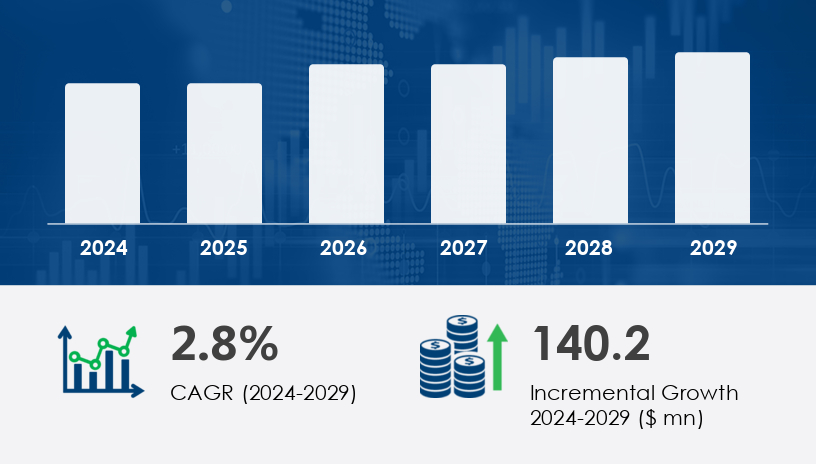

The sawmill machinery market is projected to grow steadily between 2025 and 2029, driven by increased construction activity and advances in automation. The market size in 2024 was substantial and is forecast to increase by USD 140.2 million by 2029, reflecting a compound annual growth rate (CAGR) of 2.8% over the forecast period. This growth trajectory signals expanding demand for processed wood across multiple sectors.

For more details about the industry, get the PDF sample report for free

One of the primary drivers of the sawmill machinery market is the increase in global construction activities, particularly in the Asia Pacific and Middle East regions. Rapid urbanization and population growth in these areas have escalated demand for both residential and non-residential infrastructure, leading to a surge in the use of sawn timber. This demand, in turn, is boosting the need for high-efficiency sawmill machinery. According to the source, both fixed and portable sawmills are actively used in residential and commercial projects, and modern machinery now incorporates sensors and scanners to optimize process control and ensure accurate lumber measurement. These technological upgrades are essential in reducing production costs and increasing wood processing speed, thereby supporting the market's upward momentum.

A significant trend shaping the sawmill machinery market is the increasing integration of automation, artificial intelligence (AI), and data analytics. These technologies are transforming traditional sawmills into smart, efficient production units. For example, scanning and optimization systems determine ideal cutting patterns and log rotations, enabling custom wood product manufacturing and reduced waste. Manufacturers like Linck Holzverarbeitungstechnik are pioneering these innovations with turnkey solutions that include AI-driven automation. This shift toward intelligent systems aligns with global efforts to improve building energy efficiency, particularly in the residential and commercial sectors, and supports a broader movement toward sustainable, tech-driven wood processing.

The Sawmill Machinery Market plays a crucial role in the global timber processing industry, supported by a broad array of specialized equipment designed to enhance productivity and precision. Core machines such as the band saw, circular saw, and chain saw are foundational to cutting operations. Supporting equipment like the log debarker, lumber edger, and timber planer further refine logs into usable lumber. Material reduction tools such as the wood chipper, wood shredder, and wood slicer are integral to waste management and byproduct generation. The durability and performance of components like the saw blade, sawmill blade, and blade tensioner are essential for continuous operations. Central to efficiency are systems such as the log carriage, feed system, and hydraulic system, which ensure smooth material handling and movement throughout the sawing process.

By Product

Fixed sawmills

Portable sawmills

By Type

Band saw headrig

Circular saw headrig

Frames saw headrig

By Method

Horizontal

Vertical

By Application

Forestry

Woodworking

Paper industry

Others

The fixed sawmills segment stands out as the market leader in both value and growth potential. Valued at USD 645.70 million in 2019, this segment has shown steady growth through the years. Fixed sawmills—also known as industrial sawmills—are favored for full-time sawing due to their larger structure, heavy-duty blades, and enhanced automation. They operate within enclosed facilities, allowing continuous use in various weather conditions. Key features such as resaws, edgers, sensors, and scanners contribute to improved speed and precision. According to analysts, the increasing adoption of automation in fixed sawmills makes them particularly suitable for residential and commercial construction projects, where high-quality, consistent output is essential.

Covered Regions:

North America

Europe

APAC

South America

Middle East and Africa

Asia-Pacific (APAC) is projected to contribute 39% of global market growth during the forecast period, making it the fastest-growing region. This growth is largely fueled by robust infrastructure development, rapid urbanization, and increasing demand for timber in countries like China and India. Additionally, the Middle East is emerging as a key market due to surging construction demand driven by population growth. On the other hand, Europe—with countries like Germany, Italy, and Russia—also exhibits strong demand due to its thriving forestry sector. For example, in cities like Milan and Trieste, multi-story buildings are increasingly constructed using wood, underlining a continental trend toward eco-friendly and sustainable construction materials. The use of AI-enabled, sensor-equipped sawmill machinery enhances operational efficiency in both large-scale and localized production environments across Europe.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite promising growth, the sawmill machinery market faces a critical challenge: the high cost of new equipment. Many small-scale industries and individual users are deterred by the significant capital investment required for modern sawmill systems, which incorporate advanced technologies like frequency-controlled motors and AI-based automation. As a result, the market is experiencing a surge in demand for pre-used machinery, especially portable sawmills, which offer affordability but limit new equipment sales. This trend could constrain revenue growth for equipment manufacturers, particularly those targeting emerging markets. The availability of second-hand machines reduces the incentive to invest in newer, more efficient technologies, slowing the industry's overall modernization.

Market research indicates growing demand for precision and automation in sawmill operations. Technological advancements like CNC control, laser guide, and automated sorter are enhancing cutting accuracy and reducing labor costs. Heavy-duty equipment such as the log splitter, timber cutter, and debarking drum address increasing throughput demands in high-volume mills. Machinery like the saw guide, log loader, and log turner help streamline input operations, while downstream systems such as the lumber dryer, log scanner, and lumber stacker optimize product quality and inventory handling. Tools like the wood peeler, blade grinder, and log clamp contribute to maintenance and material preparation. With the integration of smarter systems, machines such as the timber sorter, wood barker, and sawmill carriage are evolving to meet the precise needs of modern wood processing facilities.

In-depth research analysis shows a clear market shift toward enhanced automation, sustainability, and operational efficiency. The lumber trimmer, wood planer, and log processor are increasingly equipped with intelligent features to reduce waste and improve cutting performance. Machines like the timber chipper, blade aligner, and log lifter are being optimized for energy efficiency and speed. The incorporation of robust material handling systems such as the timber conveyor and lumber conveyor reflects the growing emphasis on streamlined workflow and reduced downtime. As mills seek to improve yields while lowering operating costs, integrated solutions across cutting, drying, sorting, and transport phases are becoming standard. These advancements are positioning sawmill machinery as a pivotal enabler of productivity and competitiveness in the global lumber industry.

Innovations or Recent Developments

Leading manufacturers are responding to market demands by implementing strategic partnerships, product innovations, and geographic expansions. For instance, Corley MFG offers a wide range of sawmill machinery, including carriages, edgers, gangs, and resaws, designed to maximize performance and efficiency. Companies like Linck Holzverarbeitungstechnik are pioneering scanning technology and process optimization systems that enable intelligent cutting patterns and automation. These advancements allow the production of customized wooden products, reduce labor costs, and improve processing times.

Additionally, firms such as Wood Mizer, Hud Son Forest Equipment, and Norwood Industries Inc. are focusing on expanding their product lines to cater to both large-scale manufacturing facilities and small-scale operators. The industry landscape also includes key players like Timber Automation LLC, McDonough Manufacturing Co., and Salem Equipment Inc., who are investing in R&D and AI integration to stay ahead of environmental regulations and customer expectations.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Product

6.1.1 Fixed sawmills

6.1.2 Portable sawmills

6.2 Type

6.2.1 Band saw headrig

6.2.2 Circular saw headrig

6.2.3 Frames saw headrig

6.3 Method

6.3.1 Horizontal

6.3.2 Vertical

6.4 Application

6.4.1 Forestry

6.4.2 Woodworking

6.4.3 Paper industry

6.4.4 Others

6.5 Geography

6.5.1 North America

6.5.2 APAC

6.5.3 Europe

6.5.4 South America

6.5.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted