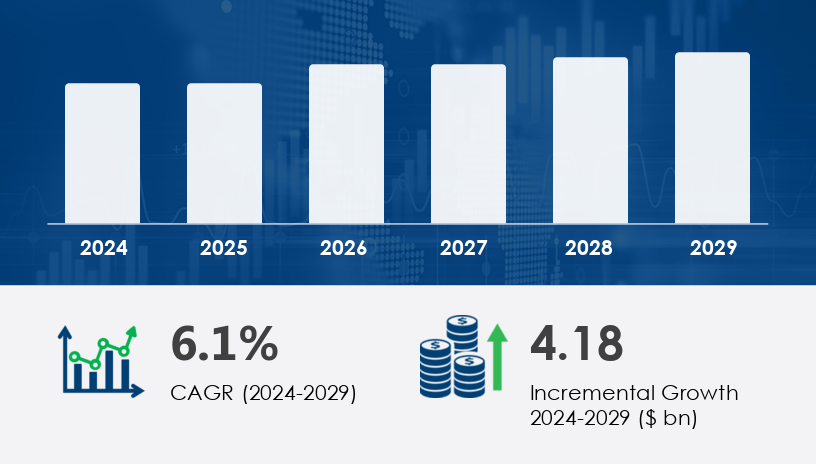

The US government cyber security market is on a steep upward trajectory, projected to grow by USD 4.18 billion between 2025 and 2029 at a CAGR of 6.1%, amid escalating threats and a rapidly evolving digital landscape. As cyber-attacks intensify and regulations tighten, federal agencies are pivoting toward robust, tech-forward strategies to protect mission-critical infrastructure.For more details about the industry, get the PDF sample report for free

Fueling this growth is a confluence of cyber threat escalation, rapid cloud adoption, and the implementation of firewall-based threat deception strategies. These dynamics are pushing federal institutions to overhaul legacy systems with AI-powered tools, blockchain, and cloud-based applications. The increasing implementation of BYOD (Bring Your Own Device) policies within government organizations also necessitates stronger endpoint protections.

Digital transformation across sectors such as manufacturing, banking, financial services, healthcare, energy and utilities, IoT, and travel and transportation has amplified vulnerabilities, urging investments in network firewalls, AI-based threat detection, and cloud gateway solutions.

Cybersecurity programs led by academic and research institutions are also playing a pivotal role in fortifying public sector defense strategies, contributing to a growing talent pool of cybersecurity professionals prepared to counter evolving digital threats.

The rise of zero-trust architecture marks a fundamental shift in cyber strategy, promoting constant verification and minimum access principles. Agencies are rapidly integrating SSO (Single Sign-On), cloud application security, secure web gateways, and endpoint security measures to mitigate threats across sprawling hybrid infrastructures.

Collaborations between academia and the tech industry are driving innovation in machine learning, big data analytics, and blockchain security—with a strong focus on information security applications.

The surge in remote work, digital transactions, and IoT device deployments has expanded the government’s cyber-attack surface, making continuous security innovation and proactive defense approaches critical.

However, high deployment costs remain a significant barrier, especially for agencies constrained by tight budgets. These costs encompass software licensing, infrastructure design, staff training, and ongoing maintenance. On-premises systems, though essential for sensitive operations, demand significant in-house IT resources, inflating long-term expenditure.

Human errors and misconfigurations continue to contribute to a large portion of data breaches, underscoring the need for specialized training and user education. In addition, the sophistication of cybercrime groups and state-sponsored espionage activities—such as those attributed to actors like Dragonfly—require increasingly advanced threat intelligence and mitigation frameworks.

The U.S. government cyber security market is segmented by end-user, deployment, product, security type, and threat type.

US Intelligence Community (CIA, NSA, FBI’s National Security Branch, Army Military Intelligence): Focuses on classified data and counter-espionage.

Department of Homeland Security (DHS): Via CISA, safeguards civilian infrastructure.

Department of Defense (DoD): Secures military networks, benefitting from substantial defense budgets.

The US Intelligence Community is projected to witness the highest growth, leveraging AI, cloud computing, and blockchain to enhance information security.

On-premises: Preferred for operations requiring stringent control and physical infrastructure.

Cloud-based: Gaining momentum for its scalability and cost-efficiency, particularly among hybrid systems.

Solutions: Firewalls, encryption, secure gateways, SSO, AI-based threat detection.

Services: Implementation, consulting, and training to ensure seamless integration.

Network Security: Core component for protecting data in transit.

Endpoint Security: Elevated importance due to BYOD and remote work.

Application Security: Ensures integrity of mission-critical software.

Cloud Security: Essential in hybrid cloud settings, growing with cloud-first strategies.

Cyber-Attacks

Data Breaches

Espionage

DDoS Attacks

Federal systems face a spectrum of risks, from ransomware and phishing to state-sponsored espionage, prompting continuous reevaluation of security frameworks.

Get more details by ordering the complete report

The US Government Cyber Security Market is evolving rapidly in response to escalating threats, with heightened emphasis on firewall protection, cloud cybersecurity, and DDoS mitigation to counteract sophisticated attacks like the Dragonfly group, Thrip attack, and Chafer threat. Public agencies are investing in managed services and enterprise security solutions such as network firewalls, BYOD policies, and SSO solutions to secure their increasingly complex IT environments. Threats including data breaches, cyber espionage, and ransomware are driving adoption of tools like malware detection, phishing defense, endpoint security, and threat deception. These capabilities are unified through comprehensive cybersecurity platforms featuring robust identity management, security analytics, and zero-trust architecture, ensuring protection across government networks.

Under the geography segmentation, the entire market focus is on the United States, where the government is heavily investing in cybersecurity infrastructure across departments and intelligence agencies.

Several industry giants and specialized firms dominate the competitive landscape. Key players include:

Booz Allen Hamilton Holding Corp.

Cisco Systems Inc.

CyberArk Software Ltd.

Cyderes

Dell Technologies Inc.

DXC Technology Co.

Fortinet Inc.

Fortra LLC

General Dynamics Corp.

International Business Machines Corp. (IBM)

Leidos Holdings Inc.

Lockheed Martin Corp.

Northrop Grumman Corp.

NXTKey Corp.

Proofpoint Inc.

RTX Corp.

SolarWinds Corp.

The Boeing Co.

Trend Micro Inc.

These companies employ strategies such as mergers and acquisitions, strategic alliances, geographic expansion, and new product launches to enhance their market presence. The competitive classification ranges from dominant to tentative, and from pure-play to diversified, depending on the firm’s core focus and sectoral reach.

For more details about the industry, get the PDF sample report for free

Strategic advancements in the US Government Cyber Security Market are centered on reinforcing resilience through encryption technology, vulnerability assessment, and proactive incident response systems. Federal agencies are bolstering security operations, cyber defense, and secure access by integrating cutting-edge data protection and threat intelligence tools. Emphasis is also placed on cyber resilience, network monitoring, and compliance management, supported by extensive risk assessment and security automation processes. Key measures such as insider threat detection, cloud authentication, and intensive cyber training are enhancing readiness. Technologies like secure communication, patch management, and security auditing work in tandem with cyber forensics, access control, and robust policy frameworks to create a secure and adaptive cyber ecosystem across U.S. government infrastructure.

Safe and Secure SSL Encrypted