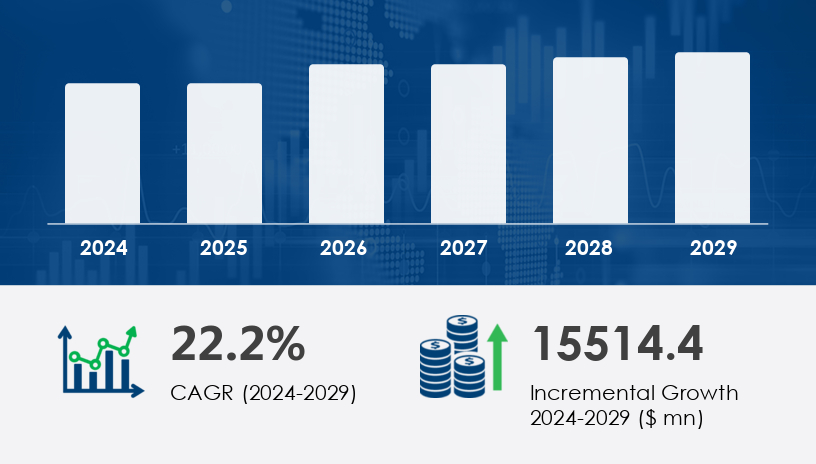

The global supply chain analytics market is undergoing a rapid transformation. With a forecasted growth of USD 15.51 billion at a CAGR of 22.2% between 2024 and 2029, this sector is becoming a critical component of modern business infrastructure. In an era where real-time data, automation, and predictive modeling dictate operational success, enterprises—especially in North America—are investing heavily in analytics to maintain competitiveness and drive efficiency across increasingly complex supply chains.

For more details about the industry, get the PDF sample report for free

The primary driver behind this accelerated growth is the increased need to improve business processes and enhance operational efficiency. Organizations are leveraging analytics to extract actionable insights from massive data sets, enabling better demand forecasting, inventory management, and cost optimization. Particularly in sectors like retail, manufacturing, and transportation, the ability to anticipate customer needs and adjust logistics accordingly is proving invaluable.

Companies are increasingly adopting automation tools, ERP systems, warehouse management systems (WMS), and procurement analytics to optimize their supply chain processes. These systems help bridge the demand-supply gap, mitigate inventory risks, and streamline procurement transactions.

A standout trend in the market is the increased use of predictive analytics. By leveraging algorithms and historical data, businesses can model future demand patterns, enabling them to optimize inventory levels, reduce waste, and ensure timely delivery. One prominent approach is vendor-managed inventory (VMI), where suppliers maintain stock levels based on consumption data, increasing efficiency and accountability.

Furthermore, the integration of machine learning (ML) and cloud-based solutions is redefining the way data is processed and interpreted. These technologies offer real-time visibility, enable remote collaboration, and reduce dependency on costly infrastructure.

The growing emphasis on sustainability, resilience, and cost-saving initiatives has also driven the adoption of analytics platforms that promote smarter, environmentally-conscious operations. From fleet optimization in transportation to demand planning in retail, these trends are shaping a data-first culture in supply chain management.

Despite its benefits, implementing supply chain analytics isn't without its challenges. One of the main obstacles is data integration and compatibility across siloed systems. Enterprises often deal with fragmented data stored in various formats across disconnected platforms, making it difficult to achieve end-to-end visibility.

Moreover, concerns around data security, elevated warehousing costs, and unethical procurement activities pose risks to economic viability. Data loss, in particular, can derail demand forecasts and compromise procurement accuracy, negatively impacting customer satisfaction and profitability.

To mitigate these risks, organizations are turning to on-premises analytics solutions, professional consulting services, and stricter oversight mechanisms. These measures help ensure data accuracy, transparency, and ethical compliance in supply chain activities.

The cloud-based deployment segment is leading the market surge and is expected to witness significant growth through 2029. Cloud solutions offer scalable, cost-effective, and on-demand access to analytics platforms, allowing organizations to adapt quickly to dynamic data volumes and business needs.

In addition to eliminating the need for heavy upfront hardware investments, cloud-based platforms foster remote collaboration, enable real-time analytics, and support integration with ERP, WMS, procurement analytics, and AI technologies. These features are critical for large enterprises focused on performance efficiency, waste reduction, and economic sustainability.

In 2018, the cloud-based segment was valued at USD 2.47 billion and has shown a consistent upward trajectory since, reinforcing its role as the backbone of modern analytics infrastructure.

The supply chain analytics market spans several industries:

Retail: Enhancing inventory tracking and consumer satisfaction

Manufacturing: Supporting production planning and cost control

Transportation: Improving fleet utilization and route optimization

Healthcare: Ensuring timely delivery and compliance

Others: Including energy, finance, and logistics

Each sector utilizes analytics to solve industry-specific challenges, with demand forecast accuracy, procurement transparency, and operational agility being common goals.

Get more details by ordering the complete report

The Supply Chain Analytics market is undergoing a transformative shift driven by innovations in Predictive Analytics, Big Data Analytics, and IoT Analytics, which are enabling businesses to achieve better forecasting and decision-making. Segment-specific tools like Retail Analytics, Manufacturing Analytics, Healthcare Analytics, and Transportation Analytics are helping companies extract actionable insights tailored to their industries. Deployment models such as On-Premise Analytics and Cloud-Based Analytics provide flexible adoption paths depending on organizational needs. Core functions including Demand Forecasting, Inventory Management, Vendor Management, and Delivery Management are increasingly reliant on analytical tools to drive efficiency. Integration of analytics into Order Management, Product Sourcing, and Risk Analytics allows companies to align supply with fluctuating Demand Patterns. Enhanced focus on Performance KPIs, Omnichannel Retailing, and Business Productivity is pushing enterprises toward stronger Data Integration and improved Real-Time Tracking capabilities, ultimately bolstering Operational Efficiency and Supply Chain Visibility.

North America is the dominant region, contributing 38% to the market’s global growth. The presence of technologically advanced ecosystems, especially in the United States, is driving the early and extensive adoption of supply chain analytics. This region benefits from a complex but mature business environment where AI, ML, and big data technologies are widely integrated into core supply chain functions.

The rise of e-commerce, coupled with evolving customer expectations, has placed immense pressure on supply chain infrastructures. To meet these demands, businesses are deploying analytics solutions that offer real-time insights, manage inventory fluctuations, and optimize logistics operations.

Germany, UK, and France are actively investing in analytics platforms to modernize aging infrastructure and stay competitive in the global market. The focus here is on network design, cost optimization, and customized supply chain solutions that align with regional sustainability goals.

China is emerging as a hub for supply chain innovation. The country’s massive manufacturing base, growing e-commerce sector, and digitization initiatives are fueling demand for analytics tools that can manage high-volume transactions and global supply interactions.

The region is slowly embracing analytics as enterprises seek to improve supply chain visibility and operational efficiency. The growth here is driven by sectors like energy, logistics, and retail.

While still in the developing stage, South America is seeing increasing adoption of cloud-based analytics to support inventory tracking, transportation optimization, and cost reduction initiatives in industries like agriculture and mining.

For more details about the industry, get the PDF sample report for free

The competitive landscape is populated by both established tech giants and niche innovators. Major players include:

AIMMS BV

American Software Inc.

Anaplan Inc.

Coupa Software Inc.

Domo Inc.

International Business Machines Corp. (IBM)

Kinaxis Inc.

Manhattan Associates Inc.

MicroStrategy Inc.

NB Ventures Inc.

NTT DATA Corp.

Oracle Corp.

Panasonic Holdings Corp.

Salesforce Inc.

SAP SE

SAS Institute Inc.

TARGIT AS

Teradata Corp.

TIBCO Software Inc.

Infor Inc.

These companies are categorized based on their market focus as pure play, category-focused, industry-focused, or diversified, with quantitative metrics further classifying them as dominant, leading, strong, tentative, or weak performers.

Each player is leveraging a mix of product innovation, regional penetration, and customer-centric strategies to capture greater market share and meet evolving enterprise needs in real time.

Recent research emphasizes how analytics is transforming procurement and logistics through advanced Procurement Analytics, Logistics Analytics, and Warehouse Management systems. Niche areas such as Consumer Goods Analytics and Retail Operations are increasingly leveraging Predictive Mechanisms and Risk-Averting Models to streamline operations and mitigate disruptions. Businesses are now making Data-Driven Decisions to facilitate Supply Chain Optimization, better manage Inventory Flow, and improve Content Collaboration across departments. Issues like System Security and Network Infrastructure are also becoming critical, especially in light of increased reliance on digital tools. The rise of E-Commerce Analytics has spurred demand for solutions that optimize Supplier Management, Customer Analytics, and Replenishment Policies, ensuring timely delivery and minimal stockouts. Enhanced Business Processes are being driven by comprehensive Analytics Solutions, positioning companies to respond quickly to market changes and deliver consistent value across the supply chain.

Get more details by ordering the complete report

Safe and Secure SSL Encrypted