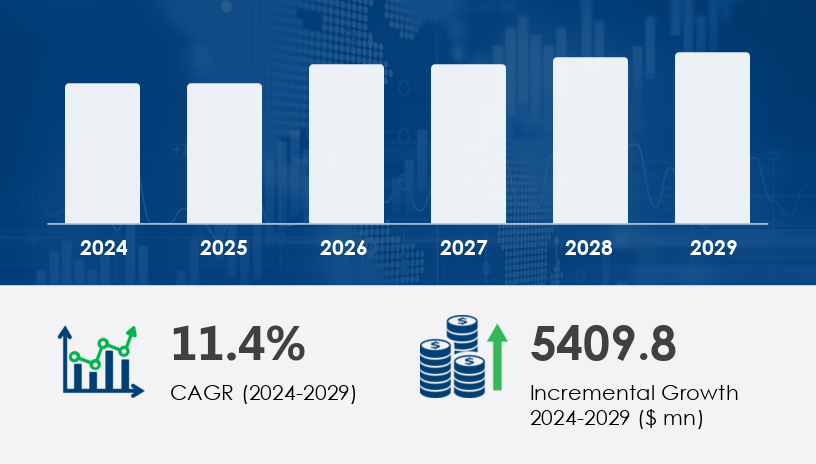

The Semiconductor Market In Healthcare Sector is set to experience transformative growth from 2025 to 2029, propelled by innovations in chip architecture, integration with healthcare IT, and the rising demand for precision diagnostics and patient monitoring solutions. As semiconductors become central to applications such as wearable devices, medical imaging, and AI-enabled diagnostics, this market is undergoing rapid expansion driven by both technological evolution and increased healthcare expenditures.The Semiconductor Market In Healthcare Sector is projected to grow by USD 5.41 billion between 2024 and 2029, registering an impressive CAGR of 11.4%.

.For more details about the industry, get the PDF sample report for free

A primary driver behind this growth is the surging demand for advanced medical devices. Semiconductors are indispensable to a wide array of modern healthcare tools, such as MRI scanners, CT scanners, and wearable health monitors, where they deliver the performance, miniaturization, and precision needed for real-time data analysis and patient care. For instance, GE Healthcare’s Revolution CT scanner, which incorporates advanced semiconductor components, offers high-resolution imaging at lower radiation doses, enhancing both diagnostic accuracy and patient safety. The proliferation of such devices across global markets is pushing semiconductor innovation further into the core of the healthcare ecosystem.

An emerging trend shaping the market is the shift toward sustainable semiconductor manufacturing. Environmental responsibility is increasingly important across industries, and the semiconductor segment is no exception. A notable initiative is the collaboration between Merck and Intel, launched in November 2024. This academic research program, involving eleven European institutions, focuses on using AI and machine learning to optimize semiconductor manufacturing, reduce waste, and improve material discovery. As the healthcare sector aligns with green practices, this trend boosts brand credibility and aligns with global ESG (Environmental, Social, and Governance) benchmarks.

The Semiconductor Market in Healthcare Sector is rapidly evolving, playing a crucial role in the functionality of a wide range of medical devices. Advanced semiconductor wafers and microcontrollers power technologies such as medical imaging systems, including MRI scanners, CT scanners, X-ray detectors, and ultrasound transducers. Wearable health tech has seen a surge, integrating wearable sensors, biosensors, ECG chips, and heart rate sensors for real-time monitoring. Other crucial components include pulse oximeters, glucose monitors, and blood pressure monitors, enhancing patient diagnostics and monitoring. The sector also includes implantable devices such as pacemaker circuits, defibrillator chips, and neural implants, which rely heavily on semiconductor innovations. These chips are essential in hearing aids, prosthetic controllers, and wireless implants, supporting both mobility and therapy

The Semiconductor Market In Healthcare Sector is segmented by:

Component:

ICs

Sensors

Optoelectronic

Discrete components

Application:

Medical imaging

Patient monitoring

Diagnostic equipment

Wearable

Others

Geography:

North America (US, Canada)

Europe (France, Germany, UK)

APAC (China, India, Japan, South Korea)

South America (Brazil)

Rest of World (ROW)

Among the components, Integrated Circuits (ICs) dominate the semiconductor market in healthcare, both in terms of market share and growth. The ICs segment was valued at USD 2.05 billion in 2019 and has consistently shown a strong upward trajectory throughout the forecast period. Integrated circuits enable seamless processing and connectivity across devices such as wearable monitors, imaging systems, and diagnostic tools.

According to analysts, the growth is supported by advancements in node technologies like 7nm, 5nm, and 3nm, alongside heterogeneous integration, which allows multiple functionalities to be embedded in a single chip. These innovations enhance efficiency and miniaturization — crucial for medical wearables and implants. ICs are also pivotal in enabling deep learning, biometric authentication, and analog-to-digital conversion, ensuring optimal device security and accuracy.

Get more details by ordering the complete report

North America

Europe

APAC

South America

Rest of World

North America leads the Semiconductor Market In Healthcare Sector, contributing 39% to global market growth during the forecast period. In 2023, the U.S. spent approximately USD 5 trillion on healthcare, a 7.5% increase from the previous year, with a per capita spend of USD 14,550. Similarly, Canada’s healthcare spending reached USD 340 billion, representing 12% of its GDP. This substantial investment in healthcare accelerates the demand for high-end semiconductor applications.

Analysts highlight that innovations like EUV lithography, machine learning integration, and precision chip architecture are rapidly being adopted across the region to support advanced diagnostics, telemedicine, and surgical robotics. Moreover, robust semiconductor fabrication capabilities, cleanroom technology, and stringent reliability testing make North America a global hub for healthcare-oriented semiconductor innovation.

Despite its promising growth, the Semiconductor Market In Healthcare Sector faces significant regulatory challenges. The stringent compliance requirements surrounding medical device safety, efficacy, and data privacy make the manufacturing and approval process complex and costly. In the U.S., for example, the FDA requires 510(k) clearance or PMA approval for semiconductor-based devices, involving rigorous testing and verification.

Analysts note that while technologies like deep learning and biometric authentication enhance medical device functionality, they also necessitate comprehensive failure analysis and testing to meet regulatory standards. This compliance burden increases operational costs and slows time-to-market, compelling companies to invest heavily in design automation, verification systems, and documentation workflows.

The increasing demand for remote and precise healthcare solutions has expanded the use of telemedicine devices, lab-on-chip platforms, and digital thermometers. Innovations in biochips, MEMS sensors, and RFID tags are contributing to improved patient monitors, drug delivery systems, and diagnostic chips. Furthermore, technologies like semiconductor lasers, optical sensors, and temperature sensors are now standard in devices such as smart inhalers, sleep monitors, fitness trackers, and infusion pumps. These components ensure accurate tracking and personalized treatment. The inclusion of semiconductors in larger devices like dialysis machines, ventilator circuits, and radiation detectors shows the expanding reach of semiconductor technologies into life-sustaining and critical-care equipment. The integration of neurostimulators and endoscopy cameras further highlights the industry's shift towards minimally invasive and patient-centric solutions.

The semiconductor landscape in healthcare is marked by increasing miniaturization, enhanced functionality, and improved energy efficiency. Components such as biosensors, biochips, and implantable devices are at the forefront of innovation, enabling more accurate and less invasive diagnostics. The growing implementation of neural implants, prosthetic controllers, and RFID tags is reshaping chronic disease management and rehabilitation. Semiconductor-enabled telemedicine devices and wearable sensors support the shift toward outpatient and home-based care. Meanwhile, the development of lab-on-chip and drug delivery systems is paving the way for personalized medicine. The focus on semiconductor lasers and optical sensors also enhances imaging and surgical precision, reinforcing the semiconductor sector’s foundational role in next-generation healthcare technologies.

Key companies are engaging in strategic partnerships, funding rounds, and new product development to gain a competitive edge:

ams OSRAM AG has developed the AS5912, a 512-channel ultra-low noise converter that enhances the diagnostic accuracy of CT scanners by improving photodiode readouts.

Intel and IBM partnered in April 2024 to co-develop AI-powered semiconductor solutions for healthcare, focusing on scalability and security.

Qualcomm Life secured a USD 100 million investment in January 2025 to expand its semiconductor-based wearable health and remote monitoring platforms.

The FDA’s approval of Google’s TensorFlow Processing Unit (TPU) in July 2025 for medical imaging is a milestone that reflects the growing trust in AI-driven semiconductor solutions in clinical diagnostics.

These developments reflect a broader industry shift towards AI integration, sustainability, and miniaturized chipsets, which are enhancing the utility of semiconductors across healthcare applications.

The Semiconductor Market In Healthcare Sector is evolving into a critical pillar of the modern healthcare ecosystem. From powering robotic surgeries and wearable monitors to securing biometric health data and enabling AI diagnostics, semiconductors are at the heart of medical innovation. Despite regulatory challenges and global supply constraints, the market is on an accelerated growth path fueled by technological breakthroughs, strategic partnerships, and regional investments. As healthcare continues to digitize and personalize, semiconductors will remain fundamental to delivering smarter, faster, and more accurate medical solutions.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Component

6.1.1 ICs

6.1.2 Sensors

6.1.3 Optoelectronic

6.1.4 Discrete components

6.2 Application

6.2.1 Medical Imaging

6.2.2 Patient Monitoring

6.2.3 Diagnostic Equipment

6.2.4 Wearable

6.2.5 Others

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 ROW

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Safe and Secure SSL Encrypted