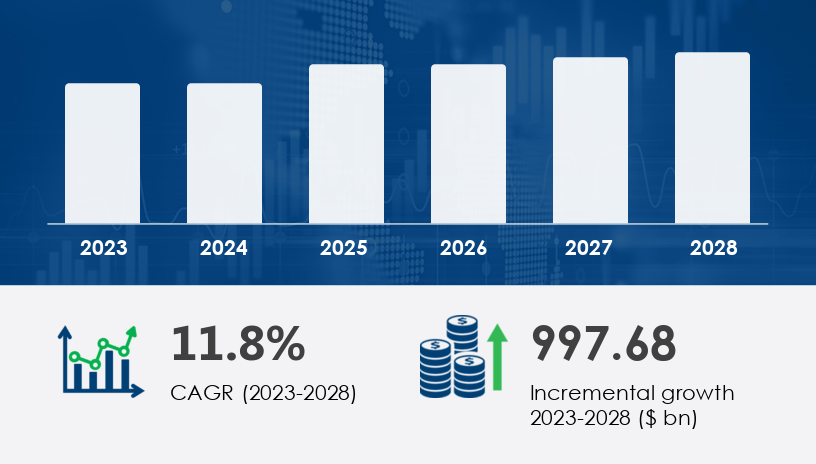

Structured Finance Market Analysis 2024-2028

The Global structured finance market is expected to experience significant growth between 2024 and 2028, with a projected CAGR of 11.8%. This growth, amounting to an estimated USD 997.68 billion, is driven by factors like increasing demand for alternative investment products, the rapid expansion of securitization, and the rising need for risk management solutions.

For more details about the industry, get the PDF sample report for free

Market Segmentation

-

End-user Segmentation:

- Large Enterprises: This segment is projected to experience the most significant growth, with large corporations using structured finance to raise capital and manage risks effectively.

- Small and Medium Enterprises (SMEs): SMEs are also adopting structured finance solutions to secure funding, although their market share is smaller compared to large enterprises.

-

Type Segmentation:

- Collateralized Debt Obligation (CDO): CDOs remain a vital component of the structured finance market, allowing investors to diversify and manage risk.

- Asset-Backed Securities (ABS): ABS products are increasingly popular as they provide a pathway for businesses to secure financing while transferring risk to investors.

- Mortgage-Backed Securities (MBS): MBS products are vital in the real estate sector, allowing lenders to sell mortgages as securities to raise capital.

Regional Market

-

North America: The U.S. and Canada dominate the region, with large enterprises driving the demand for structured finance products to manage risk and secure capital.

-

Europe: The U.K., Germany, and France are key markets, with regulatory frameworks and strong demand for ESG-linked products shaping market dynamics.

-

APAC: Countries like China, India, and Southeast Asia are witnessing rapid infrastructure development, leading to a rise in the demand for structured finance solutions. The low-interest rate environment in APAC also contributes to the growing preference for these financial products.

-

South America: Countries such as Brazil, Chile, and Argentina are seeing increasing adoption of structured finance products, driven by expanding economies and investment needs.

-

Middle East & Africa: Saudi Arabia and South Africa are the primary markets in this region, with a growing need for structured financing solutions to fund infrastructure projects.

Market Dynamics

Key Drivers:

- Rising Demand for Alternative Investment Products: Investors seeking diversification and higher returns are turning to structured finance products like asset-backed securities (ABS) and collateralized debt obligations (CDOs), which offer enhanced risk-return profiles compared to traditional investments like equities and bonds.

- Securitization Growth: As businesses increasingly use structured finance to optimize capital and manage risk, the market for securitization has expanded, boosting demand for these financial instruments.

Key Trends:

- ESG-linked Products Demand: The market is witnessing an uptrend in demand for environmental, social, and governance (ESG) structured finance products. Both investors and regulators are becoming more focused on sustainability, further driving the growth of ESG-linked finance solutions.

- Regulatory Support: Government policies and financial regulators are encouraging the adoption of ESG principles, which is contributing to the growth of this trend in structured finance.

Challenges:

- Product Complexity: Structured finance instruments, particularly CDOs and ABS, are becoming more complex, which raises challenges around transparency, liquidity, and understanding. This complexity may deter investors, limiting market growth.

Get more details by ordering the complete report

Key Companies in the Structured Finance Market

Some of the key companies of the Structured Finance Market are as follows:

- Acuity Knowledge Partner

- Avendus Wealth Management Pvt Ltd.

- Axis Bank Ltd.

- Barclays PLC

- CARE Ratings Ltd.

- Citigroup Inc.

- Credit Suisse Group AG

- Deutsche Bank AG

- ESFC Investment Group

- Greenberg Traurig LLP.

- HSBC Holdings Plc

- JPMorgan Chase and Co.

- Latham and Watkins LLP

- Mizuho Financial Group Inc.

- Morgan Stanley

- S and P Global Inc.

- SPARK CAPITAL ADVISORS INDIA PVT LTD.

- The Goldman Sachs Group Inc.

- Trade Finance Global

- UBS Group AG

Recent Developments

- January 2024: Avendus Wealth Management launched new structured finance solutions to help businesses meet their specific capital requirements.

- October 2023: Barclays PLC introduced an innovative ABS product aimed at expanding their footprint in the sustainable finance space, responding to growing ESG demand.

- July 2023: Citigroup Inc. expanded its structured finance division to focus on high-yield ABS and CDO markets, catering to institutional investors