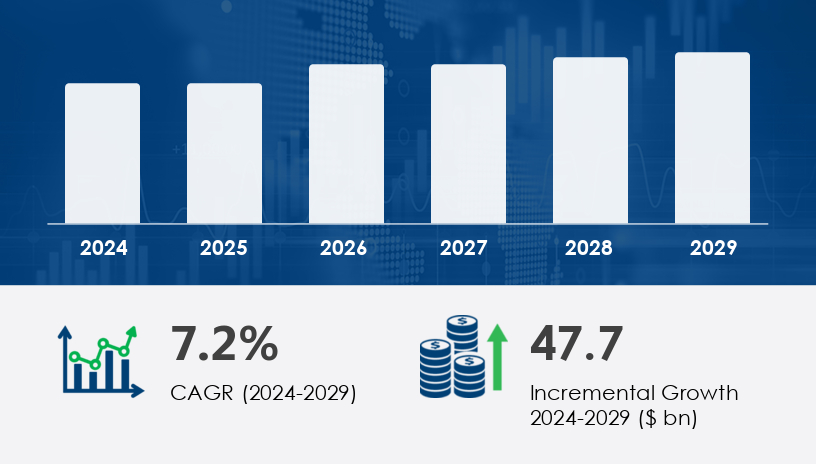

The wind turbine components market is poised for robust expansion, with its size projected to increase by USD 47.7 billion between 2024 and 2029. This growth reflects a strong compound annual growth rate (CAGR) of 7.2%, driven by global efforts to decarbonize energy production and enhance renewable energy integration. As of 2024, the wind turbine components market is experiencing strong demand, with projections indicating sustained momentum through 2029. The rapid evolution of wind energy technologies, coupled with favorable policy frameworks and the declining cost of wind power, continues to fuel market expansion across both onshore and offshore applications.

For more details about the industry, get the PDF sample report for free

The primary driver of the wind turbine components market is the expanding global wind energy sector, particularly in regions like Europe and China. Onshore wind energy, in particular, has gained commercial traction due to decreasing costs and technological advancements. Modern onshore turbines, such as those exceeding 1 MW, are delivering increased efficiency and reliability. A notable example is the £1 billion agreement between ScottishPower and Siemens Gamesa in November 2024 for 64 offshore wind turbines for the East Anglia TWO project, showcasing how large-scale deployments are reshaping the industry.

The adoption of composite materials and fatigue analysis techniques has further bolstered the durability and efficiency of wind turbine blades, while energy policies supporting utility-scale projects and grid integration continue to incentivize investment. As an analyst noted, the cost-effectiveness and scalability of wind energy are transforming it into a cornerstone of the global renewable energy transition.

A key trend shaping the wind turbine components market is the steady decline in the cost of wind power, which is being accelerated by technology advancements and economies of scale. The emergence of the SMART (System Management of Atmospheric Resource through Technology) strategy illustrates this shift. SMART integrates high-fidelity physics modeling, real-time wind monitoring, innovative rotor technology, and turbine-to-grid communication to optimize wind power plant performance.

This innovation enhances turbine efficiency and capacity factors while enabling better grid stability. As wind turbines become more advanced, control systems, structural design, and energy storage solutions are also evolving to support consistent and high-yield energy production. Analysts highlight that SMART-enabled wind farms will play a central role in delivering reliable, long-term renewable power.

The Wind Turbine Components Market is a critical segment within the global renewable energy industry, driven by rising investments in clean power generation. Central to wind turbine performance are key structural and functional elements like the rotor blade, turbine hub, main shaft, and tower flange, which work together to convert kinetic wind energy into mechanical power. Modern turbines utilize advanced materials such as carbon fiber, glass fiber, and epoxy resin to improve blade durability and efficiency. The blade root, blade tip, blade spar, and blade flange are engineered for aerodynamic performance and structural integrity. Meanwhile, the turbine nacelle, nacelle housing, nacelle frame, and rotor hub house critical mechanical systems, while the turbine tower and tower section provide height and stability. As offshore and onshore installations expand, innovation in turbine foundation design is also gaining prominence.

By Application

Onshore

Offshore

By Product

Wind turbine rotor blades

Wind turbine gearboxes

Wind turbine generators

Wind turbine towers

Others

The onshore segment holds a leading position in the wind turbine components market and is forecasted to experience significant growth through 2029. Valued at USD 71.80 billion in 2019, this segment has shown steady expansion due to reduced power generation costs and rapid technological improvements.

Technologies such as Vestas' 4 MW platform have enabled onshore turbines to operate efficiently in diverse wind conditions. Analysts suggest that onshore wind projects benefit from more streamlined permitting processes and lower infrastructure costs compared to offshore installations, making them an attractive investment for both emerging and developed markets. As a result, the onshore segment continues to attract attention for its cost-effectiveness and scalability.

Covered Regions:

North America

US

Canada

Europe

France

Germany

Spain

UK

APAC

China

India

Japan

South America

Brazil

Middle East and Africa

Asia-Pacific (APAC) is the dominant region in the wind turbine components market, contributing 39% of global market growth during the forecast period. In 2023, APAC held over 40% of the market share, with countries like China, India, and Japan leading the regional expansion.

This growth is fueled by government incentives, rising energy demand, and the presence of industry leaders such as Goldwind, Vestas Wind Systems A/S, and Siemens Gamesa Renewable Energy. However, regional challenges such as grid interconnection issues in China and policy shifts in India require adaptive strategies. Despite these hurdles, the APAC region remains a stronghold for wind energy development, particularly in onshore projects. Offshore developments are also gaining traction, especially with enhanced wind resource assessment and site evaluation practices supporting high-capacity installations.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

A major challenge for the wind turbine components market is the complexity of materials, control systems, and energy storage technologies. As renewable energy sources diversify, components must be tailored to optimize the performance of each resource. Ensuring efficiency and stability in wind power systems requires the development of specialized materials and advanced electronics.

The market faces growing demand for efficient energy storage systems to balance the intermittent nature of wind energy. Moreover, advanced control mechanisms are needed to integrate wind turbines with smart grids and manage fluctuating wind speeds. Analysts emphasize that overcoming these technical hurdles is critical for ensuring long-term reliability and profitability of wind farms.

Market research reveals an increasing demand for components that support high-efficiency operation and grid compatibility. The wind gearbox, gearbox bearing, shaft coupling, and cooling system are vital for transferring and regulating mechanical energy. Meanwhile, advancements in direct drive systems and permanent magnet generators are reducing maintenance needs and increasing reliability. The integration of smart technology is also notable, with systems such as the SCADA system, anemometer sensor, wind sensor, and wind controller enabling real-time monitoring and remote management. Other crucial elements include the generator rotor, generator stator, and wind inverter, which ensure efficient energy conversion and transmission. To enhance control, components like the pitch system, yaw drive, yaw motor, yaw gear, and hydraulic pitch systems allow for responsive turbine orientation based on wind direction and speed.

Analytical research into the wind turbine components market underscores a strong emphasis on operational control, safety, and long-term performance. The control system, pitch bearing, blade bearing, and turbine brake are pivotal for maintaining system responsiveness and reducing mechanical stress during extreme conditions. Additionally, innovations in blade coating, composite material usage, and high-precision blade mold technology are improving blade life cycles and resistance to environmental wear. Structural security is further ensured through systems like the rotor lock and the integration of the turbine transformer, which supports stable power output. As manufacturers push for lighter, more durable, and higher-efficiency turbines, the focus on research and development continues to elevate the technological benchmarks of this rapidly growing market.

Leading companies in the wind turbine components market are investing in product innovation, strategic alliances, and global expansion to maintain a competitive edge.

In January 2024, Vestas Wind Systems introduced the V160-0.52 MW turbine, offering improved efficiency and reduced levelized cost of energy (LCOE).

In March 2025, Siemens Gamesa Renewable Energy partnered with Ørsted to jointly develop offshore wind farms, leveraging next-generation turbines.

In May 2024, GE Renewable Energy secured a USD 1.1 billion contract from Ørsted for turbine supply at the Hornsea 3 offshore wind farm.

In August 2025, the European Union approved new state aid guidelines under the Green Deal to support offshore wind, opening new financial pathways for developers and manufacturers.

Companies such as CS WIND Corp., Suzlon Energy Ltd., TPI Composites Inc., Ming Yang Smart Energy Group, and ZF Friedrichshafen AG are actively enhancing their product portfolios. CS WIND, for instance, focuses on high-performance wind towers using innovative materials and engineering techniques to meet rising global demand.

Additionally, digital technologies such as digital twins, cloud computing, and machine learning are transforming project management, turbine diagnostics, and predictive maintenance. These tools improve operational efficiency, reduce downtime, and enhance overall energy yield.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Application

6.1.1 Onshore

6.1.2 Offshore

6.2 Product

6.2.1 Wind turbine rotor blades

6.2.2 Wind turbine gearboxes

6.2.3 Wind turbine generators

6.2.4 Wind turbine towers

6.2.5 Others

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted