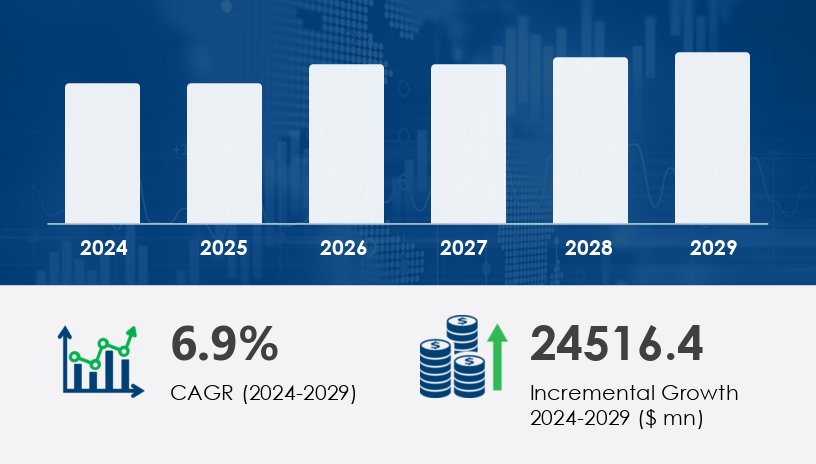

The polyester staple fiber market is poised to grow by USD 24.52 billion between 2024 and 2029, expanding at a remarkable CAGR of 6.9%. This surge is not just a reflection of growing textile demand—it signals a deeper industry transformation led by sustainable innovations, evolving consumer preferences, and global industrial expansion. In this 2025 Outlook and Comprehensive Guide, we dive into the multi-dimensional growth of this market, evaluate competitive dynamics, and offer strategic foresight for key stakeholders.

For more details about the industry, get the PDF sample report for free

Versatility Meets Demand

Polyester staple fiber, made through the polymerization of purified terephthalic acid (PTA) and mono ethylene glycol (MEG), is a synthetic fiber prized for its adaptability across sectors. In apparel, PSF mimics the look and feel of natural fibers while offering resistance to shrinkage and wrinkles. The home furnishings industry appreciates PSF’s affordability and durability in upholstery, curtains, and carpets. The automotive sector uses it in seat covers and filtration materials, while the medical industry utilizes PSF in surgical gowns and hygiene textiles due to its antibacterial and odor-resistant properties.

Eco-Conscious Trends Driving the Market

Sustainability is no longer optional. With rising awareness of environmental impact, manufacturers are transitioning toward recycled and biodegradable PSF. Derived primarily from PET bottles, recycled PSF reduces reliance on virgin petrochemical feedstocks, aligning with global efforts to combat pollution and carbon emissions. The shift is evident in regions like China and India, where eco-intelligent polyester is rapidly gaining ground.

Strategic Takeaway: Sustainability isn’t just a trend—it’s a growth accelerator. Companies integrating recycled PSF into their product lines are securing long-term relevance.

By Product Type

Solid PSF: Valued at USD 35.38 billion in 2019, this segment dominates due to its structural rigidity and broad usability in apparel, furnishings, and industrial applications.

Hollow PSF: Gaining traction in cushioning, insulation, and stuffing applications for its lightweight and breathable properties.

By Application

Apparel: Driven by fast fashion and rising disposable income in emerging economies.

Home Furnishing: Strong growth from increasing urbanization and renovation activities.

Automotive: PSF's use in nonwoven filters, seat fabrics, and insulation supports sustainability and cost-efficiency goals.

Filtration: Industrial filters using PSF offer durability and high-performance filtration capabilities.

Others: Includes medical, hygiene, packaging, and geotextile applications.

By Type

Virgin PSF: Preferred for premium applications requiring high-performance metrics.

Blended PSF: Combines the best of both natural and synthetic fibers for hybrid performance.

Recycled PSF: Emerging as the growth leader due to eco mandates and consumer awareness.

Mini Case Study: China’s Surge in Sustainable PSF

China remains the largest producer and consumer of PSF, with a 28.6% export increase in early 2024. The Chinese government's push for recycling infrastructure and green manufacturing has made recycled PSF a strategic priority.

Get more details by ordering the complete report

Asia Pacific leads global demand, accounting for 83% of market growth through 2029. China is the epicenter, driven by a booming textile industry and infrastructure development. Countries like India, Indonesia, Japan, and South Korea are enhancing their production capacity, promoting sustainable exports, and leveraging cost advantages.

China: Rapid urbanization and construction drive PSF demand in geotextiles and apparel.

India: Rising middle-class income boosts domestic demand for low-cost textiles and fashion.

Indonesia & Vietnam: Emerging hubs for apparel exports using both virgin and recycled PSF.

North America & Europe are mature markets focusing on high-quality, flame-retardant, and specialty PSF products.

South America and MEA regions show potential in automotive and construction textiles, although currently underpenetrated.

Rise of Eco-Intelligent Polyester

Recycled polyester made from PET waste is seeing large-scale adoption, driven by circular economy goals and regulatory compliance.

Innovation in Nonwoven Weaving

From filters to hygiene products, nonwoven PSF offers superior performance for industrial and medical use.

PCDT Polyester Growth

With enhanced strength and flexibility, the PCDT variant is gaining traction in filament yarns for premium textiles.

Smart Textiles on the Horizon

Innovations integrating flame resistance, odor control, and moisture-wicking properties position PSF for future-ready applications.

Volatile Raw Material Prices: PSF depends on crude oil derivatives like PTA and MEG. Price swings in oil markets can squeeze margins.

Competition from Alternative Synthetics: Nylon and PET filament pose a threat to PSF’s market share, especially in performance textiles.

Environmental Criticism: Despite recycling efforts, PSF’s roots in petrochemicals invite scrutiny. Companies must proactively address sustainability metrics.

For more details about the industry, get the PDF sample report for free

The Polyester Staple Fiber (PSF) Market is experiencing significant growth due to the increasing demand for cost-effective textiles and sustainable polyester fiber solutions across various industries. Polyester staple fiber, including solid polyester fiber and hollow polyester fiber, is widely used in the production of apparel polyester fiber, home furnishing fiber, and automotive polyester fiber. The rise of eco-friendly textiles has spurred the growth of recycled polyester fiber, which is gaining traction due to its environmental benefits. Polyester fiberfill, quilted polyester fiber, and thermal polyester fiber are increasingly popular in the production of outerwear polyester fiber and jacket polyester fiber due to their durability, wrinkle-resistant fiber, and shrinkage-resistant fiber properties. Polyester fiber blends and spun polyester fiber are commonly used in the textile industry, providing a cost-effective solution with enhanced chemical resistant fiber capabilities

Pros

Cost-effective and versatile

Recyclable and eco-intelligent versions available

Antibacterial and flame-resistant properties

Strong demand across industries

Cons

Susceptible to raw material price fluctuations

Environmental impact from virgin PSF production

Increasing regulatory scrutiny on synthetic fibers

Get more details by ordering the complete report

Diversify Feedstocks: Reduce dependency on crude oil by exploring bio-based alternatives.

Invest in R&D: Focus on smart textiles and performance enhancements like fire resistance and odor control.

Expand in Emerging Markets: Countries like India and Indonesia offer untapped demand for both apparel and industrial applications.

Strengthen Circular Supply Chains: Scale recycled PSF production and establish closed-loop collection systems.

Research into the Polyester Staple Fiber Market shows a strong demand for specialized fibers like high tensile fiber, high tenacity fiber, and dimensional stable fiber across multiple applications. Crimped polyester fiber is particularly useful in applications requiring flexibility, such as non-woven polyester and polyester fiber mats for industrial use. The polyester fiber ropes and polyester fiber webbing markets are also growing, driven by the increasing use of polyester fiber in heavy-duty applications. In addition, innovations in low-melt polyester fiber and flame-retardant polyester are improving safety and performance in industrial and construction applications. The rise of biodegradable polyester fiber and the shift towards sustainable polyester fiber are reshaping the market, as consumers and manufacturers increasingly prioritize eco-friendly textiles and water-resistant polyester options. The incorporation of coatings such as polyurethane coated fiber and silicon coated fiber further enhances the performance and versatility of polyester fibers in various end-use applications.

With rising consumer consciousness and global regulatory pressures, the future of the polyester staple fiber market hinges on innovation and sustainability. Companies that prioritize recycled inputs, invest in smart textile technology, and penetrate emerging markets will lead the next phase of growth.

As we approach 2029, the PSF industry offers more than just fiber—it provides a platform for environmental transformation, industrial scalability, and innovation-driven disruption. Will your organization be at the forefront of this textile revolution?

Safe and Secure SSL Encrypted