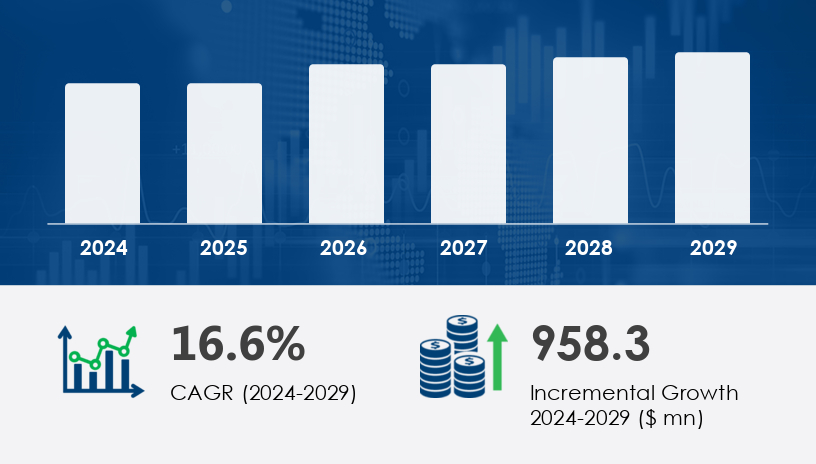

The Robotic Pet Dogs Market is poised for dynamic expansion between 2025 and 2029, fueled by the growing need for emotionally intelligent, interactive companion devices. Increasingly embraced by the aging population and consumers with cognitive challenges, robotic pet dogs are becoming a valuable tool in emotional and mental health management.The Robotic Pet Dogs Market is projected to grow by USD 958.3 million between 2024 and 2029, progressing at a CAGR of 16.6%. This robust growth is being driven by rising demand for companionship in aging populations and individuals with disorders like dementia and Alzheimer’s disease, as well as the proliferation of lifelike robotics in the consumer goods sector.

For more details about the industry, get the PDF sample report for free

A major driver fueling the Robotic Pet Dogs Market is their increasing role in entertaining and providing emotional support to the elderly population. These lifelike robotic companions are being widely adopted in settings where traditional pets may not be feasible. Individuals suffering from dementia and Alzheimer’s experience cognitive stimulation and stress relief through interaction with robotic pets. Products like Hasbro’s Fur Real Friends have captured market attention due to their responsiveness and interactivity. According to analyst insights, the combination of companionship, therapeutic value, and innovative features such as facial recognition and treat dispensers makes these devices particularly effective for elderly users. Moreover, the emotional and cognitive benefits are fostering long-term demand in healthcare and home settings alike.

A standout trend in the market is the adoption of multi-channel marketing and promotional strategies by manufacturers aiming to boost consumer reach. Vendors are leveraging online and offline platforms, strategic retail partnerships, and targeted campaigns to promote lifelike robotic dogs to children, elderly caregivers, and tech-savvy pet enthusiasts. Companies like Hasbro and others are investing in AI, responsive sensors, and behavioral mimicry to make robotic dogs more realistic and emotionally engaging. In addition, the growing use of dynamic advertising across digital and physical storefronts is enhancing product visibility, particularly in developed economies where aging demographics are creating new demand pockets.

The Robotic Pet Dogs Market is evolving rapidly as technological innovations reshape how people experience companionship, pet care, and emotional support. Modern AI robot dogs utilize artificial intelligence, machine learning, and sensor integration to provide lifelike interaction and real-time responsiveness. These robotic companions are equipped with smart sensors, autonomous navigation, and voice command functionality, enabling them to engage in interactive play and respond to face recognition cues. Designed as interactive toys and pet care robots, they are finding strong traction among both aging individuals seeking elderly companionship and children requiring educational games or child engagement tools. With built-in pet surveillance features, these devices also support pet safety, distress detection, and real-time monitoring, merging IoT capabilities with smart home integration.

By Distribution Channel:

Offline

Online

By Type:

Movable Robots

Stationary Robots

By Application:

Pet Feeding

Companionship

Mental Wellness

Others

Among all segments, the Offline Distribution Channel leads the Robotic Pet Dogs Market, driven by its broad reach through specialty stores, supermarkets, and department stores. The offline segment was valued at USD 456.20 million in 2019 and has shown steady growth due to increasing in-store consumer engagement. Despite a broader shift to online purchasing, companies are strategically expanding their brick-and-mortar presence to capture demand from older consumers and healthcare institutions. Analyst insights note that automated treat dispensers and lifelike interactions are helping these products gain traction in physical retail spaces, particularly where hands-on demonstrations influence purchasing decisions.

North America (US, Canada)

Europe (Germany, UK, France, Italy)

APAC (China, India, Japan, South Korea)

South America

Middle East and Africa

North America dominates the global Robotic Pet Dogs Market, accounting for 41% of market growth during the forecast period. The US and Canada are leading contributors, bolstered by high consumer awareness, spending power, and the widespread integration of robotic companions into both homes and assisted living facilities. Companies are launching premium models like Sony’s Aibo, which retails at USD 2,899 and includes facial recognition, motion sensors, and AI-powered learning capabilities. Analyst commentary highlights that the therapeutic role of robotic pets in managing depression and dementia, coupled with strong consumer acceptance and extensive retail infrastructure, cements North America’s position as a leading market.

Get more details by downloading the sample PDF report

Despite rapid innovation and growing demand, the high cost of advanced robotic pet dogs presents a major barrier to market expansion. Many models feature advanced AI, responsive behaviors, and sensory technologies that drive up manufacturing costs. For example, premium products like Sony’s Aibo can be prohibitively expensive for middle-income consumers. This limits adoption, especially in emerging markets and among lower-income groups. The initial investment cost remains a challenge despite long-term benefits such as companionship and mental health support. Companies are therefore under pressure to reduce production costs while maintaining realism and functionality to make robotic pet dogs more accessible across socioeconomic segments.

Driven by demand for emotional support and therapeutic applications like dementia care and pet therapy, robotic pet dogs are becoming essential tools in both domestic and healthcare environments. Their ability to mimic lifelike behavior and conduct behavioral simulation makes them ideal home assistants and pet wellness companions. Crafted with eco-friendly materials such as ABS plastic, these devices support adaptive learning, automated solutions, and remote control interfaces via pet monitoring apps. As smart home devices, they align with pet entertainment and security applications, offering users threat detection capabilities in addition to companionship. The integration of natural language processing further allows them to interact conversationally, enhancing user experience and enabling multi-functional roles such as robotic guide dogs, pet health monitoring, and pet interaction assistants

The competitive landscape of the Robotic Pet Dogs Market features manufacturers focusing on refining advanced mobility, interactive toys, and smart home compatibility. These devices are increasingly being marketed as alternatives to traditional pets, particularly in urban environments, where time constraints and housing restrictions are prevalent. With advancements in voice commands, face recognition, and automated feeding systems, robotic dogs provide scalable solutions for families, elderly individuals, and special needs users alike. As the market expands, features like educational games, child engagement, and pet wellness monitoring continue to define the next generation of AI-powered robotic companions, making the sector a core part of the future interactive pet care ecosystem.

Leading players in the Robotic Pet Dogs Market are investing in cutting-edge technologies to stay ahead. Products are increasingly equipped with AI-powered behavioral learning, facial recognition, voice interaction, and motion detection, replicating the experience of real pets. Brands like Hasbro have successfully launched their Fur Real Friends line, integrating interactive behaviors, treat dispensers, and lifelike reactions. Moreover, companies are exploring pet feeding automation, which is particularly beneficial for individuals with memory-related disorders. This feature ensures reliable care, even when users may forget regular feeding routines. Analyst commentary notes that these innovations are redefining companionship in modern households, providing emotional value beyond entertainment.Furthermore, companies are embracing value-added services, licensing agreements, and appealing design aesthetics to enhance product differentiation. Marketing teams are also leveraging digital channels and in-store experiences to educate consumers, particularly elderly buyers and caregivers, about the benefits of robotic pets.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Distribution Channel

6.1.1 Offline

6.1.2 Online

6.2 Product Type

6.2.1 Movable Robots

6.2.2 Stationary Robots

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East and Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted