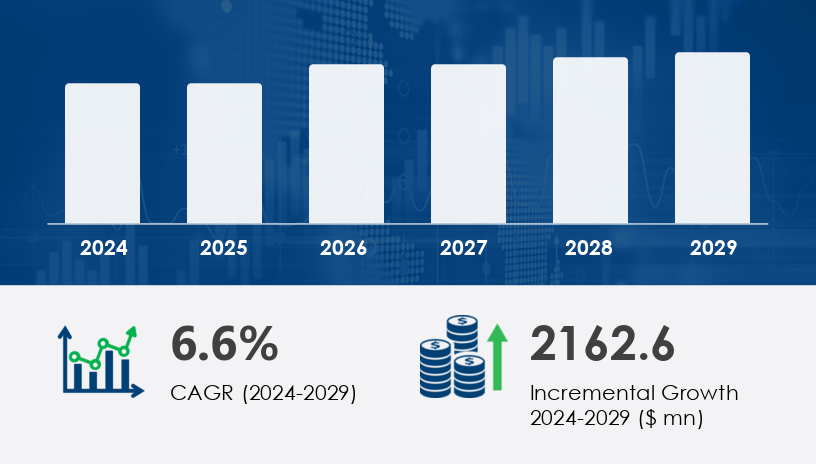

The paper bag market is poised for significant expansion, with an expected growth of USD 2.16 billion between 2025 and 2029. This reflects a robust compound annual growth rate (CAGR) of 6.6% during the forecast period. In 2024, the market has already demonstrated strong momentum, driven by rising demand for eco-friendly packaging solutions, and is forecast to continue on this upward trajectory through 2029.

For more details about the industry, get the PDF sample report for free

A key driver behind the growth of the paper bag market is increasing consumer awareness and preference for sustainable alternatives to plastic. The market is significantly influenced by environmental advantages offered by paper bags, such as biodegradability, recyclability, and the use of locally sourced, renewable materials. Consumers are more inclined to choose paper bags due to their ability to reduce plastic waste and lower carbon emissions. As noted in the research, paper bags made from biodegradable and recyclable materials can significantly reduce the ecological footprint of packaging. Their reusability further adds to their appeal, especially for retailers and e-commerce businesses seeking sustainable solutions. Regulatory support—like the European Union’s 2025 ban on single-use plastic bags—amplifies this trend, projected to lead to a 70% increase in paper bag usage across the EU.

One of the most transformative trends in the paper bag market is the growing adoption of alternative, eco-friendly materials in production. Manufacturers are shifting toward innovative sources such as cocoa bean skins, hazelnut waste, and edamame bean remnants to produce biodegradable and grease-resistant paper. These materials not only align with sustainability goals but also meet performance requirements in sectors like food service and retail. Moreover, advances in printing technology—including flexographic and digital printing—enable high-quality branding that enhances customer experience. Certifications such as FSC and SFI are becoming standard, underscoring a broader shift toward ethical sourcing and circular production methods in the packaging industry.

The paper bag market is witnessing dynamic growth, driven by increasing environmental awareness and regulations promoting sustainable alternatives. Among the key product types, brown kraft and white kraft paper bags remain dominant due to their strength and versatility. Innovations include pasted valve designs, stand-up pouches, lock bags, and SOS bags, all catering to varying storage and transport needs. Specialized formats like multi-wall sacks, flat bags, luxury bags, shopping bags, and grocery bags fulfill roles in both commercial and personal use. Applications span retail packaging, food packaging, and industrial bags, with a growing preference for biodegradable bags, recyclable bags, and eco-friendly packaging. The shift toward custom-printed bags enhances brand visibility, while the base material — primarily kraft paper derived from wood pulp — ensures strength and sustainability. The demand for heavy-duty bags, takeout bags, and delivery bags is rising, especially with the expansion of e-commerce and food delivery sectors.

The paper bag market is segmented by:

Material: Brown kraft, White kraft

End-user: Retail, Food and beverage, Construction, Pharmaceutical, Others

Product Type: Flat paper bags, Multi-wall sacks, Twist handle bags, Others

Distribution Channel: B2B, Retail stores, E-commerce

Among materials, the brown kraft segment leads in both share and growth. In 2019, it was valued at USD 3.78 billion and has shown a consistent increase since. Brown kraft paper is prized for its durability and elasticity, achieved through a chemical pulping process that removes lignin. This results in high tear resistance and handle strength, making it ideal for food packaging and retail applications. As one analyst insight highlights, kraft paper’s versatility and environmental credentials make it the preferred choice in industries prioritizing sustainable and functional packaging. Additionally, the increasing demand from beauty, gifting, and convenience store sectors further supports its dominant position.

Regions Covered:

North America

Europe

APAC (Asia-Pacific)

Rest of World (ROW)

North America is the top-performing region, contributing 34% to global market growth during the forecast period. The growth is fueled by regulatory initiatives, including bans and taxes on plastic packaging, particularly in the U.S. and Canada. The region's well-established food service and convenience retail sectors have rapidly adopted paper bags as a sustainable packaging solution. Analysts point to the increase in demand for enhanced barrier properties, such as grease and moisture resistance, which are critical for the food and bakery industries. Custom printing and FSC-certified products have become market standards, with companies emphasizing product branding to meet consumer expectations.

Despite strong growth, the paper bag market faces the significant challenge of limited durability, particularly in comparison to plastic. This is especially problematic in sectors like food and beverage, where bags must withstand moisture and heavy contents. Paper bags, while eco-friendly, may tear or fail under stress, leading to product damage and reduced customer satisfaction. As the report notes, this could hinder repeat purchases unless companies invest in reinforced or multi-layered paper bags. Additionally, businesses must balance durability with environmental impact, ensuring that material enhancements do not compromise biodegradability or recyclability.

For more details about the industry, get the PDF sample report for free

Recent market research reveals increased consumer interest in branded bags and paper sacks, along with structural innovations like pinch-bottom bags, open-mouth bags, and sewn bags. Advances in sealing mechanisms, such as heat seal, and user-friendly designs like handled bags, ziplock bags, twisted handle, and flat handle bags, enhance convenience and usability. Varieties including rectangular bags, square bags, and circular bags serve both functional and aesthetic preferences. Emerging segments such as medical pouches, chemical packaging, construction bags, and agricultural bags reflect diversification across industries. Sustainability remains central, with growing demand for sustainable packaging, reusable bags, compostable bags, and custom designs. Companies are offering tailored packaging solutions with advanced paper coatings and traceability technology to ensure safety and transparency. The market also highlights the popularity of durable bags, promotional bags, and eco-conscious packaging, reinforcing the shift toward responsible consumption and production.

The research analysis indicates a significant transformation in the global paper bag market, driven by eco-regulations, plastic bans, and evolving consumer preferences. Manufacturers are adapting by focusing on product innovation, design customization, and materials engineering. The intersection of sustainability, branding, and technological advancement is reshaping packaging norms. With demand rising across sectors like retail, foodservice, healthcare, and agriculture, strategic investments in production capacity, automation, and supply chain traceability are becoming essential. The paper bag market is poised for continued expansion, supported by increasing government policies and a strong push from environmentally conscious consumers.

Innovations and Recent Developments

To remain competitive, companies are investing in sustainable production and product innovation. For instance, Smurfit Kappa launched its BioNova line in January 2024—an eco-friendly range made from 100% recycled paper and certified compostable. Meanwhile, Amcor’s partnership with Danone, announced in March 2025, focuses on developing paper-based packaging for bottled water and bags, reinforcing the industry’s shift toward renewable materials. Additionally, the acquisition of Hemas Packaging by Sealed Air in July 2024 expands its reach in emerging markets like India and Sri Lanka, where demand for sustainable packaging is rising rapidly. These strategic moves reflect a broader industry trend toward geographic expansion, material innovation, and circular economy alignment.

Major market players such as Bulldog Bag Ltd., Mondi Plc, and WestRock Co. are actively pursuing mergers, acquisitions, and product launches to enhance market presence. Their focus on efficient supply chain management, advanced printing techniques, and customizable bag options positions them to meet evolving consumer expectations in both B2B and B2C environments.

The paper bag market is on a growth trajectory driven by regulatory pressure, environmental consciousness, and technological innovation. As the industry navigates challenges related to durability and cost, its success will hinge on the development of high-performance, eco-friendly solutions. With sustained consumer demand, government support, and increasing investment in R&D, the market is set to expand significantly from 2025 to 2029. Companies that align with sustainability goals, adopt flexible packaging technologies, and diversify their geographic reach will be well-positioned to lead in this rapidly evolving landscape.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Material

6.1.1 Brown kraft

6.1.2 White kraft

6.2 End-User

6.2.1 Retail

6.2.2 Food and beverage

6.2.3 Construction

6.2.4 Pharmaceutical

6.2.5 Others

6.3 Product Type

6.3.1 Flat paper bags

6.3.2 Multi-wall sacks

6.3.3 Twist handle bags

6.3.4 Others

6.3 Geography

6.4.1 North America

6.4.2 APAC

6.4.3 Europe

6.4.4 South America

6.4.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted