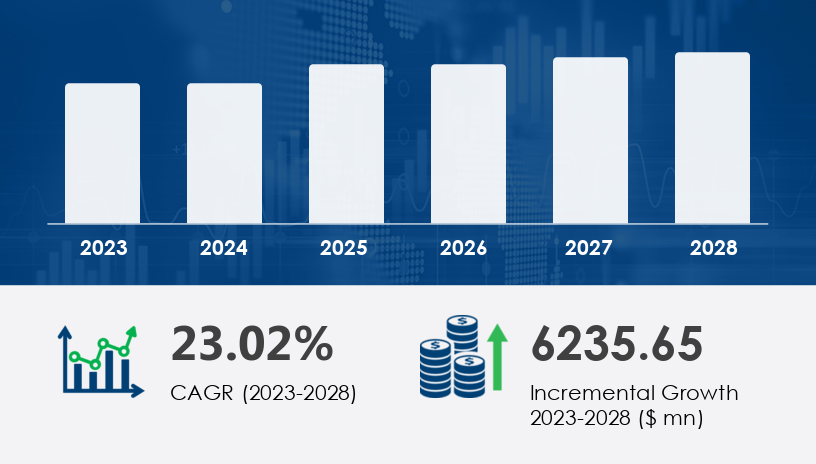

The residential battery energy storage system market is forecasted to increase by USD 6.24 billion at a CAGR of 23.02% from 2023 to 2028.The residential battery energy storage system market is undergoing a next-gen outlook that is redefining how homeowners and utilities manage energy. Once a niche technology, residential battery storage has swiftly become central to the clean energy transition, empowering consumers to gain energy independence and stabilize the grid.” This article explores the evolution of this market from 2020 through 2024 and projects the strategic shifts and bold moves shaping its trajectory through 2029.

For more details about the industry, get the PDF sample report for free

The residential battery energy storage system market has evolved dramatically over the last five years. In 2020, the market was modest, driven primarily by early adopters interested in solar self-consumption and backup power. Lithium-ion technology was emerging as the dominant choice but was still hampered by high costs and limited consumer awareness. By 2024, driven by rising electricity demand, grid modernization, and increased renewable penetration, the market size had expanded significantly, supported by innovations from leaders such as Tesla Inc. and ABB Ltd. Grid operators began to actively deploy battery systems to defer infrastructure upgrades and improve power quality.

Looking ahead to 2025–2029, the market is projected to grow with a CAGR exceeding 23%, expanding by over USD 6 billion as energy independence becomes a mainstream expectation for homeowners worldwide. New regulatory policies, technological advances in battery chemistry and management, and broader integration with electric vehicle (EV) infrastructure will propel this expansion. The market will move from simply supplementing grid power toward becoming a critical node in decentralized energy networks.

Legacy disruption: Lithium-ion batteries have established dominance for residential storage with their superior energy density and cycle life but face challenges such as raw material price volatility and safety concerns.

New strategy emerging: Enhanced manufacturing efficiency and integration with smart energy management apps are driving down costs and increasing user control. Tesla’s Powerwall series exemplifies this, offering sleek designs with solar compatibility and sophisticated load shifting features.

Analyst insight: “Lithium-ion tech will remain dominant, but ongoing innovation in safety and energy density will be critical to maintaining market share,”

Business case: Tesla’s Powerwall 3 launch in late 2024 reduced system costs by 15% while improving cycle life, resulting in 30% higher adoption in the U.S. residential segment.

Stats: Lithium-ion held over 80% market share in 2024, with a CAGR of 23% expected through 2029. Battery pack costs have fallen by 20% since 2020.

Legacy disruption: Historically, smaller systems (<6 kW) served limited backup needs, while larger systems were cost-prohibitive for residential users.

New strategy emerging: The 6-10 kW range is emerging as the sweet spot for balancing capacity and cost, meeting typical household demand while enabling time-of-use energy shifting and EV charging support.

Analyst insight: “Mid-sized systems are the fastest growing segment as consumers seek more robust energy autonomy without grid dependence,”

Business case: ABB’s SMILE G3 10.1 kWh system, launched in 2023, gained rapid market traction in Europe by offering modular scalability and easy integration with solar PV.

Stats: 6-10 kW segment accounted for 55% of total installations in 2024; projected to grow at 25% CAGR to 2029.

Legacy disruption: APAC was slower to adopt residential BESS due to infrastructure constraints and cost barriers.

New strategy emerging: Government subsidies and rapid solar adoption in China and Australia fuel APAC’s rise as the leading growth region. Regional players are tailoring affordable systems to local grid conditions and consumer preferences.

Analyst insight: “APAC’s dominance is driven by policy and technology aligning to leapfrog traditional grid models,”

Business case: BYD Co. Ltd. expanded its lithium-ion battery offerings with localized manufacturing in China, cutting costs by 18% and doubling market share between 2022 and 2024.

Stats: APAC contributed 45% of global market growth in 2024, with projected continued dominance through 2029.

Get more details by ordering the complete report

Innovation Velocity: Continuous R&D investment from tech giants like Tesla, LG Corp., and Panasonic is accelerating the release of safer, more efficient battery systems integrated with AI-driven energy management. This drives differentiation in a crowded market.

Regulatory Momentum: Global climate initiatives and grid modernization policies, including Europe’s Emissions Trading Scheme, incentivize residential battery adoption and create evolving compliance landscapes. Companies adept at navigating these shifts gain competitive advantage.

Consumer Empowerment: Increasing consumer demand for energy autonomy and sustainable living propels demand for user-friendly, integrated solutions. Companies focusing on app-driven energy insights and seamless solar+storage bundles are winning consumer loyalty.

As industry expert Ana Rodriguez from Energy Market Insights summarized in a recent panel discussion: “The convergence of technology, policy, and consumer mindset is turbocharging competition. Those who master this triad will lead the residential battery revolution.”

AI-Powered Energy Ecosystems: By 2029, AI-driven home energy management systems will optimize battery use dynamically across solar production, EV charging, and grid interaction, maximizing cost savings and carbon reduction.

Second-Life Battery Integration: The market will embrace repurposed EV batteries for residential storage, cutting costs and enhancing sustainability credentials.

Blockchain-Enabled Energy Trading: Peer-to-peer energy trading platforms will enable homeowners to monetize stored excess energy directly with neighbors or utilities, redefining ownership and consumption.

Company example: Enphase Energy Inc. has already begun pilot programs combining AI analytics with second-life battery tech in select U.S. markets, projecting a 35% cost reduction and 40% energy efficiency gain by 2027.

Are current business models ready to embrace decentralized energy trading and consumer-led grid services at scale?

For more details about the industry, get the PDF sample report for free

The US Energy Bar Market is evolving rapidly, driven by growing demand for convenient and nutrient-dense snacks among health-conscious consumers. Core offerings such as protein bars, nutrition bars, and energy snacks now serve dual purposes—as pre- and post-workout fuel as well as on-the-go meal replacement options. Innovative formulations are being introduced in the form of fiber bars, snack bars, and energy gels, often paired with complementary products like protein powder and enhanced by functional ingredients such as chia seeds, whey protein, and plant protein. To boost taste and nutritional value, brands are blending almond butter, peanut butter, dark chocolate, hemp seeds, flax seeds, and quinoa grain into their products. Key carriers like oat fiber and coconut oil improve texture, while cashew nuts and pumpkin seeds add crunch and micronutrient value, all reflecting a trend toward clean-label formulations tailored to performance, convenience, and taste.

Embrace AI-Driven Inventory Optimization for Residential Battery Segments to streamline manufacturing and distribution amid fluctuating raw material prices.

Prioritize Lifecycle Safety Enhancements and Thermal Management Systems to mitigate risks and build consumer trust.

Invest in Regional Market Customization with targeted solutions for APAC, Europe, and North America to capitalize on diverse policy incentives.

Advance Integration with EV Charging Infrastructure to meet rising demand for holistic energy ecosystems.

Drive Consumer Education on Energy Independence Benefits to accelerate adoption beyond early adopters.

Collaborate with Regulators on Grid Modernization Incentives ensuring alignment of technology deployment with policy frameworks.

As the US market diversifies, energy bar brands are incorporating novel superfoods and natural sweeteners such as soy protein, rice crisp, honey syrup, agave nectar, and date paste. Plant-based ingredients like almond milk, cocoa powder, vanilla extract, and sea salt are rising in popularity for their flavor and clean profile. Functional enhancements come from sunflower seeds, maple syrup, and brown rice, often fortified with trending proteins like pea protein and adaptogens such as maca powder and spirulina powder. Gourmet inclusions such as cacao nibs and hazelnut butter are carving a premium niche, while flax oil and tapioca starch support structure and nutrition. The addition of dried fruit, nut butter varieties, and diverse seed mixes positions energy bars as a staple in both active and wellness-driven lifestyles. This strategic ingredient innovation continues to shape consumer preferences in the increasingly competitive and health-oriented US Energy Bar Market.

For more details about the industry, get the PDF sample report for free

The residential battery energy storage system market from 2025 to 2029 will not merely grow in size but transform the very fabric of energy consumption and distribution. The shift from passive consumers to empowered energy managers redefines what it means to be “connected.” Are we thinking big enough to harness these innovations and reimagine our energy future fully? To lead in this fast-evolving market, proactive leadership and bold strategic moves are imperative.

Safe and Secure SSL Encrypted