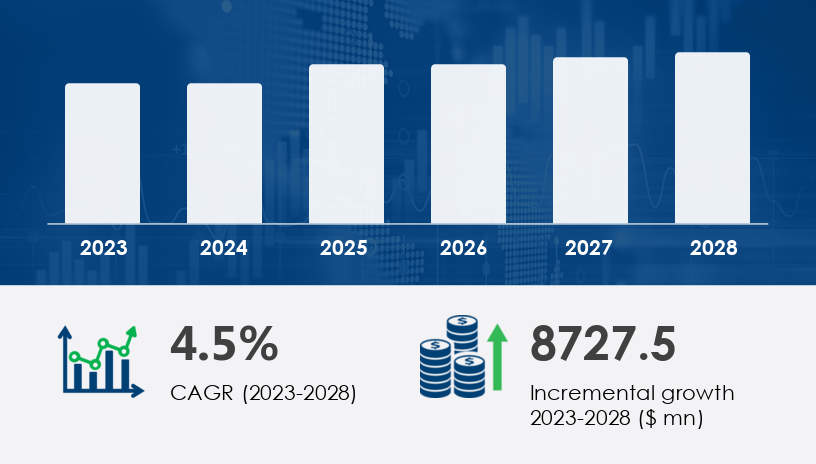

The wind turbine generator market is poised for impressive growth, expected to rise by USD 8.73 billion between 2024 and 2028, at a stable CAGR of 4.5%. This growth is driven by the increasing global consumption of wind energy and technological advancements in direct-drive generators, key to maximizing efficiency and reducing costs. As countries continue to pivot towards renewable energy, wind power stands out as a critical solution for reducing carbon emissions and addressing the depletion of fossil fuels. However, the market is also facing challenges, including competition from traditional energy sources and the inherent intermittency of wind energy.This report provides an in-depth overview of the wind turbine generator market, breaking down the key trends, regional dynamics, and emerging technologies driving growth. We will explore the key players, market segmentation, and the major factors influencing the industry's evolution.For more details about the industry, get the PDF sample report for free

The wind turbine generator market is a crucial segment of the global renewable energy sector, specifically tied to the development of wind energy infrastructure. Wind turbines convert wind energy into electrical power, and the generators used in these turbines play a vital role in determining the efficiency and reliability of wind energy systems.

Increased Wind Energy Consumption: Governments worldwide are prioritizing the use of renewable energy sources. Wind energy, one of the most abundant and cost-effective forms, is being rapidly integrated into electricity grids.

Technological Innovation: Advancements in turbine design and generator efficiency, particularly with direct-drive systems, are lowering costs and improving performance.

Policy and Regulation: Government policies and incentives continue to drive investments in renewable energy infrastructure, further boosting the demand for wind turbine generators.

The market is also witnessing significant investments in offshore wind farms, which can generate more power than onshore turbines. With innovative floating wind technologies, the potential for offshore wind generation is expected to grow exponentially in the coming years.

The competition in the wind turbine generator market is intensifying as leading companies expand their capabilities and enter new markets. Notable players include:

Vestas Wind Systems: A dominant player known for its high-performance wind turbines.

Siemens Gamesa Renewable Energy: Specializes in both onshore and offshore wind turbine solutions.

GE Renewable Energy: Provides state-of-the-art turbine generators with a focus on direct-drive technologies.

Nordex SE: A strong player in both the onshore and offshore wind turbine sectors.

Suzlon Energy Ltd.: A key player focusing on emerging markets, including India and the Middle East.

These companies are actively investing in technological advancements to reduce costs and increase the energy efficiency of wind turbine generators, ensuring their competitiveness in a rapidly evolving market.

Get more details by ordering the complete report

The wind turbine generator market can be segmented based on technology, application, and geography. Each segment plays a critical role in the overall market dynamics and helps identify key trends.

Onshore Wind Turbines: This segment remains the largest, thanks to lower capital costs and increased installations worldwide. Onshore wind is particularly cost-effective in regions with large land areas and favorable wind conditions.

Offshore Wind Turbines: Offshore installations are gaining traction due to their higher efficiency and ability to generate more power. Floating wind turbines, in particular, are expected to revolutionize this segment by making deep-water wind farms feasible.

APAC: Dominates the global market, accounting for more than 50% of the market share. China and India are major contributors, investing heavily in onshore wind projects.

North America: The U.S. is a leading market for both onshore and offshore wind farms, supported by government policies and incentives.

Europe: Germany, the UK, and Spain are key markets, with a focus on offshore wind development and advanced turbine technology.

South America

Middle East & Africa

One of the most significant trends in the wind turbine generator market is the shift from traditional geared turbines to direct-drive generators. These systems eliminate the need for complex gearboxes, making the turbines more efficient and easier to maintain. With fewer moving parts, direct-drive generators can reduce downtime, increase efficiency, and lower operational costs. Notably, companies like Vestas and Siemens Gamesa are leading this shift with their innovative direct-drive turbine solutions.

Government policies play a pivotal role in the growth of the wind turbine generator market. In many countries, there are incentives like tax credits and subsidies to promote renewable energy adoption. In Europe, for example, countries like Germany and the UK are setting ambitious goals for renewable energy generation. The EU Renewable Energy Directive is pushing for 40% of the EU’s total energy to come from renewable sources by 2030. In the U.S., the Department of Energy has been investing heavily in offshore wind projects, with a focus on floating wind turbines.

Floating wind turbines are expected to play a pivotal role in the future of offshore wind energy. Unlike traditional turbines fixed to the seabed, floating turbines can be placed in deeper waters, where wind speeds are higher and more consistent. Companies like Equinor and Siemens Gamesa are making strides in developing this technology, which could unlock vast new areas for wind energy generation.

For more details about the industry, get the PDF sample report for free

The global market for wind power generation is experiencing substantial growth, driven by the increasing focus on renewable energy sources and the transition from fossil fuel alternatives to more sustainable energy solutions. Key developments in wind turbine generator technology, including direct-drive generators and permanent magnet generators, are enhancing wind energy efficiency and wind energy production. Offshore wind energy and onshore wind power are emerging as critical components in wind farm development, with offshore wind farms in particular showing a significant rise due to their higher energy output potential. As the demand for clean energy solutions increases, wind turbine technology continues to evolve, with advances in turbine blade design, rotor blade aerodynamics, and turbine rotor diameter improving both turbine efficiency and wind power reliability. Additionally, wind turbine installation is gaining momentum as wind energy consumption rises across various regions, driven by government wind energy incentives and the need for renewable power deployment to meet energy demand increases. These developments are further supported by enhanced energy storage systems and grid-connected turbines, which help balance supply and demand.

Asia-Pacific (APAC) is forecast to contribute over 53% of the global wind turbine generator market growth during the forecast period. China, in particular, is a major player, with the country leading the world in installed wind capacity. India, too, is ramping up its wind power investments, particularly in onshore wind projects.

The U.S. remains a key player in the global wind turbine generator market, with offshore wind farms gaining momentum. Government initiatives, like the Investment Tax Credit (ITC) and the Production Tax Credit (PTC), are providing significant support for the development of wind energy infrastructure. The U.S. is also focused on advancing floating wind technologies, which could lead to increased offshore installations along the East Coast and Pacific Northwest.

Europe is expected to remain a leading market for offshore wind turbines, particularly in the UK, Germany, and Spain. The North Sea has become a hotbed for offshore wind projects, with countries working together to create one of the largest renewable energy regions in the world. As of 2021, over 30 GW of offshore wind capacity is expected to be installed by 2030, making Europe a significant contributor to the global wind turbine generator market.

Get more details by ordering the complete report

In-depth analysis of the wind power generation market highlights the growing emphasis on wind turbine maintenance and turbine downtime management to ensure the continued reliability of wind energy output. Advances in wind turbine components, including more durable turbine blade materials and synchronous generators, are contributing to wind turbine durability and improved wind energy reliability. Furthermore, wind turbine scalability is enabling larger wind power plants to be developed, thus increasing the power generation capacity of wind farms. Monitoring wind speed and integrating advanced turbine control systems are enhancing the accuracy of energy production forecasts and ensuring optimized wind turbine performance. The reduction in carbon emissions driven by wind energy production is also a significant factor in supporting the global push for clean energy. As wind turbine innovation continues to advance, the industry is seeing improved wind turbine efficiency and higher returns on investment. These factors, along with the development of robust wind power infrastructure and the need for improved wind turbine component design, will continue to drive the evolution of wind power generation technologies and ensure the industry's long-term sustainability.

The wind turbine generator market is poised for sustained growth, driven by increased wind energy consumption, technological advancements, and supportive government policies. With direct-drive generators, floating wind technology, and continued investments in offshore wind projects, the market is well-positioned to meet the growing global demand for renewable energy.

Get more details by ordering the complete report

Safe and Secure SSL Encrypted