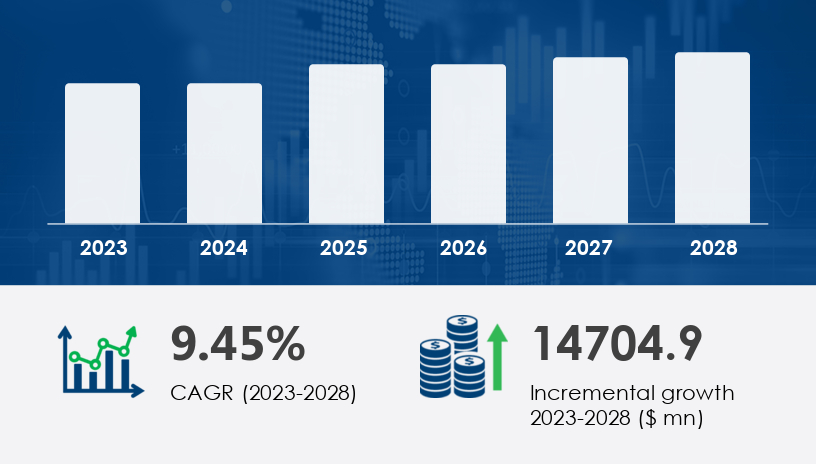

The global automotive energy recovery systems market is on track to witness an incremental growth of USD 14.7 billion from 2024 to 2028, registering a robust CAGR of 9.45%. This surge reflects an industry-wide pivot toward improved fuel economy, emissions reduction, and performance efficiency. B2B stakeholders, particularly in the OEM and automotive component manufacturing sectors, are aligning their strategies with the growing relevance of energy recovery technologies. From e-axles in Fuel Cell Electric Vehicles (FCEVs) to regenerative braking systems, these technologies are becoming core to the drivetrain innovation wave sweeping through the industry.Electric vehicles (EVs), plug-in hybrids (PHEVs), and hybrid electric vehicles (HEVs) stand at the center of this transformation. With increasing traffic congestion and environmental pressures, automotive energy recovery systems offer a dual advantage: minimizing waste and extending vehicle range. These systems convert kinetic and exhaust energy—previously lost during deceleration or heat dissipation—into electrical energy, stored in advanced battery systems for reuse. This power can then drive electric accessories, reduce engine load, and help meet stringent emissions norms, especially in urban areas.For more details about the industry, get the PDF sample report for free

The market has been segmented based on Product, Type, and Geography, with detailed performance insights for each.

By Product:

Regenerative Braking System: A standout segment poised for significant growth. This technology converts the kinetic energy generated during braking into usable electrical energy, directly supporting battery recharging and electric propulsion.

Turbocharger: Enhances engine performance by recycling exhaust gases.

Exhaust Gas Recirculation (EGR): Reduces NOx emissions by reintroducing exhaust gases into the combustion chamber.

By Vehicle Type:

Passenger Cars

Commercial Vehicles

Electric Vehicles

Among these, electric and hybrid models are seeing accelerated adoption of energy recovery systems as countries and corporations pursue zero-emission targets.

The Asia-Pacific (APAC) region dominates the global outlook, contributing approximately 45% to market growth between 2024 and 2028. This includes:

China

India

China’s aggressive EV adoption policies, driven by its pollution control mandates and incentives for domestic OEMs, position it as a key growth hub. India, meanwhile, is bolstering adoption through the National Electric Mobility Mission Plan 2020, aiming to scale both hybrid and full-electric mobility.

North America is also witnessing transformative changes, driven by:

United States

Canada

In the U.S., rising sales of light trucks and electric passenger cars, along with the deployment of electric school buses, signal growing adoption. Energy recovery systems in these vehicles support turbocharger heating and boost efficiency. Demand is further bolstered by safety features like electronic stability control.

In Europe, led by Germany, regulatory emphasis on carbon neutrality and the expansion of electric mobility infrastructure continue to catalyze growth.

South America, Middle East, and Africa present emerging opportunities, especially as electric vehicle penetration deepens and emission-related legislation becomes more stringent.

Get more details by ordering the complete report

The foremost driver of market expansion is the rising demand for electrical energy efficiency in vehicles. Regenerative braking and e-axles are playing pivotal roles by capturing and repurposing energy typically lost during braking or deceleration.

Another key catalyst is the growing concern over traffic congestion in major urban centers. In stop-and-go traffic, regenerative systems provide a tangible benefit by harnessing kinetic energy instead of allowing it to dissipate. This energy, stored in high-efficiency batteries, is later used during acceleration, achieving system efficiencies in the 60%-70% range.

Moreover, the transition to EVs and hybrids—driven by consumer demand and government policies—is creating a ripple effect across supply chains. Automakers are now integrating recovery systems in both gasoline and diesel-powered models to meet evolving efficiency and emission benchmarks.

The industry is experiencing a surge in technological innovation, particularly in waste heat recovery. Systems that repurpose engine heat that would otherwise be lost to the atmosphere are gaining commercial traction. These technologies are reducing fuel consumption, enhancing driving range, and lowering emission levels.

Companies like Brembo and its Sensify platform are developing advanced subsystems and propulsion analytics to optimize energy capture in electric vehicles. Key components like valve blocks and heat exchangers are becoming integral to vehicle design as they directly impact thermal energy recycling capabilities.

Governmental regulations are also playing a defining role. Mandates on carbon reduction and fuel economy improvements are pressuring OEMs to integrate recovery solutions proactively. In response, manufacturers are investing in R&D to develop next-generation systems that balance performance, cost, and regulatory compliance.

Despite the apparent benefits, the market is hampered by high operational and implementation costs. These systems require advanced electronics, controllers, and complex integration processes, all of which add to vehicle costs—a concern for both OEMs and end-users.

The aftermarket adoption is particularly challenging. Retrofitting older models with modern recovery systems incurs high expenses and may not yield sufficient ROI, deterring broader uptake.

Additionally, the evolving nature of energy recovery standards requires continuous investment in research and development, straining the budgets of mid-tier automotive companies and system suppliers.

For more details about the industry, get the PDF sample report for free

Several established and emerging companies are shaping the competitive landscape. Strategies include geographic expansion, product innovation, and M&A activity. Major players include:

Stellantis NV – Offers regenerative braking systems, turbochargers, and EGR systems.

Autoliv Inc.

BorgWarner Inc.

Continental AG

Cummins Inc.

DENSO Corp.

Gentherm Inc.

Hitachi Ltd.

Honeywell International Inc.

Hyundai Motor Co.

IHI Corp.

Mitsubishi Motors Corp.

Panasonic Holdings Corp.

Rheinmetall AG

Ricardo Plc

Robert Bosch GmbH

Skeleton Technologies GmbH

Tenneco Inc.

UCAP Power Inc.

ZF Friedrichshafen AG

These companies are categorized across pure play, category-focused, industry-focused, and diversified segments, based on their core activities and product portfolios. Their competitive strength is quantitatively assessed as dominant, leading, strong, tentative, or weak, helping B2B buyers evaluate suppliers strategically.

Each player is adapting to market needs by enhancing battery integration, improving thermal management, and expanding software-driven control systems. Their investments are not just aimed at compliance but also at carving out differentiation in a highly competitive, tech-driven landscape.

The Automotive Energy Recovery Systems Market is evolving rapidly, driven by advancements in kinetic energy recovery and brake energy regeneration technologies. These systems are central to modern energy storage systems and battery charging systems, particularly in electric and hybrid vehicles. Innovations in electric brake control and the deployment of regenerative brake modules have enabled more effective energy recapture technology, boosting vehicle efficiency. Developments in brake energy harvesting and hybrid braking systems allow seamless transitions between mechanical and regenerative braking, often supported by electric motor assist features. On the engine side, turbo energy recovery and exhaust energy capture via turbocharger efficiency and waste energy turbines enhance power generation. Technologies such as the turbo boost system, forced induction recovery, and turbo kinetic energy systems—including exhaust turbine generators and turbo power assist—support more energy-efficient turbo designs that reduce fuel consumption.

For more details about the industry, get the PDF sample report for free

Adoption of energy recovery systems varies by region and vehicle category, mapped across an innovation lifecycle from early adopters to laggards. Key purchase drivers include:

Fuel efficiency gains

Cost savings over vehicle lifecycle

Emissions compliance

Improved performance and range

Price sensitivity is influenced by installation complexity, component sourcing, and return on investment (ROI). Suppliers must tailor messaging to emphasize long-term savings and regulatory alignment, especially in cost-conscious fleets and commercial buyers.

As the automotive energy landscape evolves, the role of recovery systems will become increasingly strategic—not just in meeting mandates but in delivering operational excellence, sustainability, and differentiation in next-generation mobility solutions.

Complementing kinetic and turbo recovery, EGR energy recovery and exhaust heat recovery are gaining traction for their role in thermal energy capture. Integration of EGR cooling systems, exhaust gas recycling, and heat exchanger systems is improving thermal efficiency, with advanced EGR valve technology enhancing exhaust energy reutilization. These innovations are key to improving gas recirculation efficiency and optimizing the thermal management system. With rising demand for sustainable mobility, electric vehicle batteries, hybrid vehicle systems, and plug-in hybrid systems are leveraging these technologies to maximize passenger car efficiency and commercial vehicle recovery. Enhanced EV energy management, battery energy storage, and electric drive systems are reinforcing the backbone of hybrid powertrain recovery platforms. Efforts in vehicle energy optimization through energy recovery modules, automotive energy systems, and powertrain energy capture are pivotal to long-term efficiency. Technologies enabling vehicle battery regeneration, energy-efficient drivetrains, automotive thermal recovery, and electric power regeneration are converging with kinetic energy systems and cutting-edge energy harvesting technology to form the foundation of the next-generation automotive efficiency system

For more details about the industry, get the PDF sample report for free

Safe and Secure SSL Encrypted