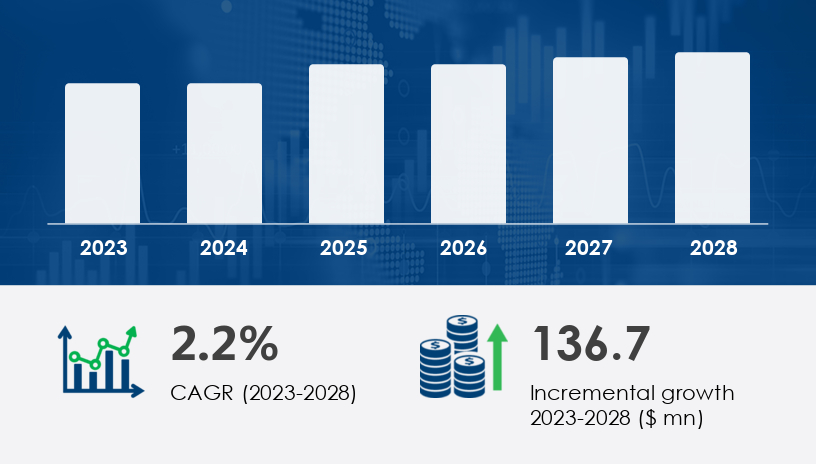

The EMEA water desalination pumps market is forecast to grow by USD 136.7 million between 2023 and 2028 at a CAGR of 2.2%, driven by the rising demand for reverse osmosis (RO) systems and the integration of intelligent pump technologies. In this comprehensive guide, we provide a deep dive into the market by analyzing key segments by application and pump type. As freshwater scarcity intensifies across the EMEA region, desalination pumps have become essential for reliable water treatment and delivery.

With a 2025 outlook shaped by the convergence of energy efficiency, renewable integration, and smart systems, this expert report delivers strategic insights for industry stakeholders. We examine the growth potential of reverse osmosis, distillation methods, centrifugal and positive displacement pumps, as well as opportunities, risks, and forecasts that define the market trajectory through 2028.

For more details about the industry, get the PDF sample report for free

The EMEA water desalination pumps market is expanding steadily, propelled by water scarcity, population growth, and technological improvements in desalination systems. RO remains the most widely adopted technology due to its efficiency and cost-effectiveness.

| Quick Facts Table | |

|---|---|

| Market Size Growth (2024–2028) | USD 136.7 million |

| CAGR (2023–2028) | 2.2% |

| Leading Application Segment | Reverse Osmosis (RO) |

| Pump Types | Centrifugal, Positive Displacement |

| Regional Focus | Europe, Middle East, Africa |

| Top Technology Trend | Intelligent Pump Systems with IoT |

Growth Drivers & Challenges:

Reverse osmosis continues to dominate the market due to its membrane-based filtration approach, which uses high-pressure pumps to remove salts and impurities from seawater. The appeal of RO lies in its low chemical use, energy efficiency, and high water quality output. However, challenges such as membrane fouling and energy consumption persist.

Expert Quote:

“RO systems offer unmatched scalability and water purity, but operators must adopt hybrid systems and IoT to overcome fouling and high operational costs,” says a Senior Environmental Engineer.

Mini Case Study:

A municipality facing severe drought installed a hybrid RO plant equipped with intelligent centrifugal pumps. By integrating predictive maintenance and IoT-based controls, they reduced energy consumption by 18% while extending pump life by 22%.

Key Stats:

RO segment was valued at USD 383.80 million in 2018 and has continued to grow steadily.

RO desalination accounts for the majority share of pump demand across the EMEA market.

For more details about the industry, get the PDF sample report for free

Growth Drivers & Challenges:

Multi-effect distillation, often used in Middle Eastern plants, relies on thermal energy and is ideal for large-scale desalination. While it offers durability and brine handling benefits, high energy requirements and capital costs limit wider adoption.

Expert Quote:

“MED systems are still crucial for legacy infrastructure in Gulf nations, but must be hybridized with RO to remain cost-effective,” remarks a Desalination Research Lead.

Mini Case Study:

A Saudi-based industrial complex modernized its MED plant by coupling it with solar thermal inputs. The introduction of smart metering pumps helped reduce freshwater production costs by 12%, despite the plant's legacy design.

Key Stats:

MED remains a secondary but strategic segment, especially in high-salinity or brine-reuse environments.

Growth Drivers & Challenges:

Centrifugal pumps are the backbone of desalination plants due to their ability to handle high-flow, high-pressure operations. They are particularly prevalent in large RO systems where energy efficiency and throughput are critical. However, corrosion and mechanical wear are persistent challenges in brine-rich environments.

Expert Quote:

“Energy optimization in centrifugal pumps is vital. With newer materials and coatings, these systems are now more durable and efficient,” notes a senior Technavio expert.

Mini Case Study:

In Spain, a desalination facility servicing agricultural irrigation upgraded its outdated centrifugal units with intelligent pumps integrated with energy recovery devices. Result: a 25% decrease in overall plant power consumption and 15% reduction in maintenance costs.

Key Stats:

Centrifugal pumps dominate large-capacity RO and MED plants in the EMEA region.

Preferred for their reduced maintenance needs and scalability in industrial applications.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Major Opportunities:

Integration of renewable energy sources like solar and wind with desalination plants to reduce carbon footprints.

Hybrid desalination systems combining RO and distillation methods to increase reliability.

Growing demand for intelligent pump systems that optimize pressure, flow, and energy usage using IoT.

Expanding infrastructure investments in water-scarce countries like Saudi Arabia, UAE, and South Africa.

Key Risks & Challenges:

High operational costs, with pumps accounting for up to 50% of energy consumption in desalination plants.

Brine disposal challenges impacting marine ecosystems and compliance risks.

Equipment degradation, including corrosion and scaling, leading to frequent pump replacements.

Regulatory uncertainties around renewable integration and environmental discharge standards.

The EMEA water desalination pumps market is expected to grow at a CAGR of 2.2%, adding USD 136.7 million in value between 2023 and 2028. Growth will be primarily driven by innovations in intelligent pump systems, hybrid RO systems, and the integration of renewable energy. Will traditional pump manufacturers pivot fast enough to meet the demand for intelligent, sustainable solutions?

Expert Prediction:

By 2028, over 40% of desalination pumps in EMEA will feature IoT-enabled performance monitoring, transforming maintenance from reactive to predictive.

The EMEA Water Desalination Pumps Market is witnessing significant growth, driven by the increasing demand for reverse osmosis systems and centrifugal pumps designed to address critical water scarcity issues across the region. Technologies like positive displacement pumps and high-pressure pumps are essential in modern desalination plants, particularly for effective seawater intake and feed pumps operations. The integration of membrane technology and support from auxiliary pumps also plays a vital role in maximizing output from processes like multi-stage flash and multiple-effect distillation. With a heightened emphasis on energy efficiency, the market is seeing greater alignment with renewable energy sources such as wind power, photovoltaic power, and hybrid desalination models. The use of RO membranes and strategies for fouling prevention and brine management are further improving the sustainability of desalination. Additionally, measures for brine disposal and the preservation of marine ecosystems are becoming central to project planning and environmental compliance.

For more details about the industry, get the PDF sample report for free

Adopt hybrid filtration methods to reduce membrane fouling and extend system life.

Invest in intelligent pump systems to automate flow and pressure regulation.

Partner with renewable energy firms to power RO systems more sustainably.

Enhance brine disposal management using eco-safe discharge technologies.

Optimize membrane and pump pairing for lower total lifecycle costs.

Integrate solar or geothermal inputs to offset high thermal energy needs.

Deploy modular MED units in remote or industrial use cases.

Update legacy plants with smart flow controllers for performance benchmarking.

Combine MED with RO for improved cost-efficiency in high-salinity scenarios.

Monitor plant corrosion risks using advanced material coatings.

Use corrosion-resistant materials like duplex stainless steel to increase durability.

Implement condition monitoring systems for predictive maintenance.

Invest in energy recovery devices to improve overall plant energy efficiency.

Scale pumps with plant size to reduce redundancy and maintenance costs.

Retrofit existing systems with IoT modules to reduce unplanned downtime.

Market research analysis reveals strong innovation trends in advanced thermal techniques like vacuum distillation and vapor-compression, as well as an increased shift toward solar-powered desalination to reduce carbon footprints. The deployment of smart pumps, ultrasonic sensors, and IoT integration enhances pump automation and monitoring accuracy. Systems focused on energy recovery, robust pressure vessels, and effective water purification are critical for transforming saline water into safe drinking water and other freshwater sources. The demand for adaptable systems in low-flow applications and high-flow systems is rising across various sectors, including waste management, chemical processing, petrochemical applications, pulp production, food processing, and agricultural water supply. Ensuring reliable pump maintenance while meeting strict operational requirements reflects the market's drive for long-term performance and sustainability in diverse and often challenging environments.

The EMEA water desalination pumps market is on a steady growth trajectory, driven by the urgent need for clean water, improved technologies, and smart energy practices. Reverse osmosis leads the charge, while centrifugal pumps offer unmatched scalability. However, operational challenges, especially around cost and sustainability, demand innovation and strategic planning. Stakeholders must align with trends in intelligent systems, renewable integration, and hybrid desalination to remain competitive.

Safe and Secure SSL Encrypted