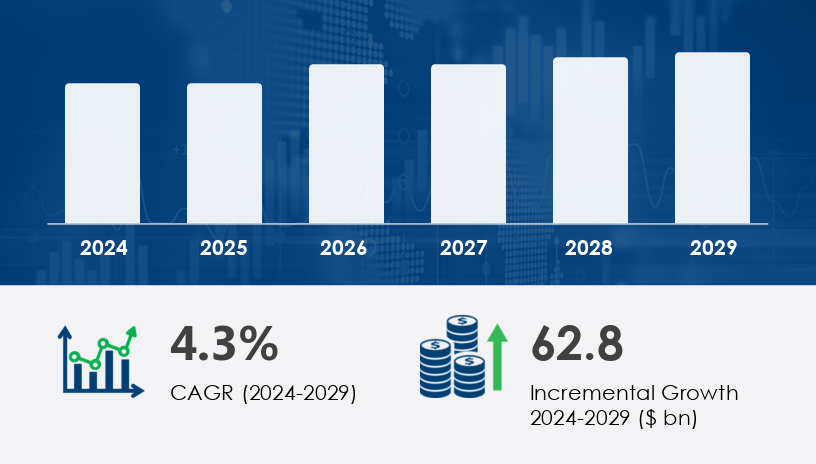

The paper and paperboard container and packaging market is poised for remarkable growth, expected to increase by USD 62.8 billion at a CAGR of 4.3% from 2024 to 2029. As the global packaging industry evolves, paper and paperboard solutions are steadily taking center stage, driven by an increasing demand for sustainable, eco-friendly options.

For more details about the industry, get the PDF sample report for free

A primary driver of this market's growth is the emergence of specialized paper and paperboard containers tailored to meet the unique packaging requirements of various industries. These containers offer several advantages, such as being lightweight, cost-effective, and visually appealing. They can be customized in various sizes and styles to suit specific product needs, effectively protecting fragile or delicate products during transportation and storage. Retailers benefit from using specialized containers as they enable better shelf management, allowing for more product display in limited space. Additionally, these containers enhance branding and support customer engagement efforts .

An emerging trend in the paper and paperboard container and packaging market is the adoption of smart packaging technologies. Smart packaging involves integrating advanced technologies, such as microsensors and the Internet of Things (IoT), into packaging materials to provide real-time information about the product's condition and usage. This trend is gaining traction, particularly in sectors like healthcare, where smart packaging solutions can monitor medication adherence and provide consumers with personalized product information. Leading companies are investing in developing innovative smart packaging solutions to meet the growing demand for interactive and informative packaging.

The Paper and Paperboard Container and Packaging Market is experiencing substantial growth due to increasing demand for sustainable packaging and eco-friendly packaging solutions across various industries. Key components such as paperboard packaging, corrugated containers, folding boxes, and paper bags remain dominant in the market owing to their versatility and cost-effectiveness. In response to environmental concerns, manufacturers are shifting toward recycled paperboard, biodegradable packaging, and lightweight packaging. This transition is supported by the growing use of cellulose fibres and pulp packaging, which provide a sustainable alternative to plastic-based solutions. As industries adapt to green practices, green packaging, recyclable packaging, and paperboard trays are becoming essential, particularly in food packaging, beverage packaging, and healthcare packaging applications.

The paper and paperboard container and packaging market is segmented based on the following categories:

Product Type: Paper bags and sacks, Corrugated containers and packaging, Folding boxes and cases, Others

End-user Industry: Food and beverages, Industrial products, Healthcare, Others

Material: Virgin paperboard, Recycled paperboard

Packaging Type: Primary packaging, Secondary packaging, Tertiary packaging

Among the various segments, the paper bags and sacks category is anticipated to witness significant growth during the forecast period. These packaging solutions are widely used in the food and beverage industry for packaging items such as snacks, bakery products, and dairy goods. Their eco-friendly nature, cost-effectiveness, and versatility contribute to their increasing adoption. The demand for paper bags and sacks is further fueled by the growing consumer preference for sustainable packaging options and the rise in e-commerce activities, which require efficient and protective packaging solutions .

The paper and paperboard container and packaging market is analyzed across the following regions:

North America

Europe

Asia Pacific (APAC)

South America

Middle East and Africa

The Asia Pacific (APAC) region is projected to dominate the market, contributing approximately 40% to the global growth during the forecast period. This dominance is attributed to factors such as a large consumer base, significant production of agricultural products, and increasing demand for packaged goods. Countries like China and India are leading the growth in this region, driven by urbanization, rising disposable incomes, and changing consumer lifestyles. The presence of numerous food, beverage, and personal care manufacturers in APAC further creates a favorable environment for investment in the packaging industry.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

A key challenge facing the paper and paperboard container and packaging market is the risk of contamination associated with recycled paperboard. The use of recycled materials in packaging can lead to the migration of harmful substances, such as mineral oils from printing inks, into food products. This poses health risks and may lead to regulatory restrictions, affecting the adoption of recycled paperboard in food packaging applications. Manufacturers need to implement stringent quality control measures and invest in technologies to mitigate these risks and ensure consumer safety.

Recent market research highlights the expansion of industrial packaging, retail-ready packaging, and e-commerce packaging, all of which are increasingly utilizing corrugated boxes, folding cartons, paperboard cartons, and secondary packaging options to ensure product safety and visual appeal. There is growing interest in primary packaging innovations, with a focus on QR code packaging and smart packaging that enhances customer engagement. In the realm of structural materials, the use of specialized containers, paperboard cans, paperboard pallets, and honeycomb paperboard is on the rise due to their strength and adaptability. Meanwhile, bleached paperboard, unbleached paperboard, chipboard packaging, white lined chipboard, and solid board are being strategically deployed based on end-use requirements, such as printability, durability, and cost efficiency.

In-depth research analysis reveals a strong emphasis on packaging innovation through the integration of smart sensors and freshness sensors, especially in perishable goods markets. These advancements enable brands to monitor product conditions in real time, improving safety and shelf-life. The market is also segmented by material type and usage, including flexible packaging, rigid packaging, fibre board, and other adaptable formats. The use of paperboard cans and fibre board is especially notable in industries requiring protective packaging for fragile or sensitive items. The ongoing evolution of the packaging sector reflects a broader commitment to sustainable and intelligent design practices that align with regulatory trends and shifting consumer expectations.

Companies in the paper and paperboard container and packaging market are adopting various strategies to enhance their market position:

Innovations in Sustainable Packaging: Companies are focusing on developing eco-friendly packaging solutions, such as biodegradable and recyclable containers, to meet the growing consumer demand for sustainable products.

Adoption of Smart Packaging Technologies: Integrating advanced technologies into packaging materials to provide real-time information and enhance consumer engagement.

Expansion into Emerging Markets: Companies are exploring growth opportunities in emerging markets, particularly in the APAC region, to capitalize on the increasing demand for packaged goods.

Strategic Partnerships and Collaborations: Forming alliances with other industry players to leverage complementary strengths and expand market reach.

These strategies enable companies to stay competitive in a rapidly evolving market and cater to the changing preferences of consumers and industries.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Product

6.1.1 Paper bags and sacks

6.1.2 Corrugated containers and packaging

6.1.3 Folding boxes and cases

6.1.4 Others

6.2 End-User

6.2.1 Food and beverages

6.2.2 Industrial products

6.2.3 Healthcare

6.2.4 Others

6.3 Material

6.3.1 Virgin paperboard

6.3.2 Recycled paperboard

6.4 Packaging

6.4.1 Primary packaging

6.4.2 Secondary packaging

6.4.3 Tertiary packaging

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted