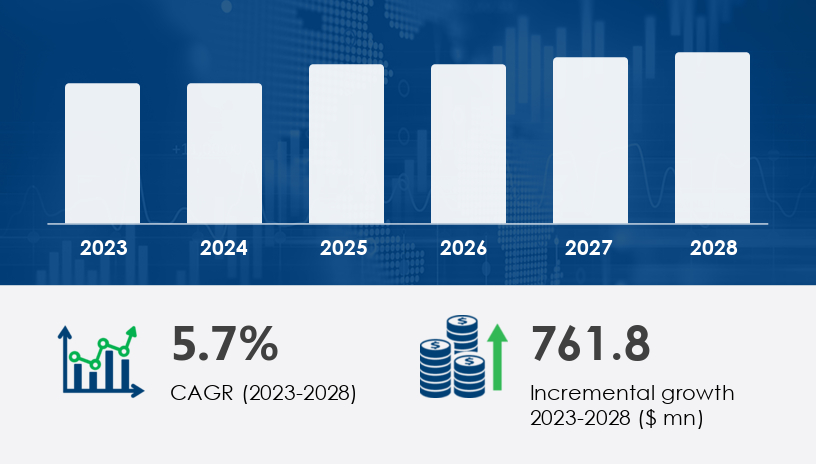

The U.S. baby shampoo and conditioner market is on a robust growth trajectory, projected to expand by USD 761.8 million at a CAGR of 5.7% between 2023 and 2028. In an industry deeply influenced by shifting parental expectations and the evolving dynamics of infant care, several key drivers are shaping purchasing behavior. Developed markets, in particular, are witnessing a matured awareness regarding baby health and hygiene, leading to a heightened preference for paraben-free, phthalate-free, and organic baby grooming products. Parents are now more informed about the ingredients they apply to their children’s skin and hair, steering demand away from harsh chemical-based formulations toward gentle, tear-free, and multifunctional shampoo and conditioner blends.According to the National Center for Health Statistics, the relatively stable U.S. birth rate—approximately 3.7 million births in 2019—continues to sustain demand in the segment. Urbanization and a rising ratio of working women further amplify the need for convenient, effective, and time-saving solutions in infant grooming. These modern parents are inclined toward formulations that cleanse and protect their child’s hair from pollutants and UV rays while preventing tangles and infections. This need for high-efficacy and easy-to-use products is reinforced by modern retail formats and e-commerce platforms offering an extensive range of baby care essentials.For more details about the industry, get the PDF sample report for free

By Product:

Non-medicated: Continues to dominate the market due to growing demand for natural, gentle formulations. These products are designed to cleanse and protect without introducing irritants. Key players such as Johnson & Johnson focus on tear-free, sensitive care lines with organic components.

Medicated: Used for specific scalp conditions such as cradle cap and eczema, this segment has niche yet steady demand.

By Distribution Channel:

Offline: Includes pharmacies, drug stores, and supermarkets that remain go-to destinations for immediate and tactile product purchases.

Online: E-commerce platforms are rapidly scaling due to their convenience, broad assortments, and easy access to product reviews and ratings.

APAC is projected to contribute 38% of global market growth, driven by rising birth rates and infant hygiene awareness, particularly in:

China

India

North America, led by:

US, continues to show sustained demand due to stable birth rates, urban lifestyles, and high health consciousness.

Europe follows closely with strong market presence in:

Germany

UK

Other emerging regions include:

South America

Middle East and Africa, where increasing disposable incomes are starting to influence consumer preferences in baby care.

Get more details by ordering the complete report

Matured consumer awareness in developed markets: With access to more information and a growing interest in ingredient transparency, parents are opting for nourishing, hydrating shampoos and conditioners made with natural, chemical-free ingredients. These are favored for their mildness on infant scalps and their ability to prevent scalp issues like flakes and infections.

Urbanization and rising female workforce: Working parents seek multifunctional, time-efficient grooming solutions, elevating demand for combination products like shampoo-conditioner-body wash hybrids.

Heightened hygiene awareness: Concerns about pollutants and UV exposure drive preference for products offering protective benefits along with basic cleansing.

Proliferation of multifunctional products: A major trend is the introduction of all-in-one bath products, such as body wash and shampoo blends. These are widely accepted by parents looking to minimize bath-time complexity while maintaining thorough hygiene.

Child-centric packaging and organic formulas: Product lines featuring colorful, playful packaging—especially those bearing cartoon characters—are gaining traction for their appeal to toddlers. At the same time, organic product ranges are rapidly expanding as parents seek out eco-conscious and safe formulations.

Global decline in birth rates: While the U.S. maintains a relatively stable birth rate, global fertility trends are declining, particularly in high-income nations where family planning choices and the cost of child-rearing impact market volume. By 2100, over 75% of countries are expected to fall below replacement fertility levels, influencing long-term demand.

Increased consumer scrutiny: The growing trend toward phthalate-free and vitamin-enriched offerings reflects consumer resistance to chemical ingredients. Brands that fail to adapt may face hurdles in maintaining consumer trust and regulatory compliance.

The Baby Shampoo and Conditioner Market is experiencing robust growth, propelled by rising demand for gentle shampoo and tear-free shampoo products tailored to infant needs. Modern parents are increasingly opting for baby shampoo and baby conditioner solutions with natural ingredients, such as chamomile extract, aloe vera, jojoba oil, shea butter, and calendula extract, known for their soothing and nourishing properties. Preference for hypoallergenic shampoo, non-toxic shampoo, and chemical-free shampoo is driving innovation, especially among brands offering pH-balanced shampoo and mild surfactants to minimize scalp irritation and address concerns like cradle cap or sensitive scalp. The shift towards organic shampoo, vegan shampoo, cruelty-free conditioner, and plant-based ingredients reflects a broader movement towards eco-friendly packaging, biodegradable packaging, and sustainable infant care solutions. As hygiene awareness grows, product formulations are increasingly dermatologist-tested and pediatrician-recommended, assuring caregivers of safety and efficacy for infant hygiene and baby hair health.

Get more details by ordering the complete report

The competitive landscape in the baby shampoo and conditioner market features a blend of multinational giants and specialized players, including:

Johnson and Johnson Services Inc.

Unilever PLC

Artsana Spa (Chicco)

Beiersdorf AG

Biocrown Biotechnology Co. Ltd.

Burts Bees

California Baby

Dabur India Ltd.

Farlin Corp.

Galderma SA

Menmoms

Mothercare Plc

My Skincare Manufacturer Pty Ltd.

Pigeon Corp.

S.C. Johnson and Son Inc.

Sovereign Chemicals and Cosmetics

The Himalaya Drug Co.

Vanesa Cosmetics Pvt. Ltd.

Vasa Cosmetics Pvt. Ltd.

Weleda Group

These players are leveraging strategies such as geographical expansion, product innovation, partnerships, and acquisitions to strengthen market share. A key focus remains on natural formulations, gentle cleansing agents, and child-friendly branding to meet evolving consumer expectations in a competitive retail landscape.

The market is segmented into non-medicated shampoo, medicated shampoo, nourishing conditioner, and hydrating shampoo, with special attention to conditions like eczema shampoo and scalp flakiness. Functional innovation is also emerging in probiotic shampoo and multifunctional shampoo formats that address both cleansing and scalp care. The inclusion of vitamin-enriched shampoo and hair detangler features has enhanced product appeal among consumers prioritizing holistic infant hair care and easy grooming routines. Driven by rising demand for organic conditioner and tearless formula products, global brands are expanding their portfolios in the baby bath products and baby grooming segments. E-commerce and rising birth rates, especially in Asia-Pacific and emerging markets, are fueling accessibility and adoption. With consumer loyalty tied closely to transparency and trust, the emphasis on safe, paraben-free shampoo, sulfate-free shampoo, and wellness-aligned branding is reshaping the landscape. The Baby Shampoo and Conditioner Market is thus positioned for continued innovation and sustainable growth across both premium and mass-market tiers

Get more details by ordering the complete report

Safe and Secure SSL Encrypted