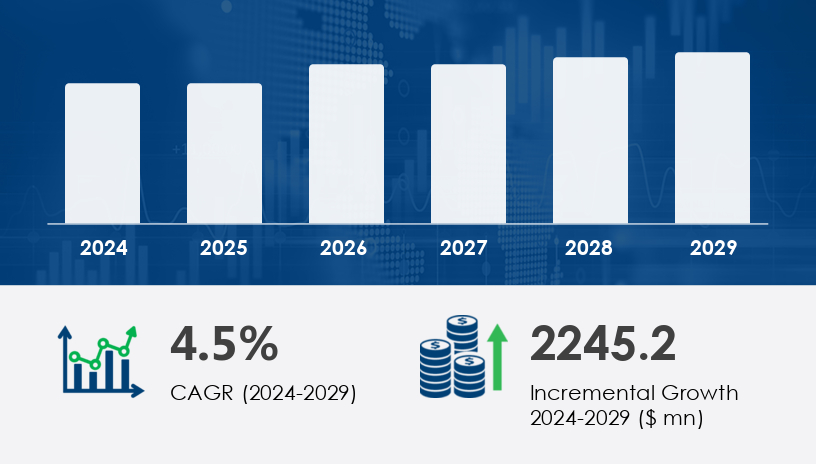

The global towing equipment market is set to grow significantly, with a projected increase of USD 2.25 billion from 2024 to 2029, expanding at a compound annual growth rate (CAGR) of 4.5%. This growth is being fueled by rising vehicle sales, growing infrastructure development, and the expanding use of passenger and commercial vehicles in emerging economies.

For more details about the industry, get the PDF sample report for free

The primary driver of the towing equipment market is the accelerating motorization trend, particularly in emerging countries like China and India. These markets are experiencing rapid growth in automotive sales and ownership, contributing to increased demand for towing solutions. For instance, the passenger cars segment alone was valued at USD 5.96 billion in 2019 and has shown steady growth since then. As vehicle ownership rises, so does the need for reliable towing systems for roadside assistance, breakdown recovery, and logistics. Market players are capitalizing on this demand by enhancing product offerings with machine learning, fuel-efficient designs, and electric compatibility to align with evolving transportation ecosystems.

A key trend reshaping the towing equipment market is the growing consolidation across industries and distribution channels, especially in mature markets like Western Europe and the United States. Larger distributors and aftermarket retailers are acquiring smaller players, focusing on suppliers that provide end-to-end product lines, category expertise, and global reach. Simultaneously, the industry is witnessing increased integration of telematics, AI, and GPS tracking in towing systems, improving operational efficiency and customer satisfaction. Sustainable practices, such as the adoption of electric tow trucks and corrosion-resistant materials, are also gaining traction due to rising environmental compliance standards.

The Towing Equipment Market continues to expand as demand for reliable and adaptable towing solutions grows across commercial, recreational, and emergency sectors. Key equipment such as tow bars, fifth wheels, and gooseneck hitches play a pivotal role in offering high towing capacity for heavy-duty applications. To ensure safety and functionality, components like weight distribution systems, trailer hitches, tow hooks, and winch systems are integrated into both light-duty and heavy-duty towing setups. Vehicle-mounted tools such as boom arms, wheel lifts, and flatbed tow configurations support a range of operations, including vehicle recovery. Enhancing secure towing, equipment like safety chains, brake controllers, and wiring harnesses remain essential features across fleets and personal vehicles.

Segmentation Categories:

By Application:

Passenger cars

Commercial vehicles

By Product Type:

Boom

Hook and chain

Wheel lift

Integrated

Flat bed

By Material:

Metal

Plastic

Composite materials

The passenger cars segment is expected to experience notable growth throughout the forecast period. Valued at USD 5.96 billion in 2019, this segment continues to expand due to increased car ownership and stricter safety regulations requiring standardized towing equipment. According to analysts, the growing need for vehicle recovery services, especially in urban areas, supports demand for advanced flatbed and integrated towing systems. The segment also benefits from innovations like autonomous towing and smart dispatch, helping reduce downtime and improve roadside recovery efficiency.

Regions Covered:

North America

Europe

APAC

Rest of World (ROW)

APAC is set to dominate the towing equipment market, contributing 46% of the global market growth between 2025 and 2029. This growth is largely driven by the rising popularity of large utility vehicles such as SUVs and pickup trucks, particularly in China and India. These vehicles are increasingly used for both personal and commercial purposes, creating robust demand for high-capacity towing systems. In addition, the rapid expansion of the e-commerce sector is fueling demand for towing and recovery equipment for delivery fleets. Analysts highlight that off-road recreational activity and stricter safety regulations are also spurring the market. Features like GPS tracking, vehicle diagnostics, and fatigue monitoring systems are gaining prominence across the region to support safety and efficiency.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

A significant challenge facing the towing equipment market is the volatility in steel prices, which directly affects manufacturing costs. Steel is a primary material in the production of towing systems, and fluctuations due to global supply conditions—particularly from oversupplied markets like China—can strain profitability. While some manufacturers mitigate this through three to six-month pricing contracts with suppliers, long-term unpredictability in material costs creates planning and budgeting difficulties. Additionally, smaller players find it harder to absorb these price shocks compared to larger competitors with diversified supply chains. This challenge is compounded by the high cost of advanced technologies and the need for ongoing operator training and customer support, both critical to ensuring safe and compliant usage of modern towing equipment.

Market trends reveal increased consumer interest in towing products designed for versatility and safety. Essential components like hitch balls, coupler locks, tow dollies, and hitch pins are seeing strong sales, especially among recreational users towing trailers, boats, or campers. Lightweight and multi-functional items such as tow straps, anti-rattle devices, hitch adapters, and tow slings are also gaining popularity for their convenience and ease of use. As awareness of towing safety grows, accessories like ball mounts, tow mirrors, hitch covers, and load equalizers are becoming standard additions. Technological improvements to mitigate trailer sway and support overall towing stability continue to influence product development and consumer purchasing decisions.

In-depth research analysis of the Towing Equipment Market shows a clear emphasis on advanced systems that support both safety and performance. Innovations in hydraulic lifts, recovery straps, and hitch receivers are being adopted for more efficient and controlled towing operations. The growing ecosystem of towing accessories includes modular options like the crossbar system, which enhances cargo flexibility. Security remains a major focus, with demand rising for hitch locks, trailer couplers, and anti-theft devices that prevent unauthorized use. Additionally, consumer demand for smarter and more efficient setups has led to the development of hitch alignment tools, enhanced trailer brake systems, and reinforced load security mechanisms. As the towing landscape becomes more sophisticated, the market is driven by a blend of traditional mechanical reliability and modern technological innovation.

The towing equipment market is highly dynamic, with key players adopting innovative strategies and launching new products to remain competitive. Companies are investing in advanced technologies such as autonomous recovery systems, AI-driven dispatch tools, and telematics for real-time diagnostics and fleet management.

Notable Developments Include:

In February 2024, Wacker Neuson launched the TowPro Series, featuring automatic braking and remote control, catering to construction and heavy-duty recovery applications.

In October 2024, Trelleborg Group formed a strategic partnership with Towmaster, aiming to offer integrated towing and winch solutions for agricultural and construction sectors.

The European Union’s new regulations approved in March 2025 introduced mandatory type approval and periodic inspections for towing equipment across the EU, strengthening safety and compliance.

In July 2025, Caterpillar Inc. acquired the towing equipment division of Hydrema A/S, enhancing its position in the heavy equipment segment and broadening its towing portfolio.

Major companies such as Andersen Hitches, CURT Manufacturing LLC, Horizon Global Corp., Brinkgroup, Bosal Nederland BV, and Technosys Equipments Pvt. Ltd. are focusing on mergers, partnerships, and regional expansion to tap into emerging markets and serve diverse customer segments. Emphasis is also being placed on fuel efficiency, corrosion resistance, and electric compatibility to meet the needs of both government and commercial sectors.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Application

6.1.1 Passenger cars

6.1.2 Commercial vehicles

6.2 Product Type

6.2.1 Boom

6.2.2 Hook and chain

6.2.3 Wheel lift

6.2.4 Integrated

6.2.5 Flat bed

6.3 Material

6.3.1 Metal

6.3.2 Plastic

6.3.3 Composite materials

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 ROW

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted