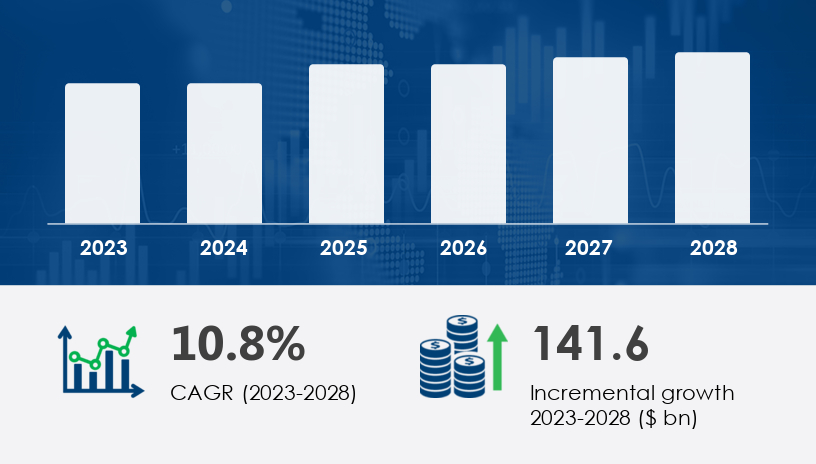

“Energy independence is no longer a future goal—it’s a present necessity,” remarked a panelist at the 2023 Global Energy Transition Forum. That urgency is fueling the rapid expansion of the Renewable Distributed Energy Generation (RDEG) Technologies Market, forecast to grow by USD 141.6 billion at a CAGR of 10.8% from 2024 to 2028. This momentum isn’t simply about cleaner power—it’s a blueprint for a decentralized energy future.

For more details about the industry, get the PDF sample report for free

2019–2023: The RDEG market was characterized by foundational infrastructure investment, with solar PV emerging as the dominant force. The world saw China alone adding 65 GW of solar capacity in 2022, part of a global pivot toward renewable decentralization driven by urbanization, rising power demands, and climate goals.

2024–2028 Outlook: The coming years will see RDEG technologies mature from an alternative model to a primary energy solution. Driven by the high costs of grid expansion, vulnerability to cyber-attacks, and a global electricity demand rise of 2.2% in 2023, RDEG technologies are entering a strategic scaling phase.

With the global RDEG market increasingly addressing intermittency and security concerns through microgrids, fuel cells, and combined heat and power (CHP) systems, the path forward is clear: energy production where it’s consumed.

Legacy Disruption: Solar PV faced challenges from intermittency and panel inefficiencies, often requiring costly backup solutions.

Emerging Strategy: Adoption of on-grid and off-grid solar systems enables energy flexibility, while CHP integration and energy management systems improve reliability.

Analyst Insight: Solar PV, which held a major market share in 2023, is expected to continue leading the RDEG expansion due to decreasing costs and rising global capacity.

Business Case: In the US, the rise in residential solar installations reflects shifting energy consumption models. Major utility players now offer solar-inclusive home energy packages—turning consumers into producers.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Legacy Disruption: Previously underutilized due to high cost and low awareness, these technologies were niche components of distributed systems.

Emerging Strategy: Their low emissions and chemical-to-electricity efficiency make them ideal for clean decentralized generation, especially in industrial and off-grid sectors.

Analyst Insight: Fuel cells, producing only water as a byproduct, are gaining traction for their environmental benefits and potential for seamless microgrid integration.

Business Case: Capstone, a leader in microturbine solutions, expanded its industrial offerings in 2023, powering remote mining operations in Southeast Asia—reducing diesel dependence and emissions.

Legacy Disruption: Centralized wind projects struggled to provide reliable, consistent output, especially during low-wind periods.

Emerging Strategy: Localized wind installations and hybrid RDEG systems (combining wind and gas turbines) are being deployed to overcome intermittency.

Analyst Insight: Gas turbines and reciprocating engines, once seen as transitional technologies, are now viewed as complementary assets in hybrid renewable systems.

Business Case: In rural India, hybrid wind-gas turbine systems now provide power to previously off-grid villages, supported by public-private partnerships and sustainability grants.

Decentralized Demand Pressure

As millions more seek energy independence—from rural communities to urban commercial hubs—companies must offer modular, scalable solutions.

Policy-Driven Acceleration

Incentives across the US, China, and the EU are fostering rapid renewable tech deployment, particularly in underserved regions with fragile grid networks.

Cybersecurity Imperatives

With SCADA systems vulnerable to cyber-attacks, RDEG providers are under pressure to integrate secure microgrid infrastructure.

Top Innovators:

ABB Ltd. – Leading the push with power switching and grid enclosure solutions.

Ballard Power Systems and FuelCell Energy – Advancing hydrogen and fuel cell adoption.

Capstone – Scaling microturbine-based RDEG globally.

Huawei Technologies – Integrating smart solar PV with AI-powered diagnostics.

The Renewable Distributed Energy Generation (RDEG) technologies market is rapidly evolving, driven by increasing demand for cleaner and more decentralized power solutions. Technologies such as Solar PV, small wind, fuel cell, micro CHP, micro hydro, and photovoltaic cells are gaining traction globally as nations push for energy independence and sustainability. Key components including wind turbine, battery storage, solar inverter, microgrid system, and energy arbitrage are instrumental in enabling efficient, localized power generation. Additionally, practices like peak shaving, load shifting, and integration with smart grid infrastructure are enhancing the adaptability of RDEG systems. The shift towards renewable energy and distributed generation is being reinforced by the deployment of solar panels, power converters, and grid tie systems, which allow seamless interaction with the main grid. The integration of energy storage technologies and hybrid microgrid setups further optimizes system performance, especially in off-grid or remote areas.

AI-Powered Energy Optimization

Expect to see AI drive predictive energy balancing, particularly in microgrid-integrated RDEG networks.

Hydrogen Hybridization

Fuel cells integrated with green hydrogen will unlock long-duration storage and power for industrial RDEG applications.

Energy-as-a-Service (EaaS) Models

Subscription-based, cloud-managed RDEG solutions will emerge, reducing upfront investment for small businesses and municipalities.

Innovation Example:

Envision Group is prototyping a solar-wind hybrid RDEG module with embedded AI and blockchain metering—targeted at African off-grid communities.

Will centralized utilities become obsolete—or will they adapt and evolve into RDEG service orchestrators?

Get more details by ordering the complete report

Commit to Gridless Strategies

Invest in RDEG infrastructure beyond the grid edge—rural, urban, and emergency-response markets are converging.

Embrace AI-driven microgrid optimization

Smarter grid monitoring and demand response technologies are becoming essential in every RDEG deployment.

Diversify Your Technology Portfolio

Include fuel cells, CHP systems, and microturbines in your roadmap to meet varied regional and industrial demands.

Build Resilience into Everything

Design for cyber-secure distributed architecture—grid protection is now business protection.

Monetize Decentralization

Develop energy storage arbitrage models, allowing customers to profit from surplus energy production.

Be Policy-Ready

Monitor and adapt quickly to renewable incentives, especially in fast-moving APAC and EU regulatory environments.

In-depth analysis of the RDEG market reveals a growing ecosystem supported by technologies such as solar batteries, charge controllers, and power optimizers, which improve system efficiency and grid responsiveness. Biomass-based solutions like biomass energy and landfill gas, along with marine technologies including wave energy and tidal turbines, are expanding the renewable portfolio. The emergence of green hydrogen and innovations in solar agriculture are reshaping how clean energy is generated and utilized. Emphasis on energy efficiency, carbon reduction, and technologies like smart meters and IoT devices enhances the intelligence of distributed systems. Moreover, energy management, advanced solar modules, aerodynamic wind blades, and high-performance fuel stacks contribute to system reliability and performance. Novel technologies such as geothermal heat, energy resilience strategies, and efforts to improve grid reliability are vital in ensuring stable operations. Advanced materials like perovskite cells, platforms for energy trading, conversion of waste energy, and improved power distribution networks are pivotal in driving the next phase of RDEG market growth.

The Renewable Distributed Energy Generation Technologies Market is no longer a supplementary force—it’s becoming the backbone of global power systems. What started as a way to reduce emissions has evolved into a resilient, scalable, and cost-effective energy infrastructure model.

By 2028, RDEG technologies won't just power homes—they’ll define economic strategies, safeguard grids, and reshape geopolitical energy dependencies.

Are we thinking big enough—or still clinging to the central grid mindset of the past?

Access our Full 2024–2028 Playbook to lead your market transformation.

Safe and Secure SSL Encrypted