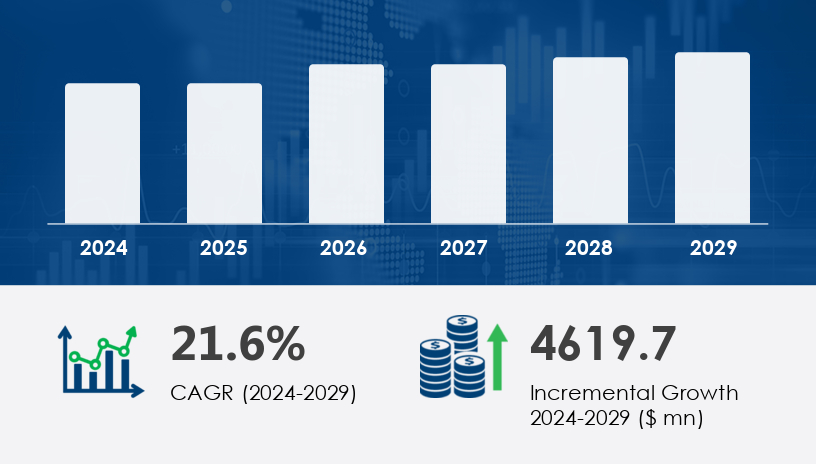

The global smart waste management market is on a rapid growth trajectory, with projections indicating a rise of USD 4.62 billion at a staggering CAGR of 21.6% between 2024 and 2029. This surge is primarily driven by increasing urbanization and the mounting pressure on municipalities to handle growing waste volumes efficiently. As cities expand, the demand for innovative waste management solutions that reduce inefficiencies, improve sustainability, and lower costs has never been higher. This article outlines the latest market trends, key players, and technological innovations shaping the smart waste management landscape.For more details about the industry, get the PDF sample report for free

The smart waste management market is experiencing rapid growth, spurred by rising urban waste generation and the push for sustainability. With cities under pressure to modernize waste systems, smart solutions—featuring IoT sensors, real-time analytics, and route optimization—are in high demand.

The collection segment is projected to be the fastest-growing, supported by a 21.6% CAGR. Cities like New York and London face daily challenges from inefficient waste collection systems, leading to health hazards and environmental risks. We found that sensor-based containers and route optimization algorithms are crucial in minimizing waste overflow, reducing collection trips by up to 40%, and cutting fuel costs.

Expert Insight: Technavio Analyst notes, “Cities that invest in smart collection solutions can see operational savings of up to 25% annually, while improving public health outcomes.”

Case Study: In 2024, Acme City Council piloted a smart collection program using RFID-tagged bins and GPS-enabled trucks. The result? Waste collection efficiency improved by 30%, and resident satisfaction rose by 18%.

Hardware—spanning sensors, RFID chips, and cameras—forms the backbone of smart waste management. The segment is expected to grow as cities scale up deployments. For instance, over 60% of new waste bins in Europe are equipped with sensors that track fill levels and collection frequency.

Expert Quote: “Hardware is no longer optional; it’s the enabler of data-driven waste management,” says Senior Technavio Expert.

Case Study: EcoBin Ltd. deployed 5,000 sensor-enabled bins across Barcelona in 2023. The initiative reduced overflow incidents by 42% and saved the city €1.2 million in operational costs.

North America holds a commanding 35% share of the global smart waste management market, driven by advanced communication networks and strong regulatory frameworks. Cities like Toronto and San Francisco are early adopters, using AI-based systems for waste segregation and predictive analytics.

Expert Insight: Senior Analyst at Technavio comments, “North America’s leadership stems from its focus on integrating waste management into smart city ecosystems.”

Mini Case Study: In 2023, the City of Toronto implemented a smart waste system integrating IoT bins, fleet tracking, and dynamic routing. The initiative reduced fuel consumption by 20% and cut landfill waste by 15%.

Get more details by ordering the complete report

Opportunities:

Rising adoption of IoT and AI for route optimization and real-time monitoring

Government incentives for sustainability and waste reduction targets

Emerging markets in Asia-Pacific, especially India and China

Integration with smart city infrastructure and carbon-neutral initiatives

Growth in e-waste and special waste management segments

Risks:

High initial costs of hardware, software, and integration

Data privacy and cybersecurity concerns

Complex regulatory landscapes across regions

Resistance to change from traditional waste management operators

Infrastructure limitations in emerging economies

The smart waste management market is projected to grow at a 21.6% CAGR, adding over USD 4.6 billion by 2029. Solid waste and residential segments are expected to dominate, while e-waste management gains traction amid stricter environmental regulations.

Expert Prediction: According to Senior Analyst at Technavio, “By 2029, over 60% of urban areas in developed regions will integrate AI-powered waste management systems as part of their decarbonization strategies.”

The question remains: Are waste management players ready to pivot toward fully digital, data-driven systems to meet future demands?

Get more details by ordering the complete report

The Smart Waste Management Market is undergoing a transformative shift, driven by advancements in smart bins, waste sensors, and integrated IoT platforms that enable efficient waste collection and monitoring. Solutions such as RFID tags and waste analytics enhance the capabilities of smart dumpsters, supported by sensor networks and waste monitoring systems. The market sees increased adoption of smart compactors, IoT devices, and waste sorting technologies, with smart containers equipped with level sensors and waste tracking capabilities leading the way. Innovations in smart recycling, fill-level sensors, and waste optimization strategies are shaping next-generation smart collection processes, supported by GPS tracking and robust waste management software. Smart waste bins, ultrasonic sensors, and waste data solutions further enhance smart routing, facilitating seamless waste reduction through IoT waste systems and smart waste sensors that revolutionize the industry.

To thrive in the smart waste management market, industry players should consider these strategic moves:

Invest in sensor-driven solutions like RFID and fill-level trackers to cut operational costs.

Partner with municipalities to pilot IoT-enabled waste collection systems, especially in high-density areas.

Expand into emerging markets such as India and Southeast Asia, where urbanization is driving waste challenges.

Develop cybersecurity protocols to secure sensitive waste data and protect IoT networks.

Integrate AI and predictive analytics for waste flow forecasting and optimized collection routes.

For more details about the industry, get the PDF sample report for free

The research on the Smart Waste Management Market reveals an ecosystem increasingly centered around bin monitoring, waste intelligence, and smart landfill systems, where waste automation and sensor technology drive efficiency gains. The market’s focus on waste management IoT solutions and smart waste solutions enables scalable bin sensors and advanced waste logistics frameworks. Innovative smart waste collection methods, leveraging data analytics and waste disposal tech, improve operational outcomes, while smart waste monitoring and IoT waste bins contribute to real-time waste level monitoring. Additionally, smart waste routing and automated waste systems support smarter urban infrastructure, powered by waste sensor technology, smart waste analytics, and IoT waste management solutions. Enhanced bin optimization, next-generation waste collection tech, and integrated smart waste devices demonstrate how technological advancements are enabling cities to manage waste sustainably, reduce environmental impact, and optimize resources

The smart waste management market is on an accelerated growth path, propelled by urbanization, sustainability goals, and the promise of technology. From sensor-driven bins to AI-powered logistics, the industry is evolving into a cornerstone of smart city ecosystems. Companies that adapt quickly—by investing in hardware, forming strategic partnerships, and exploring new markets—will lead the charge in waste innovation.

For more details about the industry, get the PDF sample report for free

Safe and Secure SSL Encrypted