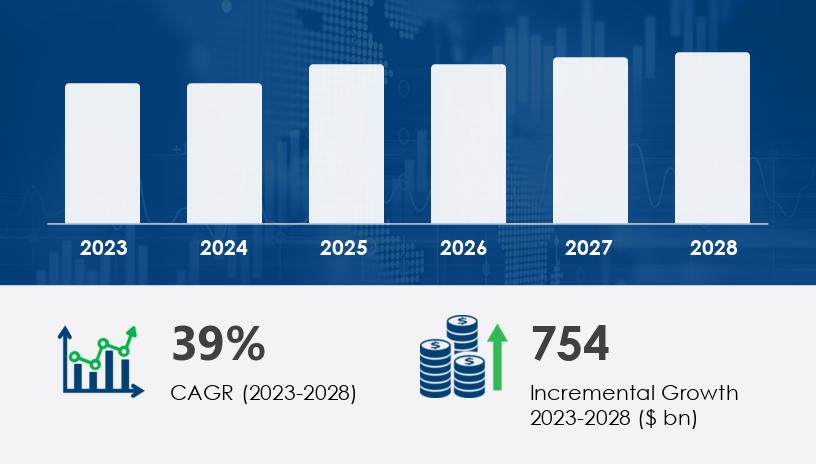

Peer to Peer (P2P) Lending Market Forecast 2024-2028: Growth and Dynamics

The peer to peer lending market is projected to experience significant growth, with an estimated market size increase of USD 754 billion, at a Compound Annual Growth Rate (CAGR) of 39% between 2023 and 2028. Several key factors are expected to drive this expansion, including reduced operational costs, the integration of advanced technologies such as artificial intelligence (AI) and blockchain, and the rising presence of small and mid-sized enterprises (SMEs) within the market. P2P lending companies are capitalizing on the advantages of digital platforms and innovative fintech solutions, streamlining their operations and reducing overhead expenses to offer competitive loan rates. The increasing number of SMEs seeking alternative financing options further accelerates the demand for P2P lending services, thereby fostering a broader spectrum of accessible financial solutions.

For more details about the industry, get the PDF sample report for free

Market Segmentation

By Business Segment:

- Traditional Lending: The traditional lending segment will account for a significant share of the P2P lending market's growth during the forecast period. With a valuation of USD 39.50 billion in 2018, traditional lending remains the most popular form of money lending, especially for small and medium businesses. This model ensures better loan quality, transparency, and simplicity, which attracts borrowers looking for straightforward and transparent lending solutions.

By End-User:

- Individual Consumers: Individual consumers are expected to hold the largest market share, as they are increasingly opting for flexible loans with lower interest rates compared to traditional financial institutions like banks. The no-collateral requirement and easy-to-understand terms make consumer P2P loans a highly attractive option for borrowers.

By Region:

- North America: Including the U.S. and Canada, North America will play a crucial role in the market's growth, driven by regulatory frameworks and the increasing adoption of digital lending solutions.

- Europe: The U.K., Germany, France, and other parts of Europe will also experience significant market growth due to the high demand for alternative lending solutions and favorable government regulations.

- APAC: The Asia-Pacific (APAC) region is estimated to contribute 46% to market growth by 2028. Countries like China and India are leading the adoption of P2P lending platforms, with fintech companies heavily investing in R&D to develop new functionalities. The rise of the lending boom in online marketplaces and growing awareness of P2P loans are pivotal in driving market expansion in this region.

- South America: In countries like Brazil, Chile, and Argentina, P2P lending is witnessing growth as more individuals and businesses embrace these alternative financing methods.

- Middle East & Africa: Saudi Arabia, South Africa, and other regions are experiencing growth in P2P lending as demand for financing solutions increases, especially in emerging markets.

Key Market Drivers and Trends

Key Driver - Reduced Operational Costs: P2P lending companies benefit from low operational costs, unlike traditional banks. The absence of physical branches, combined with low labor costs, enables P2P platforms to offer competitive rates to borrowers and high returns to investors, driving the market forward.

Significant Trend - Adoption of Digital Loans: Digital lending has gained significant momentum worldwide. The increased use of smartphones and the rise of digital infrastructure allow consumers to apply for loans quickly and conveniently from anywhere. This shift toward digital platforms is revolutionizing the lending process, leading to faster loan disbursement and simplified procedures.

Key Market Challenges

Security and Fraud Risks: While P2P lending platforms provide convenience, they also face challenges related to data security and fraud risks. The sensitive financial information shared on these platforms is vulnerable to cyberattacks, and fraudulent activities could undermine the trust of investors and borrowers alike. Hence, ensuring strong cybersecurity measures and fraud prevention protocols remains crucial for the growth of the market.

Get more details by ordering the complete report

Key Companies in the Peer To Peer (P2P) Lending Market

Some of the key companies of the Peer To Peer (P2P) Lending Market are as follows:

- AS Mintos Marketplace

- Avant LLC

- Bondora Capital OU

- Bridge Fintech Solutions Pvt. Ltd.

- Enova International Inc.

- Fairassets Technologies India Pvt. Ltd.

- Funding Circle Holdings plc

- Innofin Solutions Pvt. Ltd.

- Kiva Microfunds

- Lendbox

- LendingClub Corp.

- Lendingkart Finance Ltd.

- LendingTree LLC

- Metro Bank Plc

- Prosper Funding LLC

- Zopa Bank Ltd.