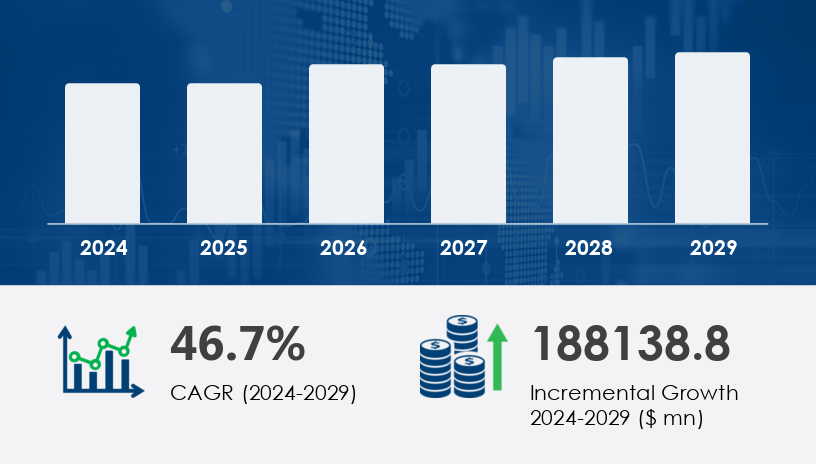

The Real Time Payments Market is poised for explosive growth between 2025 and 2029, fueled by increasing smartphone penetration and fast-paced digitalization. In 2024, the market size stands robust, and it is projected to grow by USD 188.14 billion at a CAGR of 46.7% through 2029. Businesses and consumers alike are shifting toward immediate, secure, and seamless financial transactions, elevating the relevance of real-time payment platforms in the global economy.

For more details about the industry, get the PDF sample report for free

A major driver of the Real Time Payments Market is the increasing adoption of smartphones and access to high-speed Internet. The spread of 3G, 4G, and the emerging 5G networks has significantly enhanced the convenience and accessibility of mobile-based real-time payments. This infrastructure has widened access to digital financial services, particularly in rural and semi-urban areas. The broad distribution network of global smartphone manufacturers such as Xiaomi, Samsung, and Oppo has enabled even traditionally underserved populations to access real-time payment solutions. As a result, real-time payments are becoming a go-to choice for consumers seeking speed and efficiency in financial transactions.

Rapid digitalization in the payments sector is emerging as a transformative trend in the Real Time Payments Market. Consumers are increasingly turning to digital currencies, biometric verification, and contactless payments as their preferred transaction methods. For example, dynamic real-time payment credit systems now allow merchants to scan customer codes while integrated fraud detection tools ensure safety. This technological progression, especially in post-pandemic economies like the UK, is driving the adoption of real-time transactions in sectors such as hospitality and retail. These innovations are not only enhancing user experience but also creating lucrative growth opportunities for RTP vendors and financial institutions.

The real-time payments market is rapidly reshaping the global financial ecosystem by enabling instant payments through agile payment gateways and frictionless digital channels like digital wallets and mobile payments. The rise of peer-to-peer (P2P) payments and merchant transactions is supported by reliable payment processors and robust transaction security frameworks. These systems integrate real-time fraud detection, seamless payment APIs, and even decentralized technologies like blockchain payments and crypto payments to support new transaction formats. With growing consumer demand for speed and ease, contactless methods like NFC payments, QR code payments, and secure payment tokens have surged. Further security measures, such as card tokenization and biometric authentication, ensure identity protection, while secure checkout, transaction monitoring, and payment encryption mitigate risk. Point-of-sale innovations like mobile POS terminals enhance flexibility for merchants, and scalable payment orchestration connects these systems to broader commerce ecosystems, including e-commerce checkout flows and intelligent payment analytics platforms.

Segmentation Categories:

Component

Solutions

Services

Deployment

On-premises

Cloud

Sector

Large Enterprises

SMEs

The Solutions segment is projected to dominate the Real Time Payments Market throughout the forecast period. In 2019, this segment was valued at USD 7.54 billion and has continued to grow steadily due to increasing demand for seamless digital transaction platforms. Solutions such as payment gateways, wallet systems, and point-of-sale integrations are revolutionizing industries from finance to retail. Analyst insights emphasize that innovations like API integration and biometric authentication have significantly enhanced the efficiency and security of real-time transactions. Furthermore, mobile wallet solutions and P2P payments are gaining traction for their ease of use, particularly among small businesses and mobile-first users.

Covered Regions:

North America

Europe

APAC

South America

Middle East and Africa

Rest of World (ROW)

The Asia Pacific (APAC) region is forecast to contribute approximately 44% to the global market's growth between 2025 and 2029. This impressive performance is underpinned by strong technological adoption in countries such as China, India, Singapore, and Thailand. Financial institutions across APAC are implementing open banking, artificial intelligence, and machine learning to optimize transaction speed and security. Collaborative initiatives between banks and tech providers are fast-tracking the adoption of RTP systems. Analysts note that APAC’s customer-centric digital infrastructure, paired with expanding mobile payments and cloud-based payment ecosystems, will continue to drive demand across both urban and rural demographics.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Despite its rapid growth, the Real Time Payments Market faces a significant hurdle in data breaches and cybersecurity risks. The proliferation of RTP systems has coincided with an increase in identity theft, phishing attacks, and unauthorized access to financial data. Vulnerabilities arise particularly through public Wi-Fi usage, weak authentication, and third-party mobile service providers. In some instances, scammers manipulate payment networks by swapping merchant codes, causing users to inadvertently transfer funds to fraudsters. This has led to growing consumer hesitancy, necessitating urgent investment in fraud prevention technologies and regulatory compliance to safeguard digital financial ecosystems.

Recent market research highlights increasing demand for fast, transparent, and secure transactions across borders and industries. Features like cross-border payments, automated digital invoices, and recurring payment capabilities are becoming essential for enterprise and subscription models. Efficient payment integration, the use of virtual cards, and stronger chargeback prevention tools are streamlining business operations. Platforms like payment hubs are centralizing financial processes, while dynamic transaction fee management and robust payment authentication systems support cost efficiency and compliance. The integration of smart contracts, API banking, and scalable cloud payment infrastructure reflects the industry’s shift toward automation and transparency. Key middleware components such as payment middleware, secure transactions, and payment aggregators ensure stability at scale. Real-time capabilities now extend to services like digital remittance, efficient transaction processing, and mobile-first banking models enabled by mobile banking interfaces. At the infrastructure level, innovations in fast payment systems and foundational payment rails are becoming the backbone of modern financial operations.

The real-time payments market is poised for exponential growth, driven by the convergence of speed, security, and digital integration. As businesses and consumers demand instant, cross-platform transactions, success will hinge on agile infrastructure, interoperability, and real-time data capabilities. Providers that harness automation, API-first models, and intelligent risk management will define the next wave of global payment innovation.

Key industry players are rapidly evolving their product offerings through strategic alliances, partnerships, mergers, and geographic expansion. For instance, ACE Software Solutions Inc. delivers real-time processing services tailored for Business-to-Business (B2B) transactions, streamlining payments such as refunds and supplier payouts. Companies like ACI Worldwide Inc., PayPal Holdings Inc., Mastercard Inc., and Fidelity National Information Services Inc. are leveraging cutting-edge technologies—like real-time fraud detection, biometric authentication, and AI-based analytics—to enhance transaction efficiency and security. The ongoing focus is on integrating cloud computing, API-based infrastructure, and mobile compatibility to cater to the demands of both consumers and businesses seeking immediate and transparent financial services.

Other key players include Visa Inc., Apple Inc., Ripple Labs Inc., Microsoft Corp., Tata Consultancy Services Ltd., and Ant Group, all actively participating in shaping the digital payments landscape. These companies are deploying open banking frameworks, embedded finance solutions, and instant settlement tools to build scalable and interoperable RTP platforms globally.

The Real Time Payments Market is undergoing a pivotal transformation, reshaped by technological innovations, digital payment trends, and shifting consumer expectations. With a projected increase of USD 188.14 billion and a CAGR of 46.7% between 2024 and 2029, the market’s momentum is undeniable. While cybersecurity and regulatory hurdles persist, the pace of real-time digitalization, mobile wallet adoption, and cloud-based payment infrastructure positions the RTP market for long-term growth. Companies that address trust and interoperability concerns—while focusing on customer experience—are best positioned to succeed in this high-growth, high-demand sector.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Component

6.1.1 Solutions

6.1.2 Services

6.2 Deployment

6.2.1 On-Premises

6.2.2 Cloud

6.3 Sector

6.3.1 Large enterprises

6.3.2 SMEs

6.4 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 Middle East And Africa

6.4.6 ROW

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted