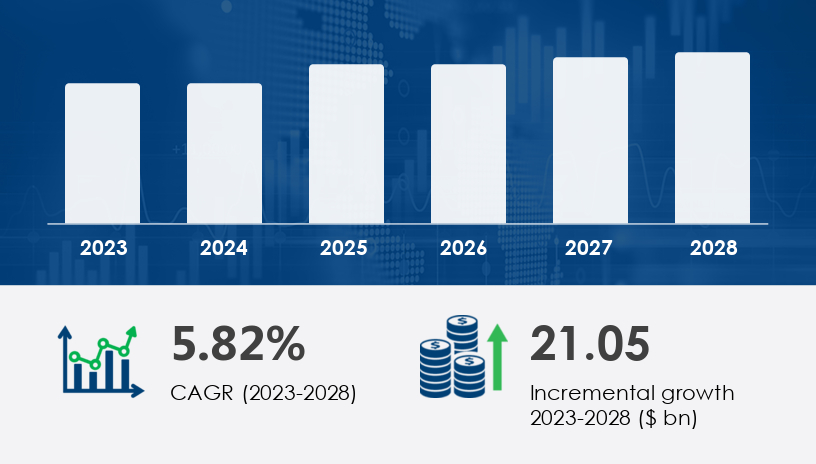

In a striking pivot from petroleum-dependence to sustainable sourcing, polypropylene fiber producers are rewriting the rules. We’re not just reshaping fiber—we’re reshaping responsibility, noted a panelist at the 2024 Global Textiles Summit. As we enter a new chapter, the polypropylene fiber market is being redefined by bio-based innovations, high-performance demands, and environmental imperatives. Welcome to the Next-Gen Outlook—where durability meets circularity with a growth USD 21.05 bn at a CAGR of 5.82%.

For more details about the industry, get the PDF sample report for free

Between 2020 and 2024, the polypropylene fiber market rode a wave of industrial demand, driven by its moisture resistance, lightweight profile, and cost-efficiency. Initially thriving in apparel and furnishings, it rapidly diversified into healthcare, construction, and automotive segments. However, growing concerns about microplastic pollution and petrochemical sourcing catalyzed a shift.

Today, eco-conscious consumers, regulatory scrutiny, and R&D investments are pushing the industry into uncharted terrain—recyclable and bio-based polypropylene is no longer a novelty but a necessity. By 2029, the market is projected to reach unprecedented heights, propelled by technological breakthroughs and sustainability mandates.

Legacy Disruption: The COVID-era demand spike revealed both the strength and fragility of synthetic fiber supply chains.

New Strategy Emerging: Manufacturers are scaling production of medical-grade nonwovens with sustainable fibers.

Analyst Insight: “Polypropylene’s chemical resistance makes it indispensable in medical textiles, but sustainability will decide future market leaders.”

Business Case: A leading Asia-based PPE manufacturer shifted 40% of its sourcing to bio-based polypropylene in 2024, reducing emissions by 18%.

Key Stats: The healthcare and hygiene segment reached USD 25.6 billion in 2018 and continues robust growth. PP fibers are now standard in masks, gowns, and tapes due to heat insulation and moisture resistance.

Legacy Disruption: Traditional geotextile uses relied on virgin PP, sparking criticism over environmental degradation.

New Strategy Emerging: Reinforced composite fibers and recycled blends are the new norm.

Analyst Insight: “Civil infrastructure is moving toward fiber blends that support soil stability and sustainability.”

Business Case: A South American geotextile firm integrated PLA-based polypropylene into erosion control products, securing a government eco-infrastructure grant.

Key Stats: Continuous fibers dominate this segment, which is now expanding in filtration and temperature-resistant applications. Heat and chemical resistance remain top adoption drivers.

Legacy Disruption: Furnishings were once an afterthought in fiber innovation cycles.

New Strategy Emerging: Now, interiors are a proving ground for recyclable and aesthetic performance.

Analyst Insight: “Home and office textiles are leading the charge in consumer-facing circularity.”

Business Case: A German carpet brand launched a 100% recyclable polypropylene collection with 3D texture printing, capturing premium market share.

Key Stats: Polypropylene’s lightweight nature supports intricate design work and reduced transportation costs. It also resists fading, making it ideal for long-life furnishings.

Get more details by ordering the complete report

Expert Quote:

“By 2029, any polypropylene supplier not embedding recyclability or renewability into their value chain will struggle to remain relevant,” noted a 2025 panelist at the Asia Sustainable Fibers Forum.

Innovation Case: A Taiwan-based startup developed a polypropylene fiber embedded with thermal sensors for real-time hospital bedding analytics—blending hygiene with IoT.

Provocative Question:

If polypropylene fibers can power future health tech and climate solutions, are we underestimating their role in the global materials transition?

Get more details by ordering the complete report

The Polypropylene Fiber Market is experiencing robust growth, driven by rising demand across various end-use sectors including healthcare, construction, and automotive. Key product types such as staple fiber and continuous fiber are extensively used in nonwoven fabric applications, particularly in medical textiles for surgical masks, face masks, medical gowns, and hygiene products. The construction industry is utilizing geotextile fabric and construction textiles for enhanced durability and chemical resistance, while interior applications favor carpet fibers and upholstery fabric due to their lightweight fibers and resilience. The market also encompasses industrial uses such as tarpaulins, surgical tapes, and adhesive tapes. Fabrication technologies like spunbonded fabric, wet-laid fabric, and dry-laid fabric are enabling the production of parallel staple, cross-staple fabric, and random staple structures tailored to specific performance needs. Sustainability trends are encouraging adoption of bio-based polypropylene, recycled polypropylene, and bicomponent fibers blended with eco-materials such as polylactic acid.

Embrace Circular Innovation

Prioritize R&D investment into biodegradable polypropylene fiber and closed-loop recycling systems.

Focus on AI-Driven Inventory Optimization for Hygiene Products

Forecast demand more accurately in healthcare segments, minimizing overproduction and waste.

Develop Strategic Sourcing Partnerships in APAC

Secure supply chains and tap into regional expertise where 53% of growth is projected.

Invest in Regulatory Preparedness for Bio-based Standards

Prepare for emerging global certifications and plastic restrictions shaping fiber markets.

Integrate Carbon Tracking into Fiber Lifecycle Management

Leverage digital tools to map environmental impacts from raw material to post-consumer phase.

Expand Direct-to-Consumer Branding in Home Furnishing Applications

Position polypropylene as not just functional but desirable and sustainable in end-consumer eyes.

Get more details by ordering the complete report

Application diversity is a major strength of the polypropylene fiber industry, with significant traction in automotive textiles, textile weaving, and apparel manufacturing. Medical and personal protective uses extend to medical bandages, overshoes, and sponges, as well as specialized protective apparel. The versatility of nonwoven textiles is supported by strong fiber durability, process efficiency in textile dyeing, and innovation in high-performance fibers. Eco-conscious trends are pushing manufacturers to develop eco-friendly fibers, alongside functional enhancements like antibacterial fibers, UV-resistant fibers, and flame-retardant fibers for demanding environments. These advanced fiber types are finding new traction in areas where regulatory and consumer demands for safety and sustainability converge, reinforcing polypropylene fiber’s role as a critical component in next-generation materials.

The polypropylene fiber market is no longer defined solely by utility—it’s defined by ingenuity. From its dominance in technical textiles to its rebirth as a sustainable material of the future, the market is transforming under the pressures of climate accountability, consumer scrutiny, and technological innovation. As we look toward 2029, the key question is no longer “What can polypropylene do?”—but “What should we make it do?”

Safe and Secure SSL Encrypted