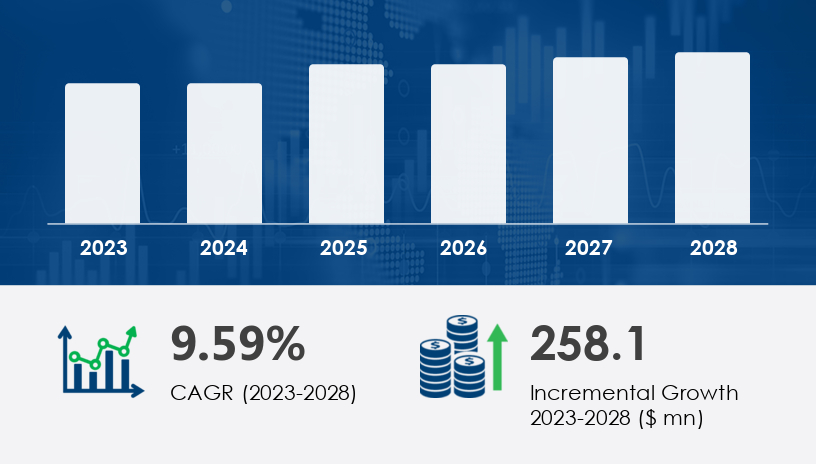

The global water-soluble pods packaging market is set to grow by USD 258.1 million between 2024 and 2028, at a striking CAGR of 9.59%. This rapid expansion signals a pivotal transformation in sustainable packaging — one being driven by environmental urgency, regulatory shifts, and smart manufacturing advances. In this comprehensive guide to the 2025 market outlook for water-soluble pods packaging, we examine the data, trends, and strategic takeaways that every packaging executive, sustainability officer, and FMCG brand must understand to remain competitive in an increasingly eco-conscious market.

Water-soluble pods are single-use packaging solutions made from biodegradable polymers like polyvinyl alcohol (PVA). Designed to dissolve in water, these pods are used to package cleaning agents, detergents, agrochemicals, personal care items, and more.

For more details about the industry, get the PDF sample report for free

The water-soluble pods packaging market is witnessing robust growth due to rising environmental concerns and the demand for eco-friendly packaging across various sectors. Products like detergent pods, laundry pods, dishwasher pods, and hand wash pods are increasingly adopting single-layer pods, dual-layer pods, and multi-chamber pods formats, utilizing poly vinyl alcohol (PVA) as a core biodegradable film component. This trend supports the shift toward single-dose packaging that enhances consumer convenience while addressing issues like plastic waste and carbon footprint. Applications extend beyond household products into sectors like personal care, where organic cosmetics, spa cosmetics, and shaving cream benefit from mess-free packaging and non-toxic material usage. The adoption of hot water soluble and cold water soluble soluble film technologies offers flexibility in product performance, while automated packaging and high-speed production systems are streamlining operations and reducing costs.

With bans on single-use plastics in full swing — from Canada’s national restrictions to Europe’s 2019 directive — brands are under pressure to pivot. Water-soluble pods offer a low-impact alternative that aligns with environmental goals and emerging compliance frameworks.

Modern packaging lines are now integrated with IoT sensors, AI-powered control systems, and data analytics, which enable:

Real-time monitoring

Reduced wastage

Customization for multi-product applications

This tech evolution is helping manufacturers scale production of water-soluble pods while reducing operational costs.

Consumers are demanding zero-waste personal care, and biodegradable pods are the answer. Leading companies such as P&G and Unilever are already offering single-dose laundry detergent pods, meeting demand with both sustainability and convenience.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The water-soluble pods packaging market is segmented according to application and geography.

The homecare segment dominates the application landscape, packaging everything from laundry detergent to toilet cleaners. Here's why:

Convenience: Pre-measured doses reduce spills and user error.

Hygiene: No direct contact with potentially harsh chemicals.

Efficiency: Reduced transportation and storage costs due to the pods’ compact format.

With established players like Cortec Corp., Kuraray Co., and Mondi Plc, North America is both the innovation hub and demand epicenter for water-soluble packaging. The region’s growth is fueled by:

Eco-conscious consumer base

Regulatory momentum

Smart logistics integration

Markets in China and Japan are rapidly scaling up, especially in personal care and agricultural applications. The combination of rising disposable income and environmental policies makes APAC a strategic region to watch.

| Opportunity | Implication |

|---|---|

| Shift to PVA-based materials | Compliance + reduced plastic tax exposure |

| Automation in packaging lines | Cost savings + higher output |

| Direct-to-consumer (DTC) models | Custom pods + smaller SKU formats |

| Environmental branding | Higher customer loyalty + market share |

Fully biodegradable (PVA breaks down quickly)

Mess-free, pre-dosed convenience

Portable and space-saving

Compatible with multiple verticals (FMCG, healthcare, agrochemicals)

Higher upfront machinery investment

Supply chain vulnerabilities (raw material shortages)

Sensitivity to moisture and humidity

Data analysis and optimization challenges in smart machinery

Detailed analysis of the water-soluble pods packaging market reveals significant advancements in solubility technology, material composition, and application-specific customization. Innovations in PVA film, film thickness, and barrier properties have improved moisture resistance, which is crucial for storage stability. Pre-measured pods are particularly impactful in industries like agrochemical packaging, pharmaceutical packaging, and industrial applications, where precision and safety are key. Emerging uses include food condiments, dye pods, fertilizer packaging, and pesticide pods, demonstrating the versatility of this packaging format. Tailored packaging material and polymer blends enhance the dissolution rate and product integrity, aligning with the needs of cleaning products and sensitive formulations. Furthermore, the rise in sustainable solution initiatives has driven the market to prioritize innovative solutions that reduce environmental impact while maintaining performance across diverse applications.

Get more details by ordering the complete report

By 2028, water-soluble pods could become the default packaging format for detergent and homecare in developed markets. Here's what our internal analysts predict:

60% of household cleaning brands will offer at least one water-soluble product line.

Biodegradable films will become cheaper and more customizable through new polymer tech.

PVA demand will create an entirely new upstream economy focused on sustainable raw material sourcing.

Material Shortages: Any disruptions in PVA supply chains could delay production.

Economic Slowdowns: Recessionary fears may affect consumer spending on eco-premium products.

Moisture Sensitivity: In humid regions, pod degradation could impact product quality.

Manufacturers must address these with moisture-proof storage, redundant sourcing, and smart logistics.

Invest in automated smart packaging machinery — it's no longer optional for scale.

Prioritize R&D in biodegradable polymers — differentiate beyond PVA.

Capitalize on the growing DTC ecosystem with customizable pod offerings.

Align with regulations early to preempt compliance risks and penalties.

The water-soluble pods packaging market is not a passing trend. It represents the next chapter in sustainable, efficient packaging — one that's backed by technology, compliance, and customer preference.

Safe and Secure SSL Encrypted