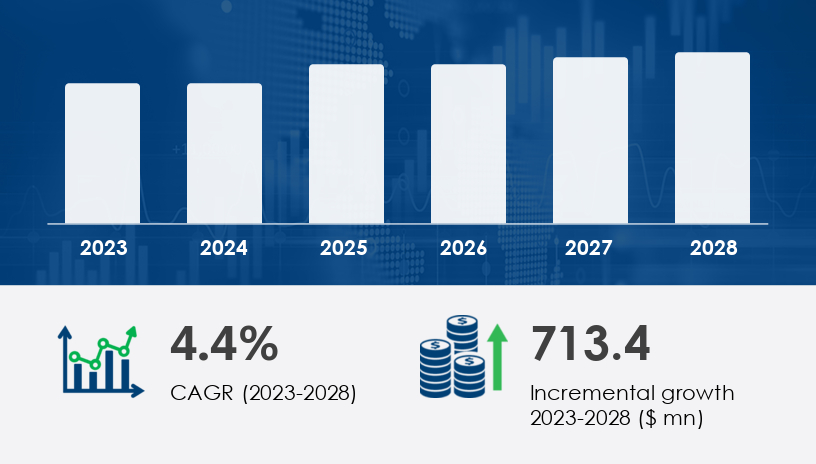

The Radiosurgery And Radiotherapy Robotics Market is projected to grow significantly from 2024 to 2028, with a forecasted increase of USD 713.4 million and a compound annual growth rate (CAGR) of 4.4%. In 2023, the market registered robust expansion due to the rise in cancer cases and the growing need for precise, non-invasive treatment options. The surge in adoption of automation technologies in cancer care has further strengthened the market's trajectory. However, the market faces challenges, including high medical equipment costs and the need for skilled professionals.

For more details about the industry, get the PDF sample report for free

One of the primary drivers fueling the Radiosurgery And Radiotherapy Robotics Market is the rising number of cancer cases and demand for retreatments. As the burden of both malignant and non-cancerous tumors increases globally, there is a growing emphasis on treatment methods that are not only effective but also less invasive. Robotic systems have become pivotal in radiation therapy simulation, treatment planning, and patient positioning, delivering precise and fractionated radiation doses. Technologies such as linear accelerators and stereotactic radiation therapy systems are enabling high-definition imaging and personalized treatments. According to analysts, the integration of AI auto-contouring and MIM software is streamlining workflows and improving dosage manipulation—factors that are drawing significant investment from healthcare providers.

An important trend shaping the market is the emergence of advanced radiotherapy treatments. These include Intensity-Modulated Radiation Therapy (IMRT), Image-Guided Radiation Therapy (IGRT), and Volumetric Modulated Arc Therapy (VMAT)—technologies that offer enhanced precision in delivering radiation to tumors while minimizing damage to surrounding tissue. These innovations are transforming how hospitals and radiotherapy centers approach cancer treatment. Robotic systems now play a central role in tumor removal, imaging integration, and patient comfort, addressing the dual challenge of increasing treatment demand and a shortage of radiologists. The development of minimally invasive techniques is expected to be a long-term market stimulant.

The Radiosurgery and Radiotherapy Robotics Market is transforming cancer care through the adoption of non-invasive treatments such as stereotactic radiosurgery and intensity-modulated radiotherapy, which offer superior treatment accuracy and patient outcomes. These innovations utilize high-precision tools like linear accelerators, gamma knife, and CyberKnife systems to deliver high-dose radiation to malignant cells. Technologies such as image-guided radiotherapy, volumetric arc therapy, and proton therapy enhance tumor targeting while minimizing damage to healthy tissues. Integral to these systems are robotic arms, imaging systems, and devices like the TrueBeam system, which provide automated patient positioning and streamlined treatment planning. Moreover, AI auto-contouring, MIM software, and surface-guided radiotherapy are revolutionizing the way radiation is delivered by supporting accurate dose verification and real-time beam positioning, helping to improve outcomes in complex cancer treatments for conditions such as head cancer, neck cancer, breast cancer, and prostate cancer.

The market is segmented by:

Type

X-ray-based

Gamma-ray-based

End-user

Hospitals

Clinics

Independent Radiotherapy Centers

The X-ray-based segment is the leading type in this market and is expected to experience strong growth throughout the forecast period. In fact, this segment was valued at USD 2.18 billion in 2018 and has shown consistent gains since. X-ray-based robotic systems like CyberKnife and linear accelerators are preferred due to their cost-effectiveness and versatility in treating multiple cancer types, including brain, lung, breast, and prostate cancers. Analysts suggest that the affordability and effectiveness of these systems, compared to gamma-ray-based alternatives, will continue to drive their adoption, especially as hospitals and clinics invest in scalable and precise cancer treatment technologies.

Covered Regions:

North America

Europe

APAC

South America

Middle East and Africa

North America is projected to contribute 37% to the global market’s growth between 2024 and 2028. The United States, in particular, is a key revenue generator, bolstered by healthcare reforms like the Affordable Care Act. These reforms aim to expand access while controlling costs, encouraging providers to adopt non-invasive technologies. Additionally, the integration of tools like AI auto-contouring, MIM software, and surface-guided radiation therapy has elevated the performance of robotic systems. The regional focus on high-definition (HD) treatment planning, early diagnosis, and precision medicine makes North America a hotbed for innovation in radiosurgery and radiotherapy robotics. Analysts emphasize that the need to manage healthcare costs without sacrificing treatment efficacy is pushing companies to prioritize cost-effective yet clinically advanced solutions.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Despite strong growth prospects, the high maintenance and equipment costs of radiosurgery and radiotherapy robotics remain a substantial barrier. These technologies require significant upfront capital, ongoing service agreements, and trained personnel to manage and operate sophisticated systems. Systems like linear accelerators, stereotactic radiosurgery platforms, and particle therapy devices often come with long installation times and high operational complexity. Hospitals and clinics, especially in developing regions, may find these costs prohibitive, thereby limiting adoption. However, even with these challenges, healthcare institutions recognize the long-term cost benefits of reduced treatment times, improved accuracy, and better patient outcomes.

The market is increasingly focused on expanding medical robotics capabilities for complex therapies like brachytherapy robots, particle therapy, and precision radiotherapy. These technologies are particularly crucial for treating intricate cases such as pancreatic cancer, lung cancer, liver cancer, gynecological cancer, and CNS cancer. Robotic solutions—integrated with 3D cameras, advanced imaging, and minimally invasive mechanisms—ensure optimal dosage distribution and improved clinical workflow. Equipment such as X-ray systems, gamma-ray systems, and robotic couches are central to offering real-time adjustments and maintaining patient alignment. These systems, along with the surge in radiation oncology demand, contribute to the sector's rapid evolution as providers seek scalable, automated tools that improve safety and efficacy.

Analyst insights reveal that the integration of ionized radiation technologies with AI and robotics is setting a new benchmark in oncology. The convergence of automation and imaging enables comprehensive planning and precise therapy delivery, minimizing risks and increasing throughput in hospitals and independent radiotherapy centers. Through effective research and development, manufacturers continue to push the boundaries of what's possible in robotic radiotherapy, enabling a new generation of adaptable, efficient, and patient-centric solutions in global cancer care.

Leading companies in the Radiosurgery And Radiotherapy Robotics Market are leveraging strategic alliances, product launches, and R&D investments to strengthen their market position. Companies like Accuray Inc., Elekta AB, Siemens Healthineers AG, and ZAP Surgical Systems Inc. are actively innovating with systems that support AI-based planning, improved imaging integration, and automated patient positioning. The introduction of MIM software and robotic-assisted planning has enabled providers to deliver more consistent and effective treatments. Analysts note that technological differentiation, especially in tumor-specific customization and imaging precision, is a key factor influencing competitive advantage. Ongoing medical robot research focused on neurological applications, brain and spinal tumor treatments, and minimally invasive techniques is likely to further elevate industry standards over the forecast period.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Type

6.1.1 X-ray-based

6.1.2 Gamma-ray-based

6.2 End-User

6.2.1 Hospitals

6.2.2 Clinics

6.2.3 Independent radiotherapy centers

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted