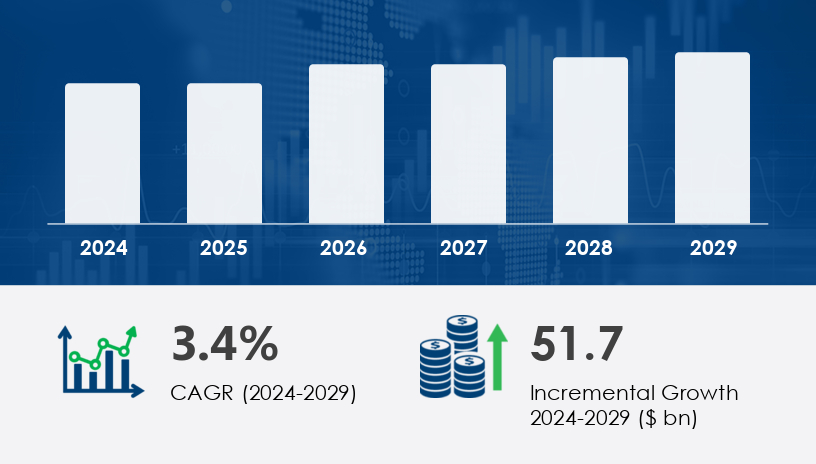

The global project logistics market is set to expand by USD 51.7 billion, growing at a CAGR of 3.4% from 2024 to 2029. This growth is driven by rising construction activities, the digitization of logistics, and increasing demand from industries such as renewable energy, oil and gas, and manufacturing. As we approach 2025, this comprehensive guide delves into the market's segmentation by service, end-user, and mode of transportation, offering strategic insights for stakeholders navigating this dynamic landscape.

For more details about the industry, get the PDF sample report for free

The project logistics market encompasses the planning, organization, management, processing, and control of the flow of goods, materials, information, and cargo in the context of large-scale projects, particularly those involving international trade and renewable energy production. Key trends include the adoption of modularization and offsite construction methods, the increasing use of ISO containers for transporting and storing goods, and the integration of technology such as driverless cars and blockchains into logistics ecosystems. Service offerings in this market cater to various industries, including construction companies and production facilities, by managing domestic and overseas logistics costs, ensuring efficient supply chain operations, and providing specialized expertise in handling raw materials and intermediate suppliers.

| Segment | Key Drivers | Leading Region |

|---|---|---|

| Transportation | Infrastructure development, demand for heavy cargo | APAC |

| Warehousing | E-commerce growth, need for efficient storage | North America |

| Construction | Urbanization, industrialization | APAC |

| Oil & Gas | Energy demand, exploration activities | Middle East & Africa |

Growth Drivers & Challenges: The transportation segment is estimated to witness significant growth during the forecast period. The transportation segment holds the largest share in the market, as it is a crucial service offering. Major players in this industry provide customized and specialized transportation solutions tailored to each project or customer's unique requirements. These comprehensive transportation packages ensure timely delivery of shipments, regardless of size. DHL International, a subsidiary of Deutsche Post AG, is an exemplary market participant offering industrial project transportation services, capable of transporting massive shipments weighing up to 1,000 tons across borders or to inaccessible locations.

Expert Insight: "The transportation segment's dominance is underscored by the increasing complexity of projects requiring specialized logistics solutions," says an analyst at Technavio.

Mini Case Study: A multinational construction firm in the Middle East partnered with a logistics provider to transport oversized equipment for a new refinery project. The provider utilized heavy-lift transport solutions, ensuring timely delivery despite challenging terrain and regulatory hurdles.

Key Facts: The transportation segment was valued at USD 113.40 billion in 2019 and showed a gradual increase during the forecast period.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Growth Drivers & Challenges: The digitization of logistics is the upcoming market trend. Project logistics is a critical component of supply chain management. The integration of digital practices into logistics operations can significantly enhance their efficiency and competitiveness in today's fast-paced, omnichannel business environment. Digitization in project logistics refers to the adoption of advanced technological solutions and assets to transform traditional logistics processes. This includes the use of modularization and offsite construction techniques, ISO containers, and automation in international trade and domestic logistics. Digitization enables project logistics companies to streamline their operations, improve planning and organization, and manage the flow of goods, materials, information, and cargo more effectively. Service offerings have expanded to include industry solutions for industries such as renewable energy, construction, and production facilities.

Expert Insight: "The shift towards digital warehousing solutions is transforming inventory management, offering real-time tracking and improved efficiency," notes a logistics technology expert.

Mini Case Study: A renewable energy company implemented a digital warehousing system to manage components for wind turbine installations. The system provided real-time inventory updates, reducing delays and improving project timelines.

Key Facts: Digitization in logistics operations can significantly enhance efficiency and competitiveness.

Growth Drivers & Challenges: Increase in number of construction activities is the key driver of the market. Project logistics plays a crucial role in the construction industry, enabling the efficient movement and storage of materials and equipment from suppliers to construction sites. The International Energy Agency reports that modularization and offsite construction have significantly increased the demand for project logistics services, as these methods require the transportation of modular packages and ISO containers via international trade. Effective logistics management in construction reduces domestic and overseas logistics costs, ensuring competitiveness for construction companies and production facilities.

Expert Insight: "The oil and gas sector's demand for specialized logistics services is driven by the need for efficient transportation of heavy and oversized equipment," explains an industry analyst.

Mini Case Study: An oil exploration company in Africa contracted a logistics provider to transport drilling equipment to a remote site. The provider coordinated multimodal transport solutions, overcoming infrastructure challenges and ensuring timely delivery.

The Project Logistics Market is witnessing substantial growth, driven by increasing global demand for heavy haulage and oversized cargo movement across sectors like energy, construction, and mining. Key services such as freight forwarding, multimodal transport, and cargo handling are essential for the effective management of complex logistics operations. Companies are investing in advanced logistics planning and equipment transport solutions to support critical sectors including oilfield logistics, mining equipment relocation, and construction logistics for large-scale infrastructure projects. With the rising deployment of power plant components and the demand for crane services, efficient rig moving and acquiring proper transport permits have become crucial. Complementary services such as customs clearance, warehousing solutions, and load securing are also essential, along with route optimization and bulk shipping methods tailored to project-specific needs. The focus on energy logistics and industrial transport continues to shape the trajectory of the market.

Emerging Markets: Expansion in regions like Africa and Southeast Asia presents new avenues for project logistics services.

Technological Advancements: Adoption of AI, IoT, and blockchain technologies can enhance efficiency and transparency in logistics operations.

Sustainability Initiatives: Growing emphasis on eco-friendly logistics solutions aligns with global sustainability goals.

Regulatory Challenges: Stringent regulations and varying standards across countries can complicate logistics operations.

Cost Pressures: Rising fuel prices and labor costs may impact profitability.

Geopolitical Instabilities: Political uncertainties in certain regions can disrupt supply chains.

The project logistics market is expected to grow by 51.7 at a CAGR of 5.95% during the forecast period (2025–2030).

Expert Prediction: "The integration of advanced technologies and expansion into emerging markets will drive the next phase of growth in the project logistics sector," predicts a senior analyst at Technavio. Are companies ready to pivot?

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Transportation: Invest in specialized equipment and technology to handle oversized cargo efficiently.

Warehousing: Implement digital inventory management systems to enhance real-time tracking and reduce delays.

Oil & Gas: Develop tailored logistics solutions to address the unique challenges of transporting heavy and oversized equipment.

A deeper analysis into the Project Logistics Market highlights the critical role of specialized carriers and offshore logistics in enabling the smooth transport of complex and high-value goods, including pipeline transport and heavy machinery. The coordination of site delivery, logistics coordination, and port handling is crucial to ensuring timely and cost-effective execution. Services such as flatbed transport and the movement of modular units and breakbulk cargo are frequently utilized in large-scale projects requiring tailored haulage services. With increased investment in infrastructure logistics, key supporting functions like cargo insurance, onsite logistics, and managing a flexible transport fleet are in demand. Technology adoption through logistics software enhances operational visibility and efficiency, especially for oversized loads and dynamic field operations. Effective material handling and logistics outsourcing continue to be integral components, allowing companies to streamline operations and focus on core project execution.

The project logistics market is undergoing significant transformation, driven by technological advancements and increasing demand across key industries. Stakeholders must navigate emerging opportunities and address potential risks to capitalize on this growth trajectory.

Safe and Secure SSL Encrypted