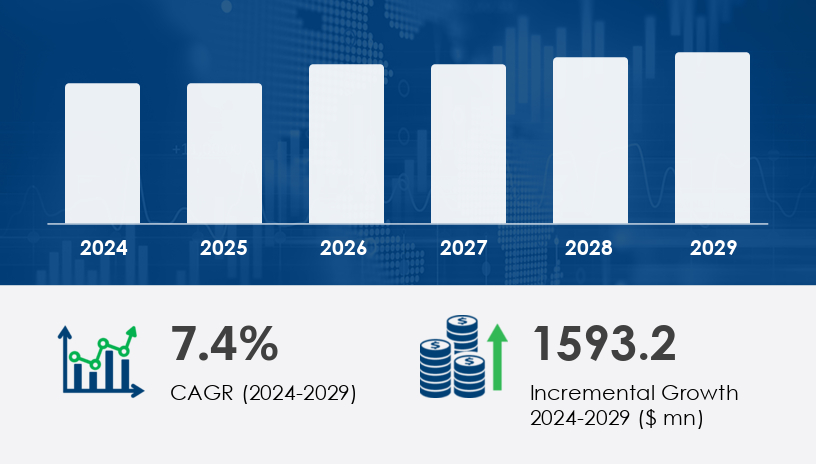

The global two-wheeler braking system market is set to expand by USD 1.59 billion by 2029, advancing at a robust CAGR of 7.4%—driven by the rising integration of advanced safety electronics and regulatory mandates.In this 2025 Outlook, we deliver a comprehensive guide to the dynamics, technologies, and players shaping the future of braking systems for motorcycles and scooters. As urban mobility transforms, the demand for enhanced two-wheeler safety systems like ABS (Anti-lock Braking Systems), CBS (Combined Braking Systems), and brake-by-wire technology continues to escalate. This evolution isn’t just regulatory—it’s revolutionary.

For more details about the industry, get the PDF sample report for free

The two-wheeler segment has seen increased electronic integration across motorcycles and scooters. “Advanced braking systems are no longer luxuries but necessities in urban transportation,” says Senior Technavio Expert.. Regulatory mandates, rising accident rates, and consumer expectations for safer, more responsive braking have reshaped OEM priorities. Systems like ABS enhance steerability and reduce stopping distance, directly impacting rider survival rates. Traction control and sensor-laden setups now feature even in mid-tier scooters, thanks to falling component costs and R&D maturity.

The market is segmented into drum and disc brake categories. Drum brakes—valued at USD 1.65 billion in 2019—continue to dominate, especially in commuter segments. Their low cost, heat resistance, and simple mechanics make them ideal for stop-and-go city traffic. However, disc brakes are gaining traction due to superior stopping power, especially when paired with ABS. In high-performance bikes and premium scooters, disc brakes are the default.

Motorcycles dominate due to broader use cases—from daily commuting to performance riding. Scooters, however, are growing rapidly, especially in developing countries due to their affordability, ease of use, and evolving styling. Both categories are witnessing rising adoption of ABS and electronic braking aids, with scooters closing the gap via low-displacement vehicles compliant with new safety mandates.

OEMs are the primary contributors, driven by regulatory push for factory-fitted ABS systems. However, aftermarket demand is surging, especially in regions like Southeast Asia and Latin America, where customization, performance upgrades, and ABS retrofits are common.

Metal brakes dominate today’s two-wheeler configurations, offering durability and affordability. However, carbon-based materials are being explored for lightweight, high-performance applications. These are mostly used in sports and premium motorcycles where thermal efficiency and precision braking are critical.

Get more details by ordering the complete report

Expected to contribute 69% of the market growth between 2025 and 2029, led by India, China, and Vietnam. These countries house 85% of the global two-wheeler population, largely due to urban density and cost-efficiency of scooters and motorcycles. Regulatory mandates for ABS in 125cc and above vehicles have accelerated tech penetration. India’s Bharat Stage VI norms and China’s safety mandates are transforming basic commuter bikes into tech-enabled mobility solutions.

Premium motorcycle ownership is a key trend. Riders are demanding ABS and electronic systems for both performance and safety. Customization is also strong, with significant aftermarket opportunities.

The European market leans towards high-performance and touring motorcycles. ABS and advanced braking are standard across most OEMs. Environmental regulations are also pushing the adoption of electric mobility, opening new pathways for tech-rich braking systems.

Urbanization and poor road conditions are driving demand for reliable braking systems, particularly in Brazil and Argentina. Cost-effective drum brakes dominate, but disc systems are gaining share.

Growth is driven by affordability and need for rugged performance. Drum brakes remain common, but government safety policies could spur disc and ABS adoption over time.

Remote Diagnostics and Prognostics: The integration of IoT and telematics systems in braking mechanisms is reshaping maintenance strategies. Riders and fleet operators can monitor braking performance in real-time, reducing breakdowns and increasing uptime.

Rise of Electric Two-Wheelers: With subsidies and growing EV infrastructure, e-scooters and e-motorcycles are booming. Their compact design favors advanced brake-by-wire systems.

Customization and Performance Upgrades: Enthusiasts increasingly demand aftermarket upgrades for disc brakes, ABS kits, and caliper replacements. This trend is especially vibrant in Southeast Asia and Europe.

Integration of Sensors: Wheel speed sensors and IMUs (Inertial Measurement Units) are enabling ABS to evolve into full-fledged traction control systems, allowing optimized brake modulation on curves, wet surfaces, and varying loads.

For more details about the industry, get the PDF sample report for free

In 2022, a major Indian OEM rolled out ABS-equipped 110cc commuter motorcycles to comply with new safety regulations. Within six months, sales in Tier 2 and Tier 3 cities rose by 27%, with customer feedback citing improved ride confidence and emergency handling. This success has pushed competitors to follow suit, contributing to a nationwide shift toward safer braking systems.

High R&D and Production Costs: Sophisticated braking systems require costly sensors, control units, and calibration.

Complexity in Design: Space constraints in compact scooters make component placement difficult.

Electronic Vulnerabilities: Braking systems with embedded chips are prone to electrical noise and environmental damage.

Skilled Workforce Gaps: Aftermarket servicing of electronic braking systems requires trained technicians, still scarce in emerging markets.

For OEMs: Prioritize integration of ABS even in low-displacement models. Invest in modular, scalable designs to suit regional regulatory variances.

For Aftermarket Suppliers: Expand product portfolios to include sensor kits, brake fluid systems, and diagnostic modules. Develop training programs for local mechanics.

For Investors: Target companies aligned with EV-compatible braking tech, especially those focusing on telematics and diagnostics.

For Policymakers: Encourage adoption via subsidies, tax incentives, and safety education initiatives, especially in rural regions.

Get more details by ordering the complete report

The Two-Wheeler Braking System Market has experienced substantial growth with the increasing demand for enhanced safety features in motorcycles and scooters. The development of advanced braking technologies, such as anti-lock braking (ABS) and electronic ABS, has become a key driver in the market. Disc brakes and drum brakes are the most commonly used braking systems, with hydraulic brakes, ceramic brakes, and composite brakes gaining popularity for their efficiency and performance. Brake pads, sintered pads, and organic pads are integral components in the braking process, providing the necessary friction materials to stop the vehicle. Manufacturers are also focusing on the development of brake rotors, brake calipers, and brake discs, which are crucial in ensuring optimal braking performance. The integration of brake sensors, speed sensors, and brake modulators into brake systems ensures better control, improved safety, and precision during operation.

"By 2029, ABS and sensor-integrated braking systems will be standard in over 75% of two-wheelers sold globally," forecasts a senior analyst at Technavio. "This transformation is not just technological but societal—elevating safety and performance across all market tiers."

The convergence of electrification, safety mandates, and smart technologies positions the two-wheeler braking system industry at the forefront of mobility innovation. From affordable city scooters to performance motorcycles, braking technology is emerging as both a differentiator and a necessity.

For more details about the industry, get the PDF sample report for free

In-depth analysis of the Two-Wheeler Braking System Market indicates a shift towards more sophisticated systems, including regenerative braking and electro-hydraulic brakes, to improve energy efficiency and performance. The evolution of brake fluid and brake hoses, along with the growing use of brake actuators and brake valves, is enhancing the responsiveness of braking systems. Key components like brake levers, brake pedals, master cylinders, and brake lines ensure smooth operation of the overall system. The introduction of brake boosters and ABS modules is making braking systems more advanced and reliable. Additionally, brake fittings, brake reservoirs, and brake linkages are playing an essential role in improving the longevity and durability of braking systems. As the market grows, manufacturers are also optimizing brake assemblies, focusing on brake shoes, brake drums, and brake components to meet safety standards and performance expectations, catering to the evolving needs of motorcycle ABS and scooter brakes.

The two-wheeler braking system market is accelerating into a new era—powered by safety, governed by tech, and driven by demographic evolution. As electronic content deepens and regulations tighten, stakeholders across OEMs, aftermarket players, and regulators must align strategy with innovation to remain competitive.

Safe and Secure SSL Encrypted