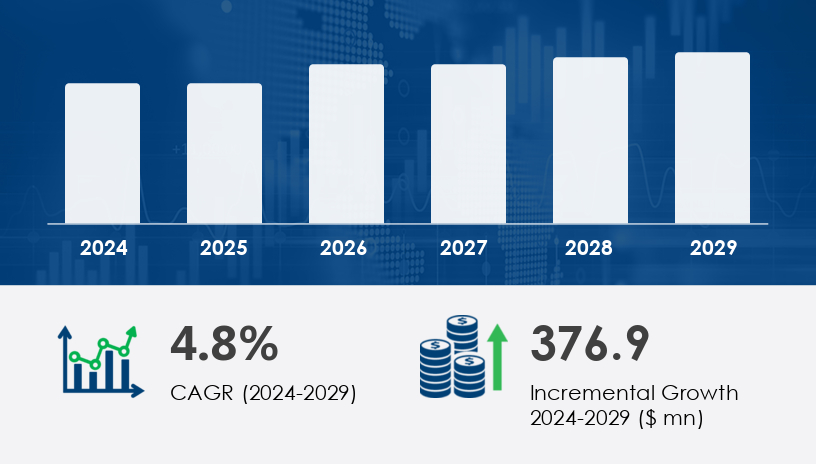

The dining table is no longer just a place to eat—it’s becoming a canvas of lifestyle, technology, and personalization. “Indian consumers are choosing tableware not just for function, but for expression,” notes a senior analyst at a leading retail consultancy. This pivot is redefining the India tableware market as we head into 2025–2029, where innovation, aesthetics, and omnichannel agility will dictate competitive success. Welcome to the next-gen outlook for one of India’s most quietly dynamic consumer markets.The India tableware market size is forecast to increase by USD 376.9 million at a CAGR of 4.8% between 2024 and 2029.

For more details about the industry, get the PDF sample report for free

From stainless steel thalis in traditional homes to tech-integrated ceramic designs in modern kitchens, the India tableware market has undergone a subtle yet significant transformation. In 2020, the market was predominantly influenced by utilitarian needs and affordability. By 2024, growing urbanization and household expansion—particularly among India’s rising middle and upper-income demographics—sparked a shift toward high-quality, design-centric, and functional products. The market reached an inflection point with increased adoption of branded ceramicware and glassware, coupled with a stronger retail presence, both offline and online.

Looking ahead, the 2025–2029 forecast anticipates a USD 376.9 million increase in market size, growing at a CAGR of 4.8%. This growth will be steered by evolving lifestyles, government-led housing initiatives, and the strategic use of omnichannel platforms by key players.

The tableware market in India is no longer defined by traditional preferences alone. The biggest growth driver today is the rising number of households, propelled by government-supported housing schemes like Pradhan Mantri Awas Yojana (PMAY). These initiatives are rapidly expanding India’s residential base, fueling demand for both functional and aesthetically pleasing dining ware.

But demographics are just the beginning. Consumers are increasingly drawn to durable, lead-free, and BPA-free materials, reflecting a broader shift toward health-conscious living. At the same time, tech-savvy buyers are pushing brands to adapt their retail and marketing strategies. Smart tableware that monitors food temperature or provides nutritional data may sound futuristic, but it’s a natural evolution when paired with wearable tech trends like smartwatches and augmented-reality interfaces.

Furthermore, brands are adopting coexistence testing, ensuring new product lines work with existing table settings—a nod to Indian consumers’ desire for harmony between old and new.

Get more details by ordering the complete report

Offline retail—led by hypermarkets, supermarkets, and department stores—still dominates the landscape thanks to tactile evaluation, expert assistance, and wide product portfolios. But the trendline points firmly toward omnichannel retailing. Market players are integrating mobile shopping, virtual tryouts via AR, and smartphone-based packaging solutions. Expect to see a sharp rise in online-exclusive product lines, especially ceramic and glassware tailored for digital-first consumers.

In 2024, ceramicware began to outpace traditional metalware, driven by its visual appeal and durability. Glassware is also trending upward due to its elegance and ability to elevate presentation. Meanwhile, innovations in biodegradable and recycled materials are opening new growth pockets in the “green dining” niche.

Residential customers remain the market’s largest and most lucrative segment. The rise of nuclear families, apartment living, and interior design awareness means tableware is now a key element of home aesthetics. While the commercial segment—including restaurants and hospitality—is steady, residential buyers are driving the real demand spike, especially in urban and Tier 2 cities

Tech-Enhanced Marketing: Augmented reality (AR) and virtual reality (VR) can transform product discovery and customization.

Eco-Friendly Innovation: Sustainable tableware could be the next big frontier as environmentally aware Gen Z consumers enter the market.

Cultural Crossovers: Tableware that blends traditional Indian motifs with modern form factors can appeal to both heritage and modernist buyers.

Price War from Unorganized Players: Low-cost imports—especially from Chinese manufacturers—pose a real threat with their aggressive pricing and vast supply chains.

Tech Adoption Gaps: While smart tableware shows promise, adoption is still limited due to usability and health safety concerns, including display heat and battery hazards.

Fragmentation: With so many small-scale players in the market, brand loyalty remains elusive and customer acquisition costs stay high

For more details about the industry, get the PDF sample report for free

The India tableware market of the late 2020s will be characterized by experiential dining, design personalization, and digitally enabled convenience. Brands that thrive will likely:

Introduce QR-code-labeled dishes offering real-time health and dietary data.

Expand D2C (Direct-to-Consumer) platforms, ensuring quicker personalization and improved delivery models.

Collaborate with health-tech companies to develop “smart” utensils and plates that guide calorie control, meal timing, or even hydration levels.

Capitalize on regional demand in emerging Tier 2/3 cities where offline expansion remains a vital touchpoint.

From minimalist Scandinavian designs to culturally resonant Indian patterns, aesthetic variety will be a core USP. Expect product modularity, where plates, bowls, and cutlery can be bought piecemeal and interchanged based on events or decor themes

The India Tableware Market is witnessing robust demand driven by changing consumer preferences and a rising focus on aesthetic dining experiences. Traditional choices like the ceramic plate, porcelain bowl, and glass tumbler remain staples, while modern households increasingly adopt premium products such as the stainless steel fork, bone china cup, and melamine platter. Luxury dining trends are further fueling sales of the crystal wine glass, silver spoon, and bamboo tray. Earthy and artisanal touches are evident in offerings like the stoneware mug, acrylic pitcher, and copper flatware. Consumers also gravitate toward sustainable and elegant options such as the wooden salad bowl, gold rim plate, and marble serving dish. Meanwhile, unique textures and vibrant designs in items like the enamel teapot, brass cutlery, and plastic dessert plate are gaining popularity. Rising demand for complete sets includes the ironstone dinner set, terracotta saucer, and pewter goblet, reflecting India's blend of traditional craftsmanship and modern functionality.

Get more details by ordering the complete report

For retailers: Double down on omnichannel strategies. Physical presence must be complemented by an immersive digital storefront with AR and voice-guided product assistants.

For manufacturers: Invest in R&D to develop smart, health-conscious, and sustainable product lines. Differentiate through material innovation and multi-use versatility.

For investors: Focus on ceramicware and glassware producers with robust D2C capabilities and strong logistics networks. Companies like Anil Ceramic, Ariane Fine Porcelain, and Clay Craft India Pvt. Ltd. are strong bets due to their category specialization and adaptability.

For policymakers: Encourage MSMEs in the tableware sector by offering incentives for eco-friendly innovation and discouraging substandard imports through stricter quality controls.

Innovation and material diversification continue to reshape the competitive landscape of the India Tableware Market. High-performance items such as the aluminum tray, titanium knife, and slate cheese board cater to the premium consumer segment. The growing gifting culture has increased demand for elegant additions like the glass decanter, porcelain teacup, and ceramic casserole dish. Functional excellence is also seen in the rise of ergonomic tools such as the stainless steel ladle, crystal champagne flute, and melamine serving bowl. Opulent serving solutions like the bone china platter, silver butter knife, and bamboo chopsticks are gaining traction in urban households. Rustic and durable designs continue to thrive through the stoneware soup bowl, acrylic wine glass, copper serving spoon, and wooden cutting board. The market also embraces ornate finishes and durable solutions including the gold dessert fork, marble cake stand, enamel coffee mug, brass salad tongs, and plastic tumbler. Lastly, traditional yet enduring items such as the ironstone salad plate, terracotta baking dish, pewter tankard, aluminum serving platter, and titanium spork underline the market’s balance of heritage and innovation.

For more details about the industry, get the PDF sample report for free

The India tableware market is no longer just about plates and bowls—it’s about consumer identity, smart integration, and curated experiences. Between 2025 and 2029, growth will be defined not only by how much is sold, but how tableware reshapes the way people eat, connect, and live. As homes become smarter and lifestyles more intentional, tableware will evolve from passive utility to active enabler. The brands that see this shift, embrace it, and innovate boldly will shape the next era of competitive advantage.

Safe and Secure SSL Encrypted