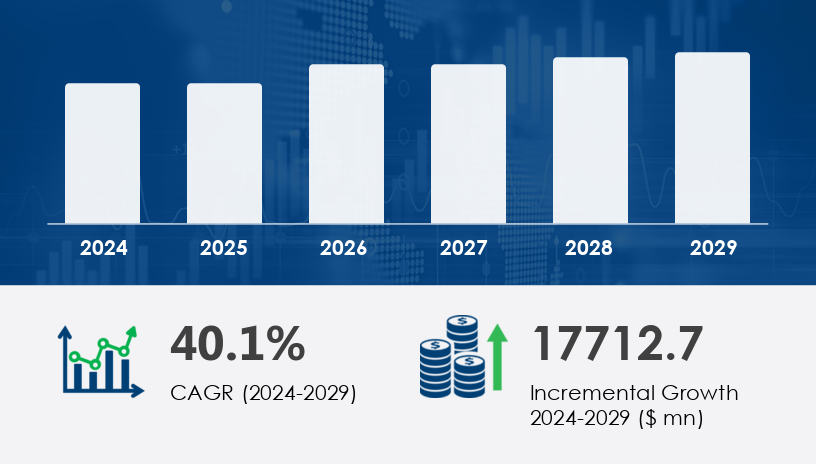

The Privileged Access Management Solutions Market is poised for substantial expansion driven by increasing cybersecurity threats and the widespread adoption of cloud-centric strategies. With rising internal and external cyber risks, the market has seen an unprecedented push toward advanced security tools for privileged accounts.In 2024, the Privileged Access Management Solutions Market was valued at a significant base, and it is forecast to grow by USD 17.71 billion from 2024 to 2029, progressing at a CAGR of 40.1% during the forecast period.For more details about the industry, get the PDF sample report for free

A major driver for the market is the need for Multi-Factor Authentication (MFA) to secure privileged accounts. As digital transformation accelerates and the number of privileged users grows, the threat from insider actors has increased sharply. According to industry insights, insider threats accounted for 32% of all security incidents in 2020. MFA systems, integrating components like biometrics, PINs, and smartcards, significantly enhance identity verification. Financial institutions and healthcare sectors especially rely on PAM tools to comply with regulations such as HIPAA, safeguarding critical digital assets. These developments have made MFA a cornerstone of PAM deployments across all enterprise sizes.

An emerging trend transforming the Privileged Access Management Solutions Market is the adoption of Bring Your Own Device (BYOD) policies. Post-pandemic work models have amplified remote access needs, increasing the use of personal devices in the workplace. This has led to heightened cybersecurity challenges, such as device diversity and decentralized data access. PAM tools help counteract these risks by managing credentials and controlling privileged sessions across various devices. As a result, industries with stringent compliance demands—like finance and healthcare—are rapidly integrating PAM tools to maintain security across hybrid and remote infrastructures.

The Privileged Access Management Solutions Market is experiencing rapid growth as organizations increasingly prioritize cybersecurity threats and regulatory compliance. PAM solutions play a crucial role in mitigating risks by managing privileged accounts through secure access control, multi-factor authentication, and biometric authentication. Key features like credential vaults, password vaults, session monitoring, and session recording ensure strict governance of sensitive operations. With rising concerns over insider threats and data breaches, businesses are deploying behavioral analytics and threat detection mechanisms to monitor user activity and secure endpoint protection across hybrid environments.

By Component

Solution

Service

By End-user

BFSI

IT and Telecom

Government and Public Sector

Healthcare

Others

By Application

Large Enterprises

SMEs

By Geography

North America (US, Canada)

Europe (Germany, UK, France, Italy)

APAC (China, India, Japan, South Korea)

Middle East and Africa

South America

Among all segments, the solution segment dominates the Privileged Access Management Solutions Market due to its critical role in threat mitigation. PAM solutions are deployed across hardware appliances, on-premises software, and SaaS platforms, managing risks tied to privileged access. The solution segment was valued at USD 886.20 billion in 2019, with steady growth forecasted through 2029. These tools support privileged account discovery, session monitoring, and credential management. According to analyst commentary, rising digital asset vulnerabilities and insider threat risks have made PAM solutions essential for securing both cloud and traditional infrastructures.

North America (US, Canada)

Europe (Germany, UK, France, Italy)

APAC (China, India, Japan, South Korea)

Middle East and Africa

South America

North America holds the largest share, contributing approximately 49% to the global Privileged Access Management Solutions Market growth during 2025–2029. The region’s dominance is driven by increased cybersecurity threats and stringent regulatory environments. Insider attacks, hosted server breaches, and governmental compliance requirements are pushing enterprises—especially in the services and industrial sectors—to adopt PAM solutions. Analysts highlight the role of Identity as a Service (IDaaS) and cloud-centric strategies in enhancing PAM implementation across North American enterprises. These advanced technologies support secure privileged access management and bolster regulatory compliance efforts.

A key challenge hindering the market’s momentum is system integration and interoperability issues. As organizations adopt diverse IT infrastructures and cloud platforms, the complexity of integrating PAM tools across systems becomes significant. This fragmentation results in inefficiencies, increased operational costs, and potential security loopholes. Furthermore, the financial strain due to inflation and tight IT budgets limits the scalability of PAM deployments, particularly for SMEs. Experts point out that while AI and machine learning are being introduced to mitigate integration challenges, widespread adoption still requires substantial investment in training and change management.

Organizations are adopting advanced PAM tools that offer just-in-time access, least privilege principles, and role-based access to minimize overexposure to critical systems. Enhanced identity governance, access certification, and audit trails are enabling better risk assessment and compliance audits. PAM platforms increasingly feature password rotation, access policies, encryption keys, and access workflow management to protect privileged credentials in real time. The move toward zero trust architecture and secure remote access is further boosting demand, especially in sectors dealing with high-value data and complex cloud security and SaaS solutions infrastructures.

The PAM ecosystem is evolving with innovations in security analytics, incident response, and real-time alerts to provide deeper visibility into critical access points. Support for directory service, identity federation, and API integration ensures seamless interoperability with existing IT environments. Session isolation, security dashboards, and access monitoring are being leveraged to enhance operational control, while enforcing strict password policies to reduce attack surfaces. As enterprises navigate complex compliance frameworks and demand tighter governance, the Privileged Access Management Solutions Market is positioned as a vital component in the global cybersecurity landscape.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Key players in the Privileged Access Management Solutions Market are actively pursuing strategic expansions, partnerships, and product innovations to strengthen their market presence. For instance, ARCON offers endpoint privilege management tools, while CyberArk Software Ltd. and BeyondTrust Corp. continue to enhance their behavioral analytics and access control capabilities. Other major companies like IBM, Oracle, and Hitachi are focusing on integrated PAM offerings that align with broader identity and security frameworks.

These companies are embracing cloud-first deployments, AI-based threat detection, and managed services models to cater to both large enterprises and SMEs. According to industry analysts, such innovations are essential to stay competitive in a rapidly evolving market defined by complex security demands and dynamic digital transformations.

The Privileged Access Management Solutions Market is on a high-growth trajectory, fueled by increasing cybersecurity threats, digital transformation, and evolving regulatory requirements. With a projected USD 17.71 billion increase by 2029 at a CAGR of 40.1%, the market is rapidly becoming a cornerstone of enterprise IT strategies. Despite integration challenges, rising adoption of MFA, BYOD policies, and cloud-native architectures are reshaping the PAM landscape. Industry leaders continue to invest in advanced features and partnerships, ensuring that PAM solutions remain pivotal in securing privileged access and safeguarding digital infrastructures worldwide.

Executive Summary

Market Landscape

Market Sizing

Historic Market Size

Five Forces Analysis

Market Segmentation

6.1 By Component

6.1.1 Solution

6.1.2 Service

6.2 By End-user

6.2.1 BFSI

6.2.2 IT and Telecom

6.2.3 Government and Public Sector

6.2.4 Healthcare

6.2.5 Others

6.3 By Application

6.3.1 Large Enterprises

6.3.2 SMEs

6.4 By Geography

6.4.1 North America

6.4.2 Europe

6.4.3 APAC

6.4.4 South America

6.4.5 Middle East and Africa

Customer Landscape

Geographic Landscape

Drivers, Challenges, and Trends

Company Landscape

Company Analysis

Appendix

Safe and Secure SSL Encrypted