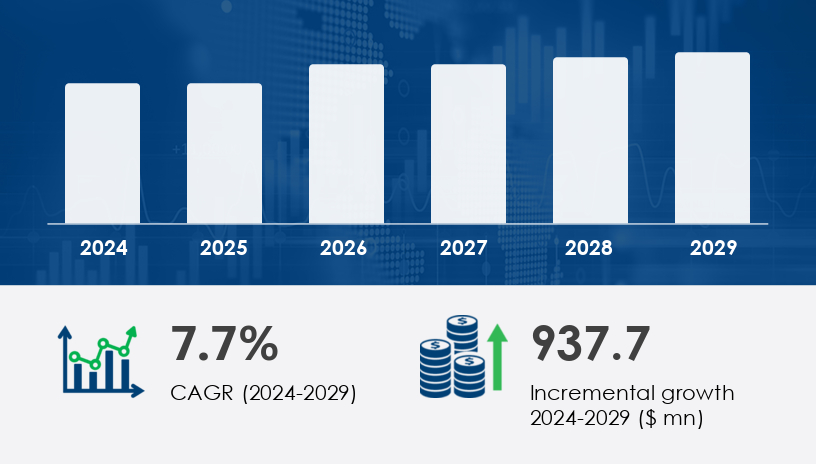

The UK energy efficiency services market is poised for robust expansion, forecast to grow by USD 937.7 billion from 2024 to 2029 at a CAGR of 7.7%. This growth is powered by a blend of stringent government regulations, the proliferation of smart technologies like IoT and AI, and rising corporate commitments to sustainability and cost control.

For more details about the industry, get the PDF sample report for free

The market is categorized into three primary service segments:

Energy Audits and Consulting

This segment is expected to witness significant growth over the forecast period. Energy audits provide detailed evaluations of consumption patterns in residential, commercial, and industrial environments. Consultants help identify inefficiencies and propose actionable cost-saving strategies, with an emphasis on green technology integration, renewable energy, and energy performance optimization.

Monitoring and Verification

Essential for validating the effectiveness of efficiency upgrades, this service segment supports long-term energy performance targets through data-driven oversight.

Product and System Optimization

Includes the refinement of energy-intensive equipment and system-level upgrades, often leveraging industrial automation, analytics, and IoT technologies to reduce waste and carbon emissions.

Industrial

The industrial sector is a primary focus area, incorporating services like energy auditing, system optimization, renewable integration, and distributed energy systems. Many firms are turning to microgrids and automated energy management to cut costs and reduce reliance on the grid.

Commercial

Commercial facilities are optimizing energy usage with smart HVAC systems, lighting retrofits, and energy management software. The rise of energy performance contracting enables firms to fund improvements through future energy savings.

Government

Regulatory compliance and public sustainability goals are fueling demand in this segment. Government-backed programs offer tax credits, grants, and green building standards to stimulate adoption.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Market Dynamics

Government Policies and Regulations

Policy is the core driver of growth in the UK market. Incentives such as energy efficiency standards, tax benefits, and grants for renewable adoption are prompting organizations to pursue decarbonization and industrial sustainability.

Energy Consumption Optimization

Businesses are increasingly focused on cost savings and carbon reduction. The integration of energy auditing, monitoring, and verification services ensures measurable results.

Sustainable Development Goals (SDGs)

Organizations are aligning with SDGs through investment in energy-efficient technologies, low-carbon operations, and compliance frameworks such as Energy Performance Contracting.

Adoption of Smart Technologies

The deployment of IoT, AI, and energy management platforms is revolutionizing how energy is tracked, optimized, and stored. These tools allow real-time monitoring, predictive maintenance, and automated control of energy systems.

Data Analytics and R&D

Sophisticated energy data analytics drive decision-making for process and product optimization. R&D in energy storage, green technology, and circular economy models is expanding the scope of solutions.

Industrial Decarbonization and Renewable Integration

Heavy industries are adopting low-emission practices and exploring solar, wind, and geothermal energy sources. These strategies enhance resilience and grid independence.

Energy Efficiency Training

As systems become more complex, certification programs and workforce development are vital. Skilled personnel enable successful implementation and long-term management of solutions.

Lack of Awareness and Understanding

Despite incentives and technologies, limited awareness among businesses and consumers remains a key barrier. Many organizations struggle to understand the cost benefits, implementation processes, and regulatory requirements associated with energy efficiency.

Low Demand Due to Knowledge Gaps

The lack of clear communication about ROI, environmental impact, and compliance benefits leads to underutilization of services.

The UK Energy Efficiency Services Market is evolving rapidly as government mandates, rising energy costs, and carbon neutrality goals accelerate adoption of smart and sustainable technologies. Key measures include energy audits, smart meters, and scalable retrofit solutions across residential, commercial, and industrial sectors. Emphasis on insulation upgrades, LED lighting, and HVAC optimization is growing, with integrated building management systems and real-time energy monitoring improving operational visibility. Renewable options like solar panels and heat pumps are being combined with energy storage and smart thermostats to create resilient infrastructure. Upgrades such as boiler upgrades, usage of energy analytics, and participation in demand response programs are becoming standard practice. Companies also leverage energy consultancy services to reduce their carbon footprint and obtain green certifications, driven by both regulatory pressures and ESG strategies.

Major players are investing in strategic alliances, M&A, and service launches to boost market presence:

Amey Ltd.

Balfour Beatty Plc

British Gas

CBRE Group Inc.

E.ON SE

EDF Energy

ENGIE SA

Equans SAS

Honeywell International Inc.

Johnson Controls

Kingspan Group Plc

Mitie Group plc

OVO Energy Ltd.

Schneider Electric

ScottishPower Energy Retail Ltd.

Siemens

Skanska AB

SSE Energy Solutions

Trane Technologies Plc

Veolia

These companies are classified across multiple dimensions—pure play, category-focused, industry-focused, and diversified—and their market strength is measured as dominant, leading, strong, tentative, or weak.

Get more details by ordering the complete report

In-depth analysis of the UK energy landscape reveals growing traction for solutions such as energy-efficient appliances, thermal imaging, and smart-connected smart grids that support dynamic pricing and real-time decision-making. Companies are investing in energy dashboards, expanding renewable energy integration, and enhancing heat exchange systems through heat recovery and advanced ventilation systems. Momentum is building around deep energy retrofitting, intelligent lighting controls, robust power management, and overall energy optimization strategies. Enabling tools such as smart sensors, building insulation, and energy benchmarking ensure performance metrics are tracked effectively. Advanced approaches like sustainable design, predictive energy modeling, and use of solar inverters and battery storage strengthen grid resilience. Meanwhile, innovations in energy harvesting, smart lighting, energy controllers, heat exchangers, and energy compliance are central to meeting national carbon reduction targets. Key upgrades in efficiency upgrades, smart HVAC, and actionable energy diagnostics are ensuring the market continues to deliver measurable sustainability outcomes.

In a landscape shaped by regulatory urgency and technological transformation, UK businesses in commercial, industrial, and governmental sectors must integrate energy efficiency strategies to remain competitive. From energy audits and consulting to software-driven optimization and smart grid integration, the market offers both savings and sustainability.

As IoT platforms, cloud-based monitoring, and green technology mature, early adoption will define market leaders. To navigate the knowledge gaps and unlock value, partnering with expert service providers will be essential. The market’s growth trajectory through 2029 highlights an urgent call for stakeholders to align energy strategy with broader ESG and decarbonization goals.

Safe and Secure SSL Encrypted