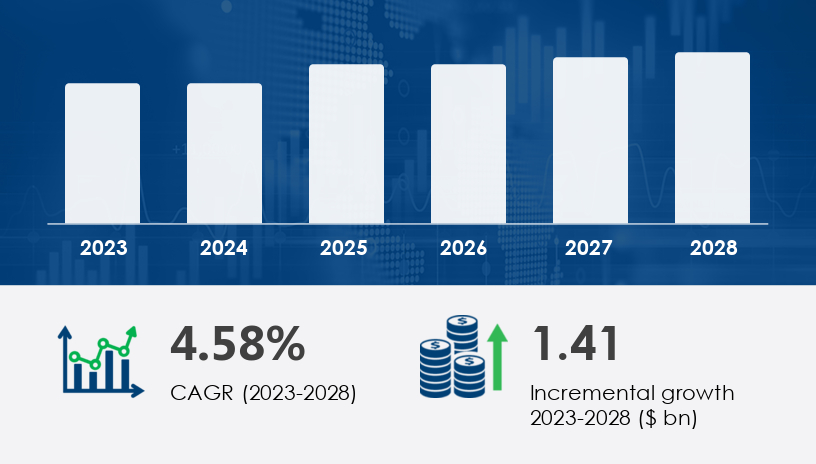

The Rigless Intervention Services Market is set for steady expansion from 2025 to 2029, driven by increasing oil and gas exploration and production (E&P) activities. Rigless interventions are gaining traction due to their cost-effectiveness and ability to perform complex operations without the use of conventional rigs.According to Technavio, the market is forecast to grow by USD 1.67 billion from 2024 to 2029, progressing at a CAGR of 4.6%. This growth highlights the sector’s increasing significance within subsea and onshore oil and gas operations.

.For more details about the industry, get the PDF sample report for free

A primary driver of the Rigless Intervention Services Market is the growing demand for efficient and cost-saving E&P solutions, especially in subsea environments. Rigless systems eliminate the need for traditional rigs, reducing operational downtime and costs. The increasing adoption of 4D seismic survey technologies enhances reservoir monitoring in real time and allows producers to optimize recovery strategies. As a result, operators are turning to rigless solutions to perform maintenance, stimulation, and logging without the need for rig mobilization, significantly boosting market adoption.

One of the leading trends shaping the market is the integration of laser technologies in workover operations. These innovations have transformed the precision and efficiency of rigless interventions, allowing operators to carry out interventions in complex well structures with minimal disturbance. Additionally, the growing use of rigless techniques in renewable energy sectors, such as offshore wind turbine maintenance, reflects a diversification of applications, further expanding the market’s potential footprint. These trends signal a shift toward greater automation and technological sophistication in intervention services.

The Rigless Intervention Services Market is transforming oil and gas operations by enabling efficient well maintenance and enhancement without requiring full rig deployment. Core offerings such as wireline intervention, coiled tubing, and hydraulic workover allow operators to perform complex tasks with reduced downtime and cost. These include well stimulation, slickline services, electric line operations, and tubing conveyed procedures. As part of routine maintenance and emergency response, these services utilize perforation tools, logging tools, fishing tools, and thru-tubing systems to maintain well integrity, improve production rates, and extend the lifespan of the well. The shift toward rigless methods is driven by the need for faster deployment and minimized operational disruption, particularly in mature and subsea fields.

By Application:

Onshore

Offshore

By Technique:

Coiled tubing

Wireline

Hydraulic workover services

By Type:

Horizontal wells

Vertical wells

Multilateral wells

Rest of World (ROW)

Among all applications, the Onshore segment is projected to witness the highest growth during the forecast period. This is primarily due to the lower operational costs of onshore E&P activities compared to offshore projects. In 2019, the Onshore segment was valued at USD 4.09 billion and has continued to grow steadily. This growth is further supported by the recovery of crude oil prices and increased investments in U.S. shale oil and gas. Analysts note that onshore activities are particularly attractive due to their ability to rapidly scale and adopt cost-efficient technologies like rigless intervention.

Regional Analysis

North America (US, Canada, Mexico)

Europe (Germany, Russia)

Middle East and Africa (UAE)

APAC (China, Japan)

South America (Brazil)

Rest of World (ROW)

North America is expected to contribute 51% to the global market growth between 2025 and 2029, making it the leading region in terms of revenue. The U.S. shale boom, driven by rising crude oil prices, has significantly impacted the upstream sector, increasing the need for rigless interventions in both maintenance and stimulation operations. Analysts highlight that high investments in subsea fabrication, underwater welding, and abandonment services across the region are accelerating the deployment of advanced rigless technologies. The Americas' role as the largest consumer of crude oil further intensifies demand for cost-effective and high-efficiency intervention solutions.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite promising growth, the Rigless Intervention Services Market faces notable challenges, particularly in terms of regulatory compliance and high capital expenditure. The deployment of rigless technologies often demands specialized expertise and equipment, making it difficult for smaller operators to enter the market. Additionally, navigating complex environmental and safety regulations poses a major hurdle. These barriers may slow down adoption rates, particularly in emerging economies or in regions with stringent environmental standards.

Rigless intervention services encompass a wide array of tasks aimed at optimizing well performance. Services such as well cleanout, scale removal, sand control, and zonal isolation play a critical role in maintaining unobstructed flow paths. Advanced diagnostics including well monitoring, reservoir evaluation, cement evaluation, and corrosion monitoring enable precise targeting of intervention strategies. Downhole tools, completion equipment, and subsea intervention technologies support enhanced recovery without requiring rigs. Additionally, artificial lift mechanisms like gas lift, pump maintenance, and valve repair are commonly managed through rigless setups, ensuring continuous production. These capabilities also facilitate well plugging, abandonment services, pipe recovery, and casing repair in cost-efficient ways.

As offshore and onshore operators seek to optimize performance and lower costs, rigless interventions are expanding with innovations such as pressure pumping, acidizing treatment, fracturing fluid deployment, and chemical injection. These techniques improve permeability and hydrocarbon flow, while methods like foam cleaning, velocity strings, and barrier installation enhance production efficiency and safety. Rigless operations also support infrastructure longevity through wellhead maintenance, liner installation, annular pressure control, and production logging. The combination of well testing, subsurface data collection, and real-time diagnostics is reshaping how wells are maintained across their lifecycle. By reducing reliance on traditional rigs, this market provides operators with a flexible, scalable, and economically sound alternative for field optimization.

Innovations and Recent Developments

To stay competitive, companies are investing in laser-assisted workover technologies, automation systems, and subsea robotics that enhance the precision and efficiency of interventions. Techniques like hydraulic and coiled tubing interventions are now widely employed to stimulate wells, while wireline technologies are used for well logging and completion. The market also benefits from real-time data analysis and subsea environmental monitoring, which allow operators to comply with regulations while optimizing production. Analysts recommend that market players forge strategic partnerships and focus on cost-effective innovations to overcome regulatory and financial hurdles and capture emerging opportunities in offshore wind and renewable integration.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Application

6.1.1 Onshore

6.1.2 Offshore

6.2 Technique

6.2.1 Coiled Tubing

6.2.2 Wireline

6.2.3 Hydraulic Workover Services

6.3 Type

6.3.1 Horizontal Wells

6.3.2 Vertical Wells

6.3.3 Multilateral Wells

6.4 Geography

6.4.1 North America

6.4.2 Europe

6.4.3 APAC

6.4.4 South America

6.4.5 Middle East and Africa

6.4.6 Rest of World (ROW)

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted