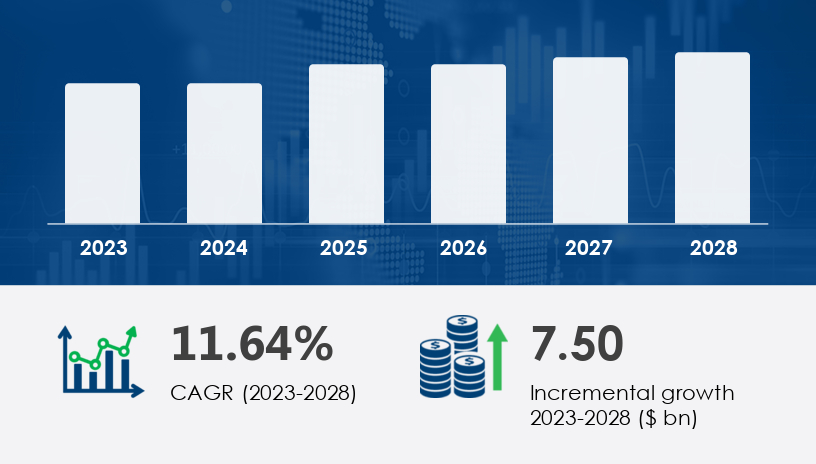

Professional Service Automation (PSA) Software Market Overview 2024-2028

The professional service automation (PSA) software market is projected to grow by USD 7.50 billion at a CAGR of 11.64% between 2023 and 2028. The market is witnessing rapid adoption due to the increasing use of cloud-based deployments and automation solutions by organizations to enhance efficiency and reduce costs. AI-driven solutions are also gaining traction to improve productivity and accuracy. However, the industry faces challenges such as a shortage of skilled professionals and high deployment costs.

For more details about the industry, get the PDF sample report for free

Market Segmentation

Deployment

End-User

- Technology companies

- Consulting firms

- Marketing and communication

- Others

Geography

-

North America

-

Europe

-

APAC

-

South America

-

Middle East and Africa

Deployment Insights

The cloud segment is expected to experience significant growth during the forecast period, providing benefits such as improved contact management, expense tracking, and resource allocation. The on-premise segment, which held the largest market share in 2023, remains preferred due to advantages such as data protection, security, and integration capabilities. Despite challenges in implementation, on-premise PSA software is valued for its reliability and scalability.

AI and machine learning are driving innovation in PSA software, enhancing functionalities such as contact management, expense tracking, and project performance. Additionally, PSA software is being leveraged in website development, facilitating seamless integration with other business applications.

Regional Market Trends

North America (40% Market Contribution)

- Presence of industrial-technological innovators

- Adoption of PSA solutions due to an aging workforce

- Widespread use of cloud technology and resource optimization

- Economic growth and service sector advancements

- Expansion through inorganic growth strategies by PSA software providers

Market Dynamics

Drivers

- Growing adoption of cloud deployments and automation

- Increased demand for cloud-based solutions due to remote work culture and advanced internet infrastructure

- Benefits such as project administration, billing & invoicing, contact management, expense tracking, and resource planning

- AI-driven solutions enabling intelligent decision-making and project visibility

- Mergers and acquisitions in the IT sector supporting the expansion of cloud-based business models

Trends

- Rising demand for AI-driven operational efficiency

- AI and machine learning integration in PSA software for automation, resource planning, and billing

- Improved project efficiency, revenue leakage prevention, and enhanced profitability

- M&A activity in digital security and IT services boosting PSA software adoption

- Enhanced integration with collaboration tools, project management platforms, and client engagement systems

Challenges

- Shortage of skilled professionals and high deployment costs

- Complex implementation processes requiring skilled personnel

- Resistance to change and integration challenges for service provider companies

- Security concerns and budget constraints impacting widespread adoption

Get more details by ordering the complete report

Key Players

- Accelo Inc.

- Aprika Business Solutions Ltd.

- BigTime Software Inc.

- Cloud Coach LLC

- ConnectWise LLC

- Datto Holdings Corp.

- HaloPSA

- Kantata Inc.

- Logic Software Inc.

- Microsoft Corp.

- Oracle Corp.

- Planview Inc.

- Primetric Sp. z o.o.

- Promys

- Rev.io LLC

- Roper Technologies Inc.

- Salesforce Inc.

- SAP SE

- Upland Software Inc.

- Workday Inc.

Future Market Insights

The PSA software market is expected to witness steady growth as businesses continue to embrace digital transformation and automation to streamline operations. Cloud-based solutions, AI-driven automation, and integrated business process management tools will remain key drivers shaping the market landscape.