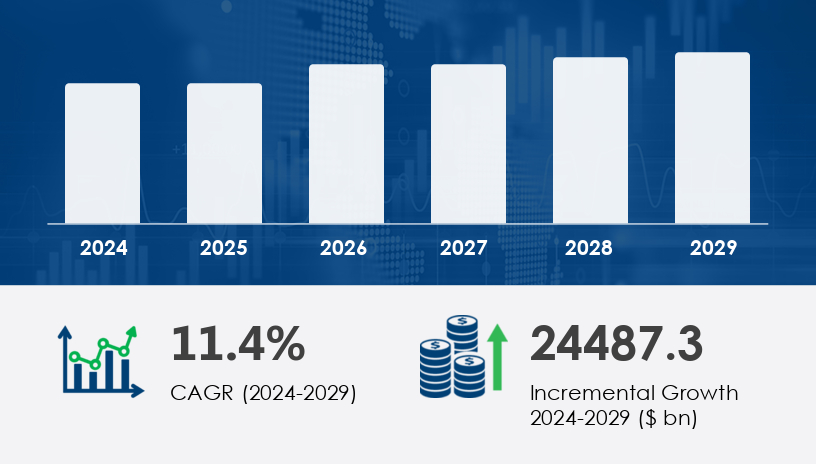

The software testing services market is poised for explosive growth, with projections estimating an increase of USD 24,487.3 billion by 2029, growing at a CAGR of 11.4% between 2024 and 2029. Businesses seeking agility, security, and performance from their software are fueling this dynamic transformation. The market is experiencing significant growth, driven by the increasing adoption of mobile applications and the growing momentum of crowdsourced testing. With the proliferation of smartphones and tablets, mobile testing has become a critical component of the software development lifecycle.

For more details about the industry, get the PDF sample report for free

A significant driver of this market's growth is the increasing adoption of mobile applications. As businesses strive to provide seamless user experiences, the demand for mobile testing services has surged. This trend is particularly evident in sectors such as gaming, entertainment, and financial transactions, where the performance and reliability of mobile applications are critical.

One of the prominent trends in the software testing services market is the rise of crowdsourced testing. This approach leverages a global community of testers to evaluate applications, providing diverse perspectives and real-world insights. Crowdsourced testing offers scalability, cost-effectiveness, and rapid feedback, making it an attractive option for companies aiming to enhance their testing processes.

The Software Testing Services Market plays a critical role in ensuring that applications and digital products meet quality, performance, and compliance benchmarks. Core services include software testing, application testing, and product testing, which are tailored across verticals such as BFSI testing, telecom testing, manufacturing testing, and retail testing. Testing methodologies have evolved to support rapid development environments, with practices such as Agile testing, DevOps testing, and test automation gaining widespread adoption. Teams employ both manual testing and automated testing strategies for comprehensive coverage. Techniques like functional testing, non-functional testing, performance testing, and security testing ensure robust validation. Specialized testing such as mobile testing, cloud testing, and crowdsourced testing helps evaluate products across diverse platforms and geographies. Supporting these efforts are testing tools, which streamline regression testing, integration testing, and system testing workflows while aligning with broader quality assurance objectives.

Functional Testing

Digital Testing

Specialized Offerings

Banking, Financial Services, and Insurance (BFSI)

Telecom and Media

Manufacturing

Retail

Others

Among the service segments, Functional Testing is anticipated to lead the market during the forecast period. This segment's prominence is attributed to the increasing complexity of software applications and the need to ensure that individual functions perform as expected. Functional testing serves as a foundation for identifying and addressing functional issues before applications reach the market, thereby minimizing post-release corrective measures' costs.

North America (U.S., Canada)

Europe (Germany, France, U.K., Italy)

Asia-Pacific (China, India, Japan, South Korea)

South America

Middle East and Africa

North America is projected to contribute 37% to the growth of the global software testing services market during the forecast period. This growth is driven by the increasing adoption of software and applications across various industries, including retail, BFSI, telecom, and media. The demand for software testing services in this region is fueled by the need to ensure application functionality, compatibility, security, and performance.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

A significant challenge facing the software testing services market is the limited availability of reliable open-source and free testing tools. While these tools offer cost-effective solutions, their quality and reliability can vary, posing risks to the effectiveness of testing processes. Organizations may struggle to choose the right solution for their specific needs, leading to potential inefficiencies and increased costs.

Recent research indicates a rise in demand for specialized testing types, such as user acceptance, load testing, stress testing, and compatibility testing, especially as organizations scale digital services. Other focal areas include usability testing, API testing, and microservices testing, which are critical for complex and distributed architectures. With the expansion of smart technologies, sectors now require dedicated IoT testing, AI testing, firmware testing, and blockchain testing, each posing unique validation challenges. Additionally, integration-level concerns are addressed through testing of device drivers, communication protocols, and embedded software, ensuring system reliability. The shift toward SaaS platforms has fueled the need for robust SaaS testing, virtualization testing, and compliance testing to ensure multi-tenant architecture stability and regulatory alignment. As data-driven applications rise, organizations are also investing in analytics testing to validate data accuracy and insights delivery.

Research analysis of the software testing services market underscores a transition toward intelligent, scalable, and industry-specific testing solutions. The convergence of AI, automation, and cloud-based infrastructures is reshaping traditional testing models, while growing compliance demands and digital transformation initiatives are fueling service innovation. As enterprises continue adopting complex architectures, the need for end-to-end testing strategies that combine speed, accuracy, and cost-efficiency will remain a driving force in the market’s growth.

The software testing services market has witnessed several innovations and strategic developments. In March 2025, Infosys launched its AI-powered test automation platform, 'Infostretch Conversational Testing,' which leverages natural language processing and machine learning algorithms to enable testers to interact with applications using natural language, thereby reducing the time and effort required for test scripting and execution. In January 2025, Capgemini and Microsoft entered into a strategic collaboration to integrate Microsoft's Azure DevOps platform with Capgemini's test automation and continuous testing services, aiming to help businesses accelerate their digital transformation journeys.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Service

6.1.1 Functional

6.1.2 Digital testing

6.1.3 Specialized offering

6.2 End-User

6.2.1 BFSI

6.2.2 Telecom and media

6.2.3 Manufacturing

6.2.4 Retail

6.2.5 Others

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted