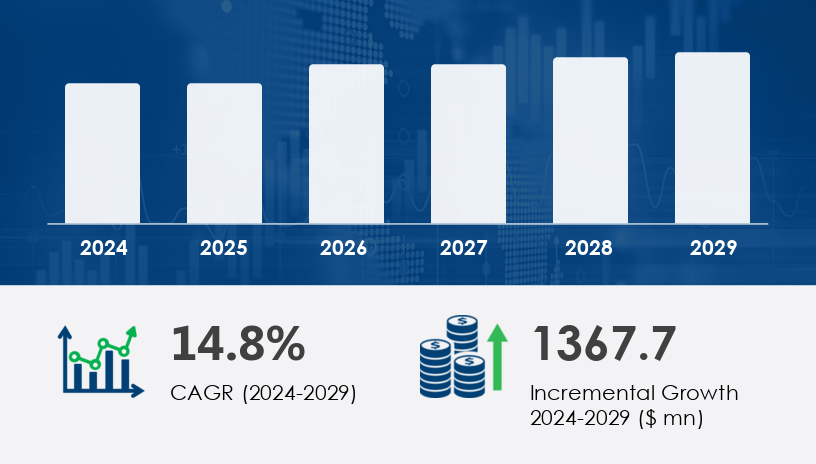

The 3D Printing In Education Sector Market is poised for rapid expansion, driven by the integration of emerging technologies in classrooms and learning environments. As educational institutions increasingly adopt 3D printing to enhance student engagement and innovation, the market is expected to witness robust investment and development across multiple educational levels.According to Technavio, the 3D Printing In Education Sector Market is projected to grow by USD 1.37 billion between 2024 and 2029, advancing at a CAGR of 14.8%. This significant growth is supported by the expanding application of additive manufacturing in STEM and STEAM programs, as well as in design, medical, and vocational education.For more details about the industry, get the PDF sample report for free

A major driver fueling the market is the educational benefits offered by 3D printing, which fosters interactive, hands-on learning. By transforming digital CAD models into tangible objects, students can visualize complex concepts, improve problem-solving skills, and develop creativity. This hands-on approach is gaining traction in both traditional and non-traditional learning environments. For instance, in engineering and biomedical programs, students now use 3D printing to prototype devices or replicate body parts for study. As per the source, this growing focus on practical application is revolutionizing curricula, particularly in higher education, making 3D printing a cornerstone of modern academic methodology.

An emerging trend in the 3D Printing In Education Sector Market is the continuous development of new 3D printer products tailored for educational use. Companies are expanding their portfolios to meet increasing institutional demand. For example, in April 2024, SprintRay Inc. introduced two advanced 3D printers—Pro 2 and Midas+ resins—specifically aimed at educational institutions. This trend is not only broadening the technological options available but is also driving competitive differentiation in the market. The expansion of 3D printing solutions that include resins, materials, and instructional software is expected to significantly influence purchasing decisions across schools and universities.

The 3D Printing in Education Sector Market is witnessing significant growth as schools, universities, and training institutions integrate hands-on technologies to enhance learning. Tools such as 3D printing, FDM printing, SLA printing, and SLS printing are being adopted widely for interactive educational experiences. Specialized techniques like DLP printing, PolyJet technology, and resin printing offer precise and diverse modeling options, allowing students to explore real-world applications in subjects like engineering and design. Devices like the 3D scanner and platforms powered by CAD software empower learners to turn concepts into tangible models. Common materials such as PLA filament, ABS filament, PETG filament, and TPU filament are used extensively for safe and flexible fabrication. Technologies such as stereolithography, selective laser systems, and additive manufacturing have reshaped project-based learning. Whether through a 3D printer in a desktop 3D lab or via industrial 3D applications in advanced institutions, the market fosters innovation. Skills in 3D modeling, rapid prototyping, and 3D design have become essential learning outcomes in modern curricula.

By End-user

Higher Education

PreK–12

By Type

3D Printing Services and Materials

3D Printers

By Application

Prototyping

Tooling

Functional Parts

By Product

Desktop 3D Printer

Industrial 3D Printer

By Component

Hardware

Software

Services

Among end-users, the higher education segment is projected to show the most substantial growth through 2029. Valued at USD 465.30 million in 2019, this segment continues to expand due to the integration of 3D printing in STEM and STEAM disciplines. Students gain real-world exposure by creating medical models, engineering prototypes, and artistic structures. Universities are also embedding legal and technical 3D printing education into their curricula—Pennsylvania State University, for instance, offers courses that address the legal implications of 3D technology. Analyst insights from Technavio suggest that the increasing demand for project-based and experiential learning will continue to propel this segment forward, especially as institutions prioritize innovation and career readiness.

Get more details by ordering the complete report

Covered Regions:

North America

Europe

APAC

South America

Middle East and Africa (MEA)

North America is forecast to contribute 34% to the global 3D Printing In Education Sector Market growth between 2024 and 2029, making it the leading region. Within North America, the United States stands out for its strong adoption of classroom innovation and STEM integration. Notably, Ohio State University’s CDME adopted the COBOD BOD2 printer in 2023 to advance construction 3D printing research. Additionally, affordable desktop printers, educational grants, and open-source printing platforms are making 3D printing accessible at all levels of education. Technavio’s analysts emphasize that universities are becoming major innovation hubs, combining AR/VR environments, design labs, and teacher training programs to expand the impact of 3D printing in the learning process.

Despite the market's optimistic growth trajectory, the increasing popularity of 3D printing rental services presents a notable challenge. These rental models offer a cost-effective alternative for institutions unable to afford the upfront investment in 3D hardware and materials. Rentals also come with technical support, training, and flexible terms, allowing schools to experiment with 3D printing without long-term commitments. While this increases accessibility, it may dampen equipment sales growth and disrupt manufacturer revenue streams. As highlighted in the source, rental services are particularly appealing in developed economies, where educational budgets are tightly managed, making the shift to full ownership more difficult.

The market is also driven by supportive infrastructure and software tools that simplify the printing process for educators and students. Components like the print bed, extruder nozzle, and G-code compatibility are central to printer setup and operation. Software such as slicing software, Cura software, and Simplify3D enhances the user experience by translating designs into printable instructions. Platforms like Fusion 360, Tinkercad, and Blender software are widely used for creative exploration and engineering precision. The integration of 3D printing in STEM education is central to hands-on teaching strategies, encouraging critical thinking and problem-solving. Programs featuring classroom 3D setups and educational 3D content are increasingly supported by brands such as MakerBot, Ultimaker, and Prusa printer. Premium equipment from companies like Formlabs and Stratasys is enabling complex modeling, while Carbon fiber, Nylon filament, and metal 3D expand material capabilities. Emerging frontiers like bio-printing are also finding relevance in higher education and research. Institutions frequently showcase 3D printed student projects, driving broader interest in the practical and future-facing applications of the technology.

Research in the 3D Printing in Education Sector Market highlights a strong upward trend in adoption due to affordability, curriculum integration, and the growing emphasis on experiential learning. Analysts are evaluating the pedagogical impact of 3D tools, with metrics such as student engagement, skill development, and project-based outcomes forming the basis of educational ROI. As the sector evolves, further studies are focusing on long-term impacts, such as readiness for advanced manufacturing roles and interdisciplinary innovation driven by 3D learning environments. The convergence of design thinking and digital fabrication is expected to reshape educational frameworks worldwide.

Companies in the 3D Printing In Education Sector Market are focusing on strategic alliances, product innovations, and academic partnerships to strengthen their market position. The launch of advanced, education-focused printers by companies like SprintRay Inc. is a testament to the competitive focus on technology differentiation. Meanwhile, 3D Systems Corp. is offering its ProJet CJP 860Pro model to cater specifically to educational applications.

To enhance market reach, companies are also exploring subscription models, curriculum integration kits, and teacher certification programs. Additionally, open-source ecosystems and compatibility with common CAD software have become central to vendor strategies. According to Technavio analysts, firms that invest in R&D and collaborate with academic institutions are most likely to lead in the evolving landscape of 3D educational printing.

The 3D Printing In Education Sector Market is entering a transformative period from 2025 to 2029, driven by dynamic educational needs and technological advancements. With a projected USD 1.37 billion increase in market size and a CAGR of 14.8%, the sector offers immense potential across regions, particularly in North America. The adoption of 3D printing in higher education, supported by curriculum enhancements and hands-on learning experiences, underscores the technology’s vital role in shaping future-ready students.

However, institutions and companies alike must navigate challenges such as rental service competition and evolving cost structures. By investing in innovative product development, flexible business models, and strategic educational partnerships, stakeholders can tap into the full promise of 3D printing as a cornerstone of next-generation learning.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Enduser

6.1.1 Higher Education

6.1.2 PreK12

6.2 Type

6.2.1 3D printing services and materials

6.2.2 3D Printers

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

6.4 Application

6.4.1 Prototyping

6.4.2 Tooling

6.4.3 Functional Parts

6.5 Product

6.5.1 Desktop 3D printer

6.5.2 Industrial 3D Printer

6.6 Component

6.6.1 Hardware

6.6.2 Software

6.6.3 Services

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Safe and Secure SSL Encrypted