodes in intelligent and connected environments.

Analytical studies in the Blue Laser Diode Market focus on improving diode efficiency, diode lifespan, and diode performance through optimized diode packages, enhanced laser sources, and better laser driver integration. Research is also addressing thermal stability with systems for laser cooling to prolong operational integrity. The importance of laser beam precision necessitates advancements in laser alignment techniques and the use of high-grade optical coatings to maintain consistent output. Safety remains a top priority, prompting innovation in laser safety measures, particularly for medical and industrial uses. Finally, ongoing development in laser crystals and optical enhancement materials further strengthens the reliability and effectiveness of blue laser diodes across applications.

To stay competitive, leading companies are focusing on expanding their application base and enhancing product performance. Firms such as ams OSRAM AG and USHIO Inc. are at the forefront, offering advanced single-mode and multi-mode blue laser diodes designed for high-intensity, low-heat performance. Key strategic actions include:

R&D investments aimed at improving efficiency and reducing manufacturing costs.

Strategic partnerships and acquisitions to broaden market access and integrate new technologies.

Geographical expansion into emerging markets such as India and Southeast Asia.

Launch of high-power diode series, such as OSRAM’s 250W blue lasers, targeting industries like metal processing and medical imaging.

These efforts underscore a shift toward multi-sector adoption, as companies seek to move beyond traditional entertainment applications and establish a foothold in industrial automation, defense, and biotechnology.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Type

6.1.1 Single-mode

6.1.2 Multi-mode

6.2 Application

6.2.1 Bio/medical

6.2.2 Laser projectors and scanner

6.2.3 Blu-ray devices

6.2.4 Others

6.3 Material

6.3.1 Gallium nitride (GaN)

6.3.2 Indium gallium nitride (InGaN)

6.4 Product Type

6.4.1 Continuous wave (CW)

6.4.2 Pulsed

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted