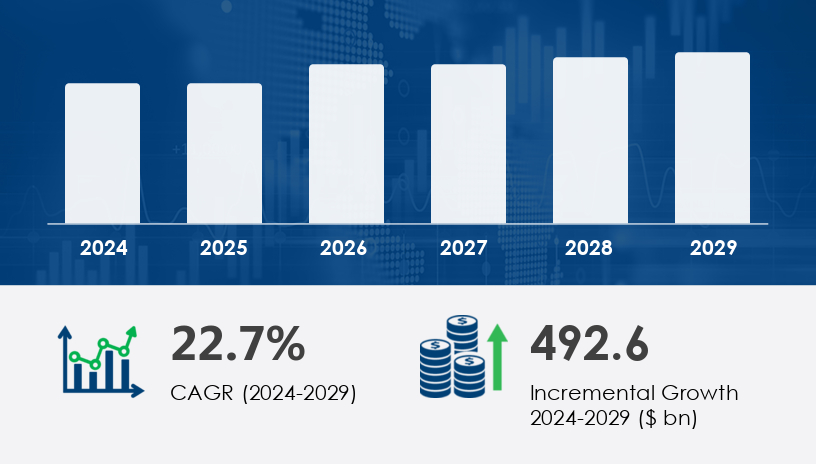

The global shared services market size is estimated to grow by USD 492.6 billion from 2024 to 2029, according to a new report by Technavio. The market is projected to expand at a CAGR of 22.7% during the forecast period, fueled by increasing adoption of shared services models for cost optimization, operational efficiency, and the integration of advanced digital technologies. Growing initiatives by enterprises to streamline back-office operations and leverage economies of scale are driving this market forward, with a notable trend toward automation and cloud-based solutions.For more insights on the historic data (2019 to 2023) and forecast market size (2025 to 2029) - Request a sample report

Shared services, a business model where organizations consolidate common functions such as HR, IT, finance, and procurement into a centralized unit, are gaining traction globally. The primary driver of this growth is the need for cost reduction, as companies seek to eliminate redundancies and improve service delivery. Additionally, the rise of digital transformation including the adoption of artificial intelligence (AI), robotic process automation (RPA), and cloud computing has revolutionized shared services, enabling faster, more scalable operations.

The report highlights that regulatory compliance and the demand for enhanced data security are also pushing organizations to adopt shared services frameworks. With businesses facing complex global regulations, centralized shared services units offer standardized processes to ensure adherence while reducing risks. Furthermore, the shift toward remote work and hybrid models post-pandemic has accelerated the demand for cloud-based shared services platforms, allowing seamless collaboration across geographies.

The report identifies several trends reshaping the shared services landscape. The adoption of automation technologies, such as RPA and AI chatbots, is reducing manual workloads and improving process efficiency. Additionally, the rise of multi-function shared services centers, which combine HR, IT, and finance under one roof, is gaining momentum as organizations aim for holistic operational improvements.

Another significant trend is the shift to cloud-based platforms, enabling real-time data access and scalability. This is particularly beneficial for SMEs, which can now access enterprise-grade shared services without significant upfront investments. The integration of sustainability goals into shared services operations is also emerging, as companies align centralized processes with environmental, social, and governance (ESG) objectives.

Despite its promising outlook, the shared services market faces challenges. High initial implementation costs for automation and digital tools can deter smaller organizations. Additionally, data security concerns, particularly with cloud-based systems, remain a hurdle, as centralized data hubs become prime targets for cyberattacks. Resistance to change within traditional organizational structures also poses a barrier to adoption.

Insights on market trends and challenges, historic period (2019 to 2023), and forecast

period (2025 to 2029) - Request a sample report!

The shared services market is segmented based on service type, end-user, and geography, providing a comprehensive view of its growth dynamics:

Service Type:

End-User:

Geography:

The shared services market is undergoing a significant shift driven by business process automation, digital transformation, and the adoption of artificial intelligence and robotic process automation. Organizations are increasingly leveraging cloud computing to enhance operational efficiency while ensuring regulatory compliance and data security. The rise of remote work and hybrid models has further accelerated the need for centralized back-office operations, allowing companies to achieve economies of scale and implement standardized processes for risk reduction. The integration of cloud-based solutions and automation technologies, including AI chatbots, enables multi-function centers to provide real-time data access, enhancing scalability and aligning with sustainability goals and environmental objectives. However, despite these advancements, businesses must address challenges such as high implementation costs, cybersecurity risks, and change resistance stemming from traditional structures that hinder digital adoption.

The shared services market is highly competitive, with several key players driving innovation and expansion. Notable companies include:

These companies are investing heavily in R&D to integrate cutting-edge technologies like AI, machine learning, and blockchain into their offerings, positioning them as market leaders.

For businesses, the growth of the shared services market represents an opportunity to enhance efficiency, reduce costs, and stay competitive in a rapidly evolving global economy. As digital transformation accelerates, companies that leverage shared services will be better positioned to adapt to market shifts and regulatory demands.

A detailed analysis of the shared services industry highlights its role in optimizing finance reporting, payroll management, and accounts payable and accounts receivable functions. Additionally, enterprises are leveraging shared service models for employee onboarding, benefits administration, and helpdesk support, enhancing workforce efficiency. The growing adoption of infrastructure management, supply chain optimization, and vendor management within shared services is also reshaping customer service and legal support for both large enterprises and small and medium enterprises. As technological advancements drive the demand for shared services across industries, the manufacturing sector, BFSI sector, and other key verticals are embracing digitalization to enhance business processes. With the continued impact of globalization, companies are redefining their strategies to ensure seamless operations while maximizing cost efficiencies and improving service delivery.

Safe and Secure SSL Encrypted