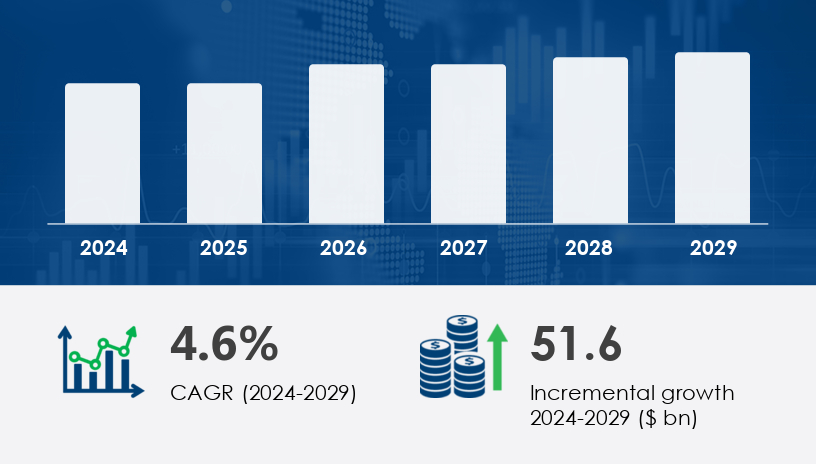

The US pickup truck market is set to experience a robust growth trajectory, with an expected market size increase of USD 51.6 billion by 2029, at a compound annual growth rate (CAGR) of 4.6%. This expansion, poised for steady recovery, reflects both the adaptability of pickup trucks in various applications—spanning personal, commercial, and industrial use—and the growing consumer demand for improved fuel efficiency and towing capacity. As we look ahead, 2025 Outlook and strategic insights into the US pickup truck market reveal critical shifts and trends, from the rise of electric vehicles (EVs) to the increased utility of lighter materials.

For more details about the industry, get the PDF sample report for free

The electric work truck market is evolving rapidly with advancements in electric powertrain technologies, enhancing fuel efficiency, torque performance, and overall towing capacity. Electric work trucks are now designed for better off-road capability, equipped with suspension systems, all-wheel drive, and skid plates for rugged use. The integration of hybrid engines further optimizes battery range and charging speed, while regenerative braking systems help improve overall performance and energy efficiency. Notable features such as advanced safety tools including blind-spot monitoring, lane-keeping assist, adaptive cruise control, and collision avoidance are standard for enhanced driver assistance. Furthermore, the inclusion of telematics systems and smart navigation helps improve connectivity features while ensuring streamlined management of payload capacity and cargo bed loads. For work trucks, trailer assist, bed liners, and tailgate assist systems ensure smooth handling of large equipment and materials.

The US pickup truck market is buoyed by several key factors, including versatility, rising demand for robust utility vehicles, and shifting consumer preferences towards more fuel-efficient models. But what exactly is pushing this market forward?

Pickup trucks have long been revered for their high torque, large payload capacities, and exceptional towing capabilities, making them indispensable for both commercial enterprises and individual consumers. These characteristics make them ideal for tasks such as hauling large loads, towing trailers, and transporting goods—appealing to both businesses in construction and agriculture and families seeking an all-purpose vehicle.

The inherent strength and flexibility of pickup trucks are key to their ongoing success in the US market. As consumer lifestyles evolve, the demand for multi-purpose vehicles that can balance both family-friendly features and workhorse capabilities remains strong.

As the automotive industry shifts towards more sustainable options, fuel efficiency has become a pivotal factor. Manufacturers are responding by incorporating lighter materials into pickup truck designs. The use of aluminum in models like the Ford F-150 has reduced the vehicle's overall weight by approximately 700 lbs, translating into better mileage and improved towing performance without sacrificing strength.

Example Case: Ford’s F-150, which uses aluminum, has set an industry standard for fuel-efficient full-size pickups, increasing its appeal to environmentally-conscious consumers without compromising power.

This trend is significant not only for fuel efficiency but also for reducing emissions, as lighter vehicles contribute to better overall environmental performance.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Full-size pickup trucks are the dominant force in the US market. Defined as vehicles with a gross vehicle weight rating (GVWR) between 6,000 lbs. and 14,000 lbs., these models provide higher profit margins and greater utility for both personal and commercial applications.

Data Callout: The full-size segment is forecast to witness significant growth in the 2025-2029 period, led by increasing consumer preference for these trucks' enhanced engine capacity, towing capabilities, and payload capacities.

Key full-size models include the Chevrolet Silverado 1500, Ford F-150, and RAM 1500. These trucks often offer a range of features such as crew cabs for additional passenger space and are powered by diesel or gasoline engines, with diesel engines offering superior torque and towing power.

While full-size pickups dominate, small and mid-size pickups are steadily gaining traction. Their affordability, combined with sufficient utility for most tasks, makes them a strong choice for consumers seeking the best of both worlds—a truck's capabilities at a smaller footprint and more economical fuel usage. The Toyota Tacoma and Chevrolet Colorado are leading models in this category.

Strategic Takeaway: Small and mid-size trucks cater to urban and environmentally-conscious buyers. Their market share is expected to grow as fuel efficiency becomes a larger consideration.

One of the most exciting developments in the pickup truck market is the growing push towards electric vehicles (EVs). Companies like Rivian and Tesla are positioning themselves as disruptors in the market, launching electric models that offer similar performance levels to traditional fuel-powered trucks.

Electric pickups like the Rivian R1T and Ford F-150 Lightning signify the industry's commitment to sustainability, while still offering the essential utility features consumers expect.

While diesel and gasoline trucks continue to dominate the US market, EVs are seen as a way to reduce CO2 emissions and fuel dependency. The light-duty pickup segment is likely to see a substantial increase in EV adoption as infrastructure for charging networks improves.

The US pickup truck market, like many others, has experienced significant disruptions due to supply chain bottlenecks and the shortage of semiconductor chips. These issues have led to delayed production, higher vehicle prices, and longer wait times for consumers.

Risk & Challenge: The availability of auto parts, including essential components like semiconductor chips, remains a persistent issue. As the automotive industry recovers from these disruptions, manufacturers must adapt their operations to mitigate these challenges.

The increased sales of used pickup trucks in the US represent a challenge for new vehicle sales. Consumers increasingly seek budget-friendly alternatives, fueling a competitive used vehicle market.

Data Insight: Used pickups, particularly those that retain strong towing capacity and payload features, are becoming highly sought-after, particularly for small businesses looking for cost-effective fleet options.

Looking ahead to 2029, the US pickup truck market will likely see:

Growth of Electric Pickup Trucks: Expect more automakers to enter the EV truck segment, expanding choices and improving adoption rates.

Technological Advancements: Integration of autonomous driving and smart technology in pickup trucks will change consumer expectations, particularly in navigation, towing, and off-road capabilities.

Environmental Shift: Increasing fuel efficiency standards and consumer preference for low-emission vehicles may push manufacturers to focus more on eco-friendly pickup options.

Strategic Insight: Manufacturers must continue innovating by offering electric and fuel-efficient options while ensuring that core attributes like payload capacity and towing power are not compromised.

While the future looks bright for the US pickup truck market, companies must navigate key challenges, including:

Supply Chain Bottlenecks: Ongoing disruptions could impact production timelines and vehicle availability.

Environmental Regulations: Increasingly stringent CO2 emissions standards will require manufacturers to adapt their fuel offerings.

Competition from EVs: The rise of electric vehicles could disrupt traditional pickup truck sales, especially as consumers become more environmentally conscious.

Get more details by ordering the complete report

As demand for electric work trucks grows, the market is witnessing significant innovation in vehicle design, especially with the use of aluminum bodies for enhanced durability and reduced weight. These vehicles are also equipped with infotainment systems, wireless charging, and voice control for a more intuitive user experience. Eco mode and terrain management features provide the flexibility needed for various working conditions, while hill descent and locking differential ensure stability on challenging terrains. The expanding role of autonomous driving technology is shaping the future of electric work trucks, integrating remote start, keyless entry, and smart navigation to offer greater convenience. The adoption of last-mile delivery solutions is becoming more prevalent, supported by features such as load securing and cab configurations designed to meet the needs of logistics operations. Additionally, safety innovations like LED headlights, adaptive cruise, and blind-spot monitoring play a key role in making electric work trucks a viable option for industries focusing on work truck applications.

The US Pickup Truck Market presents ample opportunities for manufacturers, but it also requires a nuanced approach to succeed. Key insights include:

Invest in Electric Options: As consumer interest in EVs grows, companies must develop more electric pickup models to stay competitive.

Focus on Fuel Efficiency: With fuel efficiency at the forefront, integrating lighter materials and more fuel-efficient engines is crucial.

Adapt to Supply Chain Realities: Manufacturers must streamline their supply chains and mitigate the impacts of semiconductor shortages.

Actionable Recommendation: To stay ahead, companies should focus on innovation, sustainability, and adapting to shifting consumer preferences, while capitalizing on the growing demand for full-size pickups and light-duty electric trucks.

Want more insights into the US Pickup Truck Market? Download our exclusive strategic report to explore in-depth forecasts, market segmentation, and actionable strategies tailored to your business.

Safe and Secure SSL Encrypted