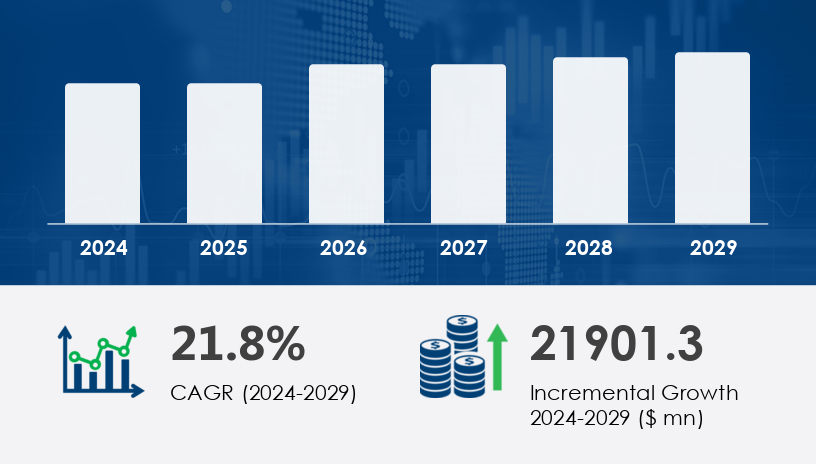

The application security market is projected to grow significantly from 2025 to 2029, driven by escalating cybersecurity threats and digital transformation initiatives across industries. In 2024, the market was valued at USD 21.9 billion and is forecast to expand further at a CAGR of 21.8% through 2029, fueled by the increasing reliance on web and mobile applications and the need to secure sensitive data.

For more details about the industry, get the PDF sample report for free

A key driver propelling the application security market is the rising number of data leaks and high-profile cyberattacks. In December 2024 alone, multiple incidents targeted critical sectors, with over 13 breaches in healthcare compromising more than 1 million records each. These attacks impacted roughly 42% of the population and underscored the urgent need for robust application security measures. Organizations are responding by investing in advanced security solutions to prevent data exposure, ensure regulatory compliance, and build customer trust. According to analysts, these high-profile breaches have intensified enterprise demand for comprehensive application security frameworks that can effectively mitigate the risks posed by evolving cyber threats.

One of the most impactful trends shaping the application security landscape is the proliferation of shadow IT. As businesses increasingly adopt unapproved digital tools—such as Slack, Google Docs, and cloud-based services—to accelerate operations, they unintentionally create security blind spots. Additionally, the surge in IoT device integration without formal oversight further compounds vulnerabilities. Despite the risks, the agility and scalability offered by shadow IT continue to attract enterprises, signaling a need for adaptive application security models that account for these decentralized and often unmanaged digital assets.

The Application Security Market has expanded rapidly due to increasing demand for robust Application Security Testing solutions across industries. Enterprises now integrate tools like Web Application Firewall and Mobile App Security platforms to address rising cyber threats. The surge in API-centric development has fueled demand for API Security and practices such as Static Code Analysis and Dynamic Testing, which provide proactive vulnerability detection. With modern software pipelines, Software Composition Analysis and Runtime Protection are becoming integral in defending against open-source threats. The industry also emphasizes Secure Coding frameworks, particularly in regulated sectors. In high-risk verticals like finance, BFSI Cybersecurity ensures compliance and protection of sensitive transactions, while Healthcare Data Protection and Telecom Network Security address threats to critical personal and operational data. Moreover, sectors such as retail and public services enhance defenses through Retail Payment Security and Government Cyber Defense, emphasizing the wide applicability of application security practices.

By Deployment

On-premises

Cloud

By End-user

Web Application Security

Mobile Application Security

By Component

Solution

Service

Among the deployment models, the on-premises segment is expected to experience notable growth during the forecast period. Valued at USD 3.94 billion in 2019, this segment has steadily gained traction, particularly among organizations seeking greater control over their application environments. On-premises solutions offer robust protection through features such as Web Application Firewalls (WAFs), AI-powered threat detection, and transparent data encryption. According to industry analysts, this segment’s growth is fueled by demand from enterprises that prioritize data sovereignty and want to minimize third-party exposure. These security features help organizations effectively manage threats within their physical infrastructure, reducing risks of unauthorized access and data compromise.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Covered Regions:

North America

Europe

Asia-Pacific (APAC)

South America

Middle East and Africa

North America leads the global application security market, contributing approximately 39% to its growth between 2025 and 2029. The region’s dominance is attributed to widespread mobile device usage, cloud-based infrastructure adoption, and the presence of major vendors like IBM, Cisco, and Synopsys. Both large enterprises and SMEs are increasingly prioritizing the protection of their web and mobile applications. AI-driven methods, including machine learning and big data analytics, are widely employed for vulnerability management and workload protection. Analysts note that North America’s proactive cybersecurity stance and robust technology ecosystem enable it to respond effectively to complex threat landscapes, driving sustained regional growth.

One of the most pressing challenges facing the application security market is the widespread adoption of open-source security solutions, particularly in cost-sensitive regions. While these solutions offer affordability and ease of use, especially in emerging markets like India and China, they often lack comprehensive security features and maintenance. Their growing popularity among small-scale enterprises, which may not have the expertise or resources to implement advanced security protocols, poses a threat to revenue streams in the proprietary solutions market. As analysts caution, this trend may dampen the profitability of commercial vendors and hinder the broader growth potential of the market if not counterbalanced by innovation and differentiation.

Research into the Application Security Market reveals a growing adoption of tools like Penetration Testing, Vulnerability Scanning, and Threat Modeling, particularly in agile development environments. Enterprises increasingly depend on Security Orchestration platforms and Code Review Tools for real-time risk mitigation. The rise of DevSecOps has also fostered the integration of Container Security, Cloud Security Posture, and Identity Access Management into development workflows. Strict adherence to Encryption Standards and implementation of Secure SDLC (Software Development Life Cycle) strategies further reflect the shift toward embedding security earlier in the pipeline. Organizations face regulatory pressures and use Compliance Management frameworks to align with mandates like PCI DSS Compliance, GDPR Security, and HIPAA Compliance. These market dynamics underscore a shift from reactive to proactive strategies, which are reshaping how security is approached throughout the software development lifecycle.

Recent analyses of the Application Security Market highlight the evolution of technologies such as SAST Tools, DAST Tools, and IAST Solutions, which are central to adaptive security mechanisms. Advanced defenses like RASP Technology and Security Automation are now embedded within enterprise systems to improve threat response efficiency. As remote work expands, Endpoint Security and Zero Trust Security models are essential in maintaining integrity across dispersed networks. The implementation of Application Hardening and Fuzz Testing techniques supports resilience against novel attack vectors. Additionally, crowdsourced approaches like Bug Bounty Programs offer real-time threat intelligence. With the proliferation of APIs and mobile platforms, solutions like Secure API Gateway, Web App Scanner, and Mobile Threat Defense have seen substantial investment. Finally, robust cloud strategies incorporate Cloud Workload Protection and Data Loss Prevention to address risks associated with hybrid environments, solidifying their role in the future of application security.

Key players in the application security market are pursuing various strategies to enhance their competitiveness and market presence. Notably, companies like Broadcom Inc. have launched advanced solutions such as Gen 8.6, while others are leveraging AI and machine learning to automate threat detection and prioritization. Strategic alliances, mergers, and acquisitions are being used to expand technological capabilities and geographic reach. For example, vendors are increasingly focusing on cloud-native security platforms and hybrid deployment models to meet the growing needs of both SMEs and large enterprises. Analysts emphasize that continuous innovation in AI-driven analytics and secure DevSecOps integration will be crucial in differentiating leading providers in this competitive landscape.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Deployment

6.1.1 On-premises

6.1.2 Cloud

6.2 End-User

6.2.1 Web application security

6.2.2 Mobile application security

6.3 Component

6.3.1 Solution

6.3.2 Service

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted