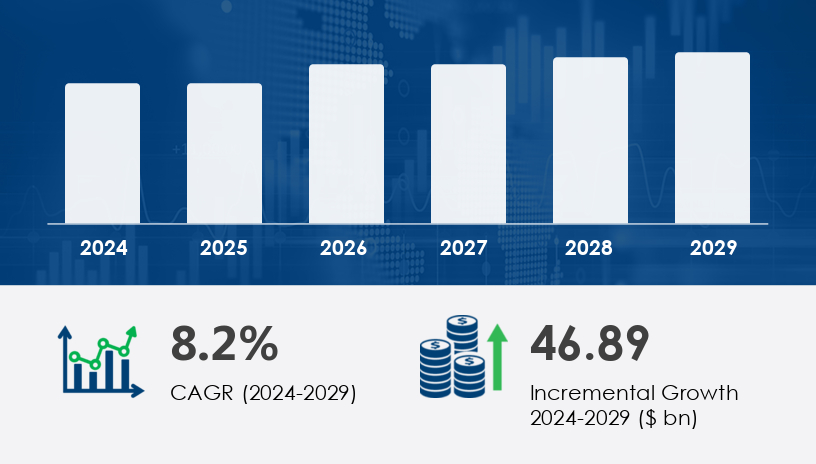

The Baby Food And Infant Formula Market is poised for substantial expansion, fueled by shifting consumer preferences and innovation in product offerings. Rising health consciousness among parents and demand for organic alternatives are key dynamics influencing this growth.The market size is projected to increase by USD 46.89 billion from 2024 to 2029, registering a compound annual growth rate (CAGR) of 8.2%. This robust trajectory reflects the increasing prioritization of infant health and nutrition globally.For more details about the industry, get the PDF sample report for free

One of the principal drivers propelling the Baby Food And Infant Formula Market is the continuous launch of new and innovative products. Companies are expanding their product portfolios to cater to the growing demand for nutritionally superior, safe, and convenient options. These innovations are not just fulfilling nutritional requirements but also establishing brand loyalty. For instance, manufacturers are increasingly incorporating ingredients that mimic breast milk—such as whey protein, essential fatty acids like DHA and ARA, and iron fortification—to boost cognitive development and energy levels in infants. As parents seek products aligned with dietary guidelines and pediatrician recommendations, brands that deliver these attributes are gaining a competitive edge.

A significant trend shaping the Baby Food And Infant Formula Market is the surge in demand for organic baby food products. Parents are gravitating towards products that are free from synthetic additives, pesticides, preservatives, and hormones. This preference stems from a growing awareness of the potential health risks posed by chemically treated ingredients. As a result, brands are emphasizing clean-label offerings, ethical sourcing, and eco-conscious manufacturing practices. Furthermore, the rise of e-commerce platforms and well-established retail distribution channels has enhanced the availability of organic options. To meet this demand, companies are investing in sustainability initiatives and reducing packaging waste, further resonating with environmentally aware consumers.

The Baby Food and Infant Formula Market is witnessing robust expansion fueled by growing parental awareness regarding high-quality nutrition and the increasing demand for natural options in infant care. Essential products like infant formula, infant milk, and growing-up milk serve as the foundation of early infant feeding routines. These formulations are increasingly fortified with vitamin fortified and mineral enriched blends to ensure nutritional balance during crucial developmental stages. As consumer preferences shift, demand for organic formula, plant-based formula, and chemical-free products is on the rise, promoting safer, non-GMO ingredients and clean label offerings for infants and toddlers alike.

The Baby Food And Infant Formula Market is segmented into:

By Product: Infant Formula, Baby Food

By Type: Milk Formula, Dried Baby Food, Prepared Baby Food, Others

By Formulation: Organic, Conventional

By Age Group: 0–6 Months, 6–12 Months, 12–36 Months

The Infant Formula segment leads the Baby Food And Infant Formula Market, driven by the increasing number of working mothers and growing health consciousness. This segment, valued at USD 38.40 billion in 2019, continues to expand steadily. Infant formula is designed to closely replicate the nutritional composition of breast milk, featuring components such as whey and casein proteins, vegetable oils, and essential vitamins and minerals. Technavio analysts note that despite its inability to exactly mimic breast milk’s amino acid profile, infant formula remains a vital solution for parents unable to breastfeed. The evolution of e-commerce and labeling transparency also contributes to the rising adoption of infant formula across markets.

Get more details by downloading the sample PDF report

Regions covered:

North America

Europe

APAC

South America

Middle East & Africa

Rest of World (ROW)

APAC is expected to account for 31% of global market growth during the forecast period. Countries like China, India, and Japan are spearheading this expansion due to a combination of rising disposable incomes, urbanization, and increased awareness about infant health and wellness. The growing middle-class population is particularly driving demand for premium and organic baby food products. In China, in particular, the confluence of government regulations, digital retail expansion, and a cultural emphasis on early childhood development fuels strong market growth. According to Technavio analysts, labeling regulations and sustainability practices in APAC are evolving rapidly, prompting manufacturers to adapt with clean-label products, ethical sourcing, and stringent quality controls.

A critical challenge confronting the Baby Food And Infant Formula Market is the rising number of product recalls due to contamination issues. These incidents, whether originating from packaging defects or manufacturing lapses, undermine consumer trust and tarnish brand reputation. Packaging contamination may arise during transport or storage, while manufacturing contamination can result from improper handling, unsanitary equipment, or even clothing of food handlers. Such recalls not only incur significant financial penalties but also necessitate rigorous quality assurance protocols. Brands must intensify microbiological testing, comply with food safety audits, and implement stringent allergen controls to preserve consumer confidence and regulatory compliance.

A wide array of offerings within baby food includes baby cereals, dried food, pureed food, and prepared food, all aimed at providing convenience feeding options for modern families. Packaging innovations—such as bottled packaging, can packaging, and smart packaging—help ensure freshness and ease of use. Advances in nutritional science have led to the development of casein protein, whey protein, prebiotics blend, and probiotics formula, which contribute to digestive health and immune support. For specific life stages, options such as first infant, follow-on milk, and specialty milk cater to newborns, growing toddlers, and infants with dietary sensitivities or allergies.

The diversification of infant nutrition now includes products like toddler food, formula tabs, organic snacks, and solid snacks, extending beyond infancy into early childhood. Many formulations today support lactation support for breastfeeding mothers and offer premium quality alternatives that mimic modified cow milk for improved tolerability. Enhanced nutritional content continues to be the driving factor behind purchasing decisions, especially for gluten-free options, digestive-friendly, and immune-boosting solutions. Meanwhile, developments in smart packaging and baby nutrition tracking are helping parents make informed decisions with ease. As a result, this market remains at the forefront of innovation in both product development and consumer satisfaction

Innovations and Recent Developments:

To maintain competitive advantage, companies in the Baby Food And Infant Formula Market are pursuing innovative product development and sustainability practices. There is a strong emphasis on formulations tailored for specific dietary needs, such as soy-based and hydrolyzed formulas for lactose intolerance or food allergies. Brands are incorporating vitamin D and iron fortification to enhance infant nutrition and are exploring DHA and ARA supplementation for brain development. In addition, social media marketing, customer relationship management, and content-driven brand positioning are vital tools for building long-term consumer trust. Manufacturing processes are being upgraded with food safety audits, while eco-friendly packaging innovations help address environmental concerns.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 Product

6.1.1 Infant Formula

6.1.2 Baby Food

6.2 Type

6.2.1 Milk Formula

6.2.2 Dried Baby Food

6.2.3 Prepared Baby Food

6.2.4 Others

6.3 Formulation

6.3.1 Organic

6.3.2 Conventional

6.4 Age Group

6.4.1 0–6 Months

6.4.2 6–12 Months

6.4.3 12–36 Months

6.5 Geography

6.5.1 North America

6.5.1.1 US

6.5.1.2 Mexico

6.5.2 Europe

6.5.2.1 France

6.5.2.2 Germany

6.5.2.3 Italy

6.5.2.4 UK

6.5.3 APAC

6.5.3.1 China

6.5.3.2 India

6.5.3.3 Japan

6.5.3.4 South Korea

6.5.3.5 Australia

6.5.4 South America

6.5.4.1 Brazil

6.5.5 Middle East and Africa

6.5.5.1 UAE

6.5.6 Rest of World (ROW)

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted