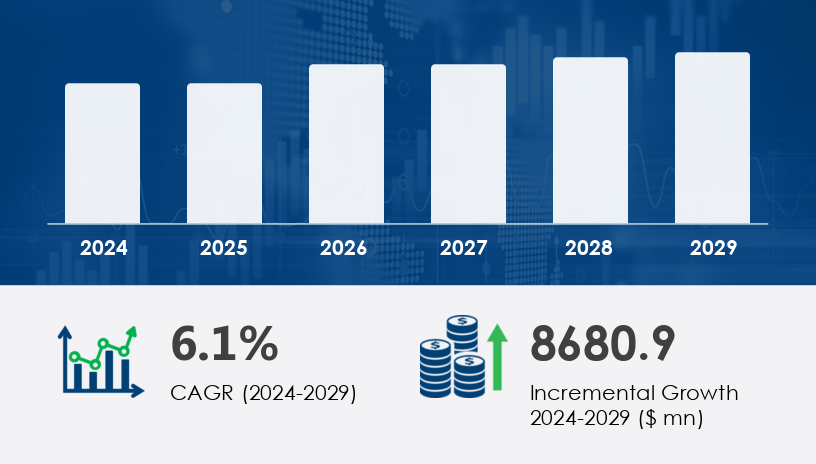

The global tablet touch panel market is poised for substantial growth, expected to expand by USD 8.68 billion between 2025 and 2029, progressing at a CAGR of 6.1%. This surge is fueled by the rising adoption of tablets across diverse sectors—from education and enterprise to healthcare and entertainment—catalyzed by the shift to digital learning and remote work. Market players are actively developing advanced coatings and leveraging novel materials to improve durability and responsiveness, keeping pace with evolving user expectations.Driving this growth is the integration of Projected Capacitive Touch (PCT) and Surface Acoustic Wave (SAW) technologies, along with the fusion of artificial intelligence (AI) and machine learning (ML) into touch panel interfaces. These innovations are reshaping the user experience, particularly in consumer electronics and industrial applications such as automotive displays, digital signage, and medical devices. However, supply chain vulnerabilities—exacerbated by the pandemic and regulatory changes—pose a challenge to consistent production and global distribution, especially with new export restrictions on advanced semiconductor technologies imposed in 2023.

For more details about the industry, get the PDF sample report for free

Less than 12 inches (Key growth segment)

Greater than 12 inches

Projected capacitive touch

Resistive touch

Infrared touch

SAW (Surface Acoustic Wave) touch panel

Optical imaging touch

Geography

The Asia-Pacific (APAC) region is set to contribute a staggering 44% of the market's growth during the forecast period. This dominance stems from a combination of cost-effective labor, advanced manufacturing ecosystems, and robust supply chain infrastructure. Key APAC countries fueling this expansion include:

China

India

Japan

South Korea

Other significant regional contributors include:

North America: US, Canada

Europe: Germany, UK, France

South America: Brazil

Middle East and Africa

The US market benefits from a high penetration rate in enterprise applications, educational systems, and premium consumer electronics, while Germany and the UK are showing increased demand for integrated touchscreen notebooks and point-of-sale solutions.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

The primary catalyst behind this expansion is the rising global adoption of tablets in both B2B and B2C environments. Tablets are now central to digital workflows—supporting remote collaboration, interactive learning, sales enablement, and mobile field service operations. This increased utility is complemented by their lightweight design, long battery life, and the integration of energy-efficient displays like OLED and AMOLED, making them viable for all-day productivity.

Additionally, the cost of manufacturing touch-sensitive interfaces has decreased, making advanced technologies accessible to mid-tier and even entry-level devices. Businesses are deploying tablets as portable point-of-sale systems, digital kiosks, and fleet management tools—accelerating commercial adoption.

A pivotal trend in the industry is the application of advanced coatings and materials to enhance the panel’s tactile response and longevity. This evolution supports the growing need for rugged tablets in industrial and healthcare settings. Furthermore, flexible displays—especially foldable OLED and AMOLED panels—are carving out new subsegments, transforming user interaction by offering seamless browsing, immersive gaming, and multimedia streaming experiences.

Manufacturers are also investing heavily in R&D to reduce production costs while maximizing performance. LED and LCD technologies are continually being refined to balance affordability with display sharpness and power conservation. The expanding application of these panels across notebooks, smart home displays, and industrial machinery underpins sustained market momentum.

Despite robust demand, the market faces significant supply chain disruptions. From geopolitical instability to trade restrictions—particularly around semiconductor technology—manufacturers face logistical and regulatory hurdles. The 2023 restrictions targeting Chinese access to advanced semiconductors have disrupted the availability of key components like touch controllers, display driver ICs (DDICs), and flexible OLED materials, impacting production timelines and costs.

These challenges, though formidable, are prompting diversification strategies among manufacturers, including localized production, strategic sourcing partnerships, and inventory optimization to mitigate risks

The tablet touch panel market is undergoing a transformative phase, driven by rapid innovations across display technologies and interactive interfaces. Capacitive touch and resistive touch remain foundational technologies, but modern tablets increasingly integrate AMOLED display, OLED panel, and LCD touchscreen formats for enhanced visual clarity and responsiveness. The demand for multi-touch screen functionality, haptic feedback, and gesture recognition is surging in sectors like digital signage, interactive kiosk systems, and POS terminals. Meanwhile, advanced configurations such as in-cell touch and on-cell touch contribute to thinner, lighter devices. Emerging trends include the adoption of flexible display and foldable screen designs that push the boundaries of device form factors. Touch sensor advancements, particularly in mobile devices and hospitality tablets, are further propelled by energy-efficient display technologies and sustainable touchscreen manufacturing practices. The market is also seeing increased penetration into niche applications, including medical displays, automotive touchscreens, and gaming displays, all of which prioritize high responsiveness and durability

Top industry players are actively deploying strategies such as mergers, product launches, strategic partnerships, and regional expansions to gain market share. The competitive landscape includes global leaders offering specialized touch panel technologies and vertically integrated solutions.

AUO Corp. – Known for reflective LCD technology enhancing eye comfort

BOE Technology Group Co. Ltd.

Corning Inc.

ELK Products Inc.

Elo Touch Solutions Inc.

Fujitsu Ltd.

General Interface Solution (GIS) Holding Ltd.

Iljin Display Co. Ltd.

Infineon Technologies AG

Innolux Corp.

KYOCERA Corp.

LG Corp.

Nissha Co. Ltd.

OFILM Group Co. Ltd.

Orient Display

Samsung Electronics Co. Ltd.

Sharp Corp.

TPK Holding Co. Ltd.

Weintek Labs Inc.

Young Fast Optoelectronics Co. Ltd.

These companies are categorized across the adoption lifecycle—from innovators to laggards—and analyzed based on both quantitative dominance and qualitative specialization, enabling vendors to evaluate their competitive positioning in the market.

Research Analysis Overview

Research reveals that manufacturers are placing strong emphasis on refining the touch interface through components such as touch controllers and tablet processors, which enhance stylus compatibility and overall touch accuracy. Innovations in touch module integration and display panel engineering are improving touchscreen durability and supporting features like anti-glare coating and fingerprint-resistant screens. The introduction of pressure sensing technologies, along with support for active stylus and electromagnetic resonance input, is reshaping the user experience for professional and creative applications. Optical touch, infrared touchscreen, and surface acoustic sensing systems are being tested for use in large-scale commercial settings. Meanwhile, bezel-less design is becoming a key aesthetic and functional priority in next-gen tablet displays. The rise in single-layer touch solutions and incorporation of ITO coating materials is optimizing cost-efficiency without compromising on performance. Additionally, smartwatch displays are emerging as a complementary growth segment, sharing innovations in micro-touch technologies that are increasingly compatible with mainstream tablet systems.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Safe and Secure SSL Encrypted