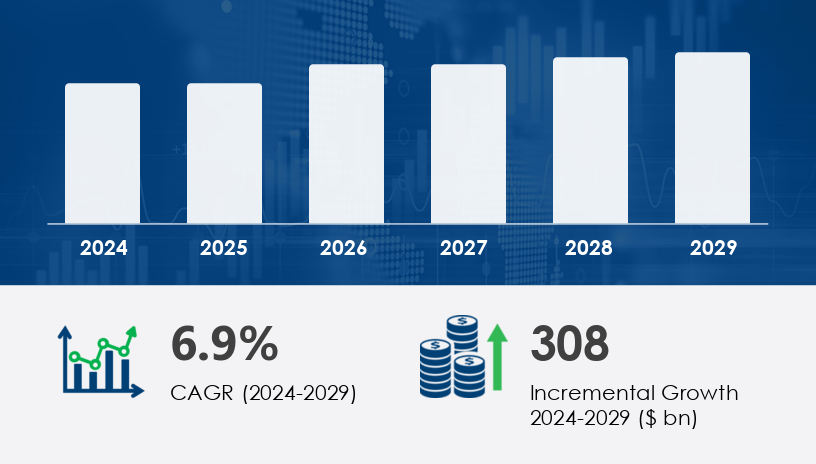

The global road transportation fuel market is set to grow by USD 308 billion between 2024 and 2029, with a steady CAGR of 6.9%, driven by rising vehicle ownership and a crucial shift toward cleaner energy solutions. As private and public mobility demands rise globally, the urgency to decarbonize and diversify fuel sources is more prominent than ever.

For more details about the industry, get the PDF sample report for free

A primary driver of this market's growth is the substantial increase in the number of automobiles on roads worldwide. In 2023, passenger car production experienced a significant rise of over 18.70% compared to 2010, underscoring the growing demand for personal vehicles. This surge is attributed to factors such as urbanization, rising disposable incomes, and improved road infrastructure in developing economies. Consequently, the demand for fuels like gasoline and diesel has escalated, propelling the market forward.

The road transportation fuel market is witnessing several transformative trends. The adoption of bio-based and clean fuels is gaining momentum as governments and consumers seek to reduce greenhouse gas emissions. Simultaneously, advancements in fuel efficiency standards and the development of fuel management systems are enhancing vehicle performance and reducing environmental impact. Additionally, the integration of electric vehicles (EVs) and renewable energy sources is reshaping the fuel landscape, offering sustainable alternatives to traditional fossil fuels.

The Road Transportation Fuel Market continues to evolve, shaped by technological innovation, environmental policies, and shifting consumer preferences. Traditional fuels such as gasoline, diesel, and kerosene remain dominant in many regions due to existing infrastructure and vehicle fleets. However, alternatives like biodiesel, ethanol, natural gas, and liquefied petroleum are gradually gaining ground as governments and industries strive to reduce emissions. Emerging options such as hydrogen fuel, compressed natural gas, bioethanol, and synthetic fuel represent a shift toward sustainable energy sources. Growth in the aviation segment also indirectly influences the market with overlap in aviation fuel usage and refining capabilities. Meanwhile, fueling infrastructure—including the standard fuel pump, gas station, and fuel injector systems—remains critical to supporting the widespread distribution and operation of combustion-based vehicles.

Gasoline: The gasoline segment remains a dominant force in the market, driven by its widespread use in passenger vehicles and light-duty trucks. In 2019, the gasoline segment was valued at USD 336.10 billion and is expected to witness significant growth during the forecast period.

Diesel: Diesel continues to be a preferred choice for heavy-duty vehicles due to its higher energy density and fuel efficiency. Despite the rise of alternative fuels, diesel's role in the transportation sector remains substantial.

Biofuels: The biofuels segment is gaining traction as a sustainable alternative to traditional fuels. Blends like E10 (10% ethanol) and B20 (20% biodiesel) are becoming increasingly common, supported by government policies and environmental considerations.

Natural Gas: Compressed natural gas (CNG) is emerging as a cleaner alternative, especially in regions like India, where its market share has more than tripled over five years due to high fuel prices and a broader range of model offerings from automakers.

Light-duty vehicles: This category encompasses passenger cars and light trucks, which are experiencing increased fuel demand due to higher vehicle ownership rates and urbanization.

Heavy-duty vehicles: Commercial trucks and buses fall into this segment, with diesel remaining the dominant fuel choice. However, alternative fuels and electrification are gaining ground in this sector.

Gas stations: Traditional fuel stations continue to be the primary distribution channel, offering gasoline and diesel to consumers.

EV charging stations: With the rise of electric vehicles, the establishment of charging infrastructure is expanding, facilitating the adoption of EVs.

Fleet fueling: Dedicated fueling solutions for commercial fleets are becoming more prevalent, focusing on efficiency and cost-effectiveness.

The gasoline segment is anticipated to witness significant growth during the forecast period. In 2019, the gasoline segment was valued at USD 336.10 billion and is expected to show a gradual increase. This growth is driven by the increasing number of passenger vehicles and light trucks in operation, with urbanization and rising disposable income playing pivotal roles in their adoption. Alternative fuels, such as diesel, biofuels, hydrogen, and electricity, are gaining traction due to environmental concerns and regulatory pressures. Biofuel blends, like E10 and B20, are becoming increasingly common, reflecting the industry's shift towards cleaner energy sources.

In North America, the U.S. and Canada are witnessing a transition towards alternative fuels and electric vehicles. The adoption of biofuels and natural gas is supported by government incentives and environmental policies. However, challenges such as infrastructure development and fuel price volatility remain.

Europe is at the forefront of adopting clean fuels and stringent emissions standards. Countries like France, Germany, and the UK are implementing policies to reduce greenhouse gas emissions, promoting the use of biofuels and electric vehicles. The EU's "Fit for 55" package aims to reduce emissions by at least 55% by 2030 compared to 1990 levels, significantly impacting the market.

Asia-Pacific is estimated to contribute 40% to the growth of the global road transportation fuel market during the forecast period. The rapid economic growth in countries like China and India is driving the demand for mobility solutions. In India, the popularity of petrol-powered vehicles has significantly declined as compressed natural gas (CNG) vehicles gain traction among consumers. Over the past five years, the market share of CNG vehicles has more than tripled, driven by persistently high fuel prices and a broader range of model offerings from automakers.

Other regions, including parts of Africa and Latin America, are experiencing varying growth rates in the road transportation fuel market. Factors such as economic development, urbanization, and infrastructure investment influence fuel demand in these areas.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

A significant challenge facing the road transportation fuel market is the volatility in global oil and gas prices. Fluctuations in crude oil prices, influenced by factors such as supply and demand imbalances, geopolitical tensions, and production costs, impact the cost competitiveness of various fuel types. This volatility complicates market dynamics, affecting both consumers and producers.

Recent market research highlights a strong pivot toward electrification and alternative propulsion technologies. The rise of the electric vehicle, hybrid vehicle, and fuel cell systems is reshaping demand patterns and regulatory priorities. Within this shift, battery electric, plug-in hybrid, and internal combustion models coexist, each with distinct fuel needs and efficiency profiles. Infrastructure plays a crucial role, with expansion in charging stations and the emergence of hydrogen stations accelerating adoption. Component-level advancements in the fuel filter, fuel nozzle, and oil pump reflect ongoing efforts to optimize engine performance. Research also shows increased use of fuel additives to improve octane rating and cetane number, enhancing combustion and reducing emissions. These trends underscore the importance of innovation in fuel blends and highlight the growing interest in lower-carbon options such as renewable diesel and green hydrogen.

In-depth research analysis reveals that alternative fuels and distribution systems are reshaping the landscape of the Road Transportation Fuel Market. New entrants like methanol fuel, biogas, and synthetic diesel are carving out niche applications, supported by regulatory incentives and advances in production technology. Infrastructure development includes investment in fuel dispensers, fuel pipelines, and storage tanks, which are essential for scaling both traditional and next-generation fuels. Improving fuel efficiency remains a core objective, alongside stricter standards for emission control. Technologies such as fuel catalysts are being adopted to enhance engine performance while reducing environmental impact. Together, these developments mark a significant transformation, as fuel markets diversify and adapt to the dual challenges of energy demand and climate responsibility.

Hydrogen Fuel Cell Technology: In February 2024, Shell and BMW announced a strategic collaboration to develop and test hydrogen fuel cell technology for heavy-duty trucks, aiming to reduce carbon emissions in road transportation fuel.

Electric Vehicle Charging Infrastructure: In June 2025, Tesla unveiled its new Supercharger V3, capable of charging an EV in just 15 minutes, marking a significant technological advancement in EV charging infrastructure.

Biofuel Production: In August 2024, BP and Reliance Industries Limited announced a strategic partnership to develop a 1.2 million metric tonnes per annum bio-refinery in India, focusing on the production of bio-diesel and other advanced biofuels.

Policy Initiatives: In December 2025, the European Union approved the "Fit for 55" package, a comprehensive set of legislative proposals to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, significantly impacting the market.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 End-user

6.1.1 Gasoline

6.1.2 Diesel

6.1.3 Biofuels

6.1.4 Natural gas

6.2 Vehicle Category

6.2.1 Light-duty vehicles

6.2.2 Heavy-duty vehicles

6.3 Distribution Channel

6.3.1 Gas stations

6.3.2 EV charging stations

6.3.3 Fleet fueling

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 ROW

6.4.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted