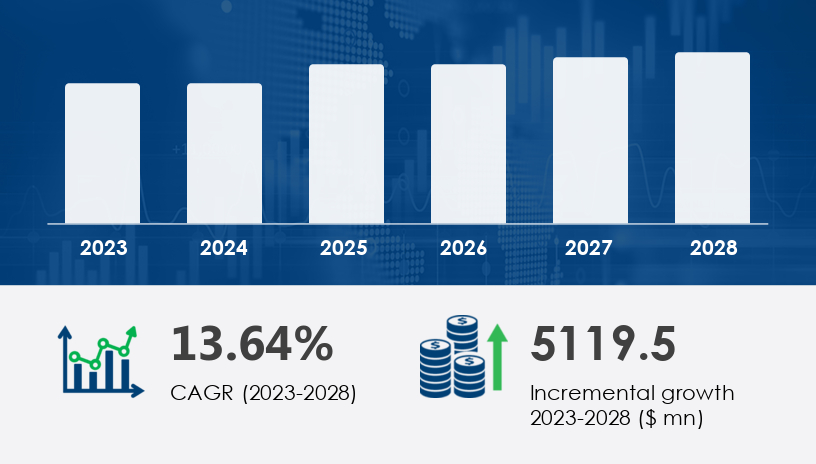

The submarine power cable market is undergoing a major transformation, projected to grow by USD 5.12 billion at a CAGR of 13.64% between 2023 and 2028. This surge is closely tied to the rising global emphasis on offshore renewable energy, particularly wind energy, and the integration of international grid systems. The need for reliable, high-capacity, long-distance electricity transmission from offshore wind farms to mainland grids is reshaping the energy infrastructure landscape.For more details about the industry, get the PDF sample report for free

Single Core: This segment is expected to experience the most significant growth. Single-core cables, featuring a single conductor within a protective sheath, are ideal for long-distance underwater transmission, providing high insulation, lower energy loss, and enhanced durability under harsh marine conditions.

Offshore Wind

Island Connection and Inter-country

Offshore Oil

Others

The offshore wind application dominates the market, driven by expanding floating wind technology and deep-sea wind turbines.

Key countries: Germany, UK, Belgium, Denmark, Netherlands

Europe leads the way, with Germany alone achieving a 7.7 GW offshore wind capacity by 2022. The region is focused on achieving 45% renewable electricity generation by 2025. The installation of larger and more efficient turbines is expected to further accelerate submarine cable adoption.

Key countries: China, Japan

The region is witnessing increased offshore wind deployment, especially in China’s expanding renewable energy landscape.

Key country: United States

Offshore wind projects along the East Coast, coupled with robust federal clean energy mandates, are expected to drive demand.

Offshore oil operations and emerging renewable initiatives are contributing to demand.

Investments in inter-country energy transmission and offshore resources are gradually shaping the market here.

Get more details by ordering the complete report

Offshore wind capacity is expanding rapidly, with 6.3 GW added in 2022, and a cumulative 17.3 GW capacity in 2021. Europe accounts for nearly 60% of global offshore wind installations. The superior efficiency of offshore wind (up to 40% greater output than onshore) makes it a prime energy source. Submarine cables are essential to transmit power to shore, ensure international grid connectivity, and support carbon neutrality goals.

Cable systems using materials like Cross-linked Polyethylene (XLPE) and copper or aluminum conductors are critical for maintaining stability and efficiency in international energy transmission.

Initiatives such as the Kyoto Protocol and various national renewable energy targets are reinforcing the shift toward sustainable energy infrastructure, boosting investments in submarine cable networks.

High Voltage Direct Current (HVDC) submarine cables are gaining traction due to their ability to transmit large volumes of electricity across long distances with minimal losses. These systems are lighter than AC cables, making them ideal for deep-sea deployment and international grid connections.

Advanced offshore wind solutions like floating turbines and deep-sea platforms are pushing the boundaries of traditional cable infrastructure, increasing demand for durable and flexible cable solutions.

Beyond renewable energy, submarine cables are also crucial in data transmission, capable of handling terabytes per second. The convergence of power and data needs is broadening the cable market's utility.

Submarine cable installation is capital-intensive, with prices reaching $10–12 million per kilometer. Maintenance is equally challenging, requiring precision in route planning, securing international permissions, and maintaining accessibility for repairs.

Cables that cross international waters face significant regulatory hurdles, necessitating bilateral agreements, safety zones, and compliance with maritime laws.

The Submarine Power Cable Market plays a crucial role in global energy infrastructure, driven by the growing demand for submarine power cables, especially in regions focusing on offshore wind cables and HVDC power cables for efficient long-distance transmission. Critical projects rely on island connection cables, inter-country cables, and offshore oil cables to connect remote locations and facilitate energy flow. The surge in demand for renewable energy cables and underwater power lines is propelled by the shift towards sustainability and the installation of high-voltage cables and cross-border cables across regions like Europe and Asia. In parallel, marine wind cables, subsea cable systems, and ocean floor cables are vital for supporting deep-sea power transmission. Governments and energy providers are investing in power transmission cables and green energy cables, supported by offshore grid cables and robust submarine cable networks. These networks require bulk power cables and long-distance cables, designed to meet the challenges of subsea environments while supporting clean energy objectives.

Prominent players are pursuing partnerships, acquisitions, and product innovation to strengthen their market positions:

ABB Ltd.

Eland Cables Ltd.

Europacable

Fujikura Co. Ltd.

Furukawa Electric Co. Ltd.

HELUKABEL Romania Srl

Hengtong Group Co. Ltd.

Hydro Group

Jiangsu Zhongtian Technology Co Ltd

KEI Industries Ltd.

Leoni AG

LS Cable and System Ltd.

Nexans SA

NKT AS

Parker Hannifin Corp.

Prysmian SpA

Southwire Co. LLC

Subsea 7 SA

Sumitomo Electric Industries Ltd.

The Okonite Co.

These companies are leveraging their technical expertise in XLPE-based cables, HVDC technology, and offshore installation to serve the rising demand from governments and energy operators.

The analytical landscape for this market reveals growing interest in energy isolation cables aligned with international climate goals like the Kyoto Protocol cables and EU energy cables. Specialized segments such as solar energy cables, intermittent power cables, and urbanization cables are emerging to meet varying energy demands. With increased digital connectivity, data traffic cables capable of carrying terabytes per second are also gaining traction. Strategic partnerships, exemplified by Alliances cable systems, aim to develop green innovation cables and enhance coverage in regions such as the Arabian Gulf cables and Playa Blanca cables. Key cost factors, including production cost cables, are influencing deployment strategies for international grid cables. Tools like PESTEL analysis cables are being used to assess market viability, particularly for offshore renewable cables, wind farm cables, and subsea power lines. Technological developments in cable installation ships and the deployment of high-capacity cables are critical for building reliable underwater grid cables, reinforcing global marine energy cables and expanding the overall submarine cable infrastructure.

For more details about the industry, get the PDF sample report for free

As countries double down on renewable energy investment, the submarine power cable market is becoming a linchpin for the global energy transition. With strong momentum in Europe and growing adoption across Asia, North America, and beyond, the market is poised for substantial B2B growth. The focus on reliable, long-distance power transmission aligns with national energy security goals, while innovations in HVDC and floating wind open new frontiers for developers and infrastructure providers.

Safe and Secure SSL Encrypted