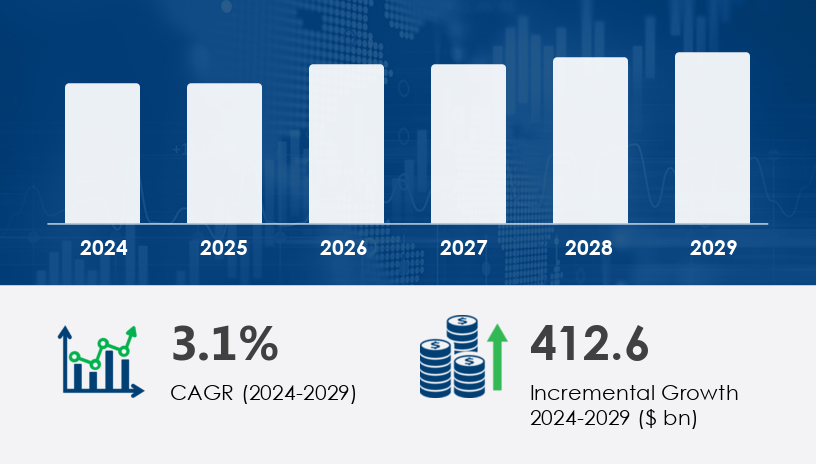

The alcoholic beverages market is a dynamic and culturally significant industry, deeply rooted in social practices and traditions across the globe. In recent years, consumer demand has evolved toward premium, sustainable, and craft options, influencing both product development and marketing strategies.In 2024, the alcoholic beverages market was valued significantly and is projected to grow by USD 412.6 billion from 2024 to 2029, expanding at a CAGR of 3.1% during the forecast period.For more details about the industry, get the PDF sample report for free

A major driver fueling the alcoholic beverages market is the rising popularity of craft segment products. Consumers are increasingly seeking unique, small-batch, and high-quality offerings that deliver distinctive taste experiences. This trend reflects a shift in consumer preference away from mass-produced options toward more artisanal and authentic beverages.

Craft alcoholic beverages—particularly craft beer—are experiencing increased demand due to their varied styles and flavors, such as American Amber Ale, English-Style Pale Ale, and Barrel-Aged Beers. These offerings are commonly produced by small, independent brewers who emphasize quality, freshness, and innovation. According to analysts, this surge in demand is a response to lifestyle changes, urbanization, and the growing cocktail culture among millennials and Gen Z consumers.

Top Trends in Alcoholic Beverages Market

An emerging trend shaping the alcoholic beverages market is the increasing consumption of alcoholic beverages in social and hospitality settings. Urbanization, rising disposable incomes, and changing lifestyle habits are driving this growth. The expansion of the hospitality and tourism industry has further accelerated consumption, with more consumers dining out, staying in hotels, and participating in social events.

Simultaneously, digital marketing and social media have enabled brands to reach broader audiences. Alcohol producers are also focusing on product innovation, such as ready-to-drink cocktails, flavored spirits, and low- or non-alcoholic variants, appealing to health-conscious and younger demographics. Analysts note that this diversification of offerings reflects the industry's adaptability to evolving consumer needs and preferences.

The Alcoholic Beverages Market continues to diversify with growing consumer preferences for craft beer, premium liquor, and distilled spirits. Products like sparkling wine, hard seltzer, and packaged beer are gaining traction due to their convenience and evolving tastes. Regional specialties such as bourbon whiskey, rye whiskey, and Tennessee whiskey appeal to niche demographics, while global options like vodka beverages, tequila shots, rum cocktails, and gin tonic contribute to the category’s expansion. Additionally, offerings like canned wine, bottled spirits, and seasonal trends such as pumpkin beer reflect the growing demand for diverse and ready-to-drink alcoholic options.

Market Segmentation

The alcoholic beverages market is segmented by:

Product:

Beer

Spirits

Wine

Distribution Channel:

Off-trade

On-trade

Geography:

Europe (Germany, France, Spain)

APAC (China, India, Japan)

North America (Canada, US)

South America (Brazil)

Middle East and Africa

Beer leads the alcoholic beverages market and is projected to retain a significant share during the forecast period. In 2019, the beer segment was valued at USD 896.60 billion, demonstrating steady growth thereafter. Although saturation in mature markets like North America and Western Europe has caused a slight deceleration, beer remains the most consumed alcoholic product globally.

Analysts highlight that beer's popularity stems from its cultural significance and affordability. Innovations such as flavored lagers, craft varieties, and eco-conscious brewing methods continue to boost this segment's appeal. The fermentation process using cereals like rice, corn, and barley contributes to a wide range of flavor profiles, further expanding its consumer base.

Regional Analysis

Regions Covered:

Europe

APAC

North America

South America

Middle East and Africa

Rest of World (ROW)

Europe dominates the alcoholic beverages market, contributing 28% to the global market growth during the forecast period. Key countries driving this expansion include France, Germany, the UK, Russia, Belgium, Romania, and Poland.

Europe's alcoholic culture is deeply rooted, with beer being the most consumed alcoholic drink. Analysts report that off-trade channels (e.g., retail sales) have higher volume consumption than on-trade channels (e.g., bars and restaurants). The region also shows strong preferences for lager, craft beers, and flavored varieties. Moreover, stringent regulatory frameworks ensure transparency through alcohol content labels and health warnings, building consumer trust and driving repeat purchases.

Get more details by downlaoding the sample PDF report

Market Challenge

One of the critical challenges facing the alcoholic beverages market is the proliferation of counterfeit products. The widespread availability of fake or adulterated alcoholic drinks poses severe health risks and undermines consumer confidence.

These counterfeit products can bypass safety regulations, lack proper labeling, and potentially contain harmful substances. Analysts warn that such challenges can damage brand equity and reduce market share for legitimate producers. To combat this, manufacturers must prioritize product authenticity, implement track-and-trace systems, and reinforce quality assurance mechanisms to maintain trust and comply with evolving regulatory standards.

Emerging trends in the market are shaped by a surge in low-alcohol drinks, non-alcoholic beer, and flavored vodka, catering to health-conscious consumers. Environmentally responsible offerings like organic wine and sustainable packaging—including liquid cartons, recyclable bottles, and biodegradable packaging—are becoming key differentiators. Innovative smart labels and QR codes are enhancing consumer engagement through digital scanning and intelligent packaging. Brands are shifting toward lightweight packaging and eco-friendly cartons such as cardboard packaging to reduce environmental impact and appeal to conscious buyers.

Manufacturers are now focusing on optimizing ethanol content, experimenting with fermented grains, fruit fermentation, barley malt, and wheat hops to enhance beverage texture and alcoholic taste. The shift toward single-serve cans and multi-pack bottles aligns with changing consumption habits favoring portability and sharing. Additionally, niche beverages and premiumization drinks continue to fuel market growth as consumers seek sophisticated and personalized experiences. The Alcoholic Beverages Market is responding to this evolution with dynamic offerings that blend tradition with innovation, catering to both indulgence and sustainability.

Competitive Strategies

To stay competitive, companies in the alcoholic beverages market are embracing sustainability, premiumization, and technological innovation. For instance, many producers are now offering organic and biodynamic wines, investing in eco-friendly packaging, and supporting local sourcing to reduce environmental impact.

The rise of ready-to-drink (RTD) cocktails and premium beverages, such as Scotch whisky, also demonstrates the market's shift toward convenience and luxury. Furthermore, producers are leveraging digital platforms for branding and direct-to-consumer sales, while exploring low-alcohol and alcohol-free options to tap into the wellness trend.

Paraphrased analyst insights suggest that craft producers, by offering distinctive, locally inspired products, are gaining traction among modern consumers who value authenticity, environmental responsibility, and diverse flavor profiles.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 Distribution Channel

6.1.1 Off-trade

6.1.2 On-trade

6.2 Product

6.2.1 Beer

6.2.2 Spirits

6.2.3 Wine

6.3 Geography

6.3.1 Europe

6.3.2 APAC

6.3.3 North America

6.3.4 South America

6.3.5 Middle East and Africa

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted